If we are still range trading, then we should see a pullback fairly quickly (maybe starting this afternoon) as more profit taking sets in... hope to buy the dips (if there are any). The question is, with limited trades, if one buys in do we believe that the market will continue to sustain an uptrend for several days?

What to do, what to do...

It all depends on what you believe.

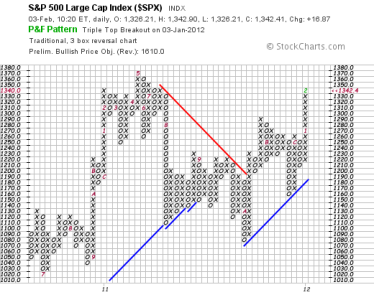

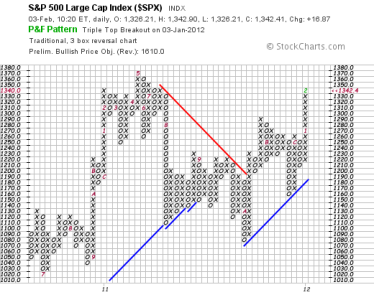

IF you believe in the P&F charts, then look at this amazing set of charts:

#1. If you believe the S&P P&F chart, we are going up to 1610 on this up cycle.

That's an amazing 20% higher than where we are today. That's what the chart says- a 20% gain ahead on this up cycle!

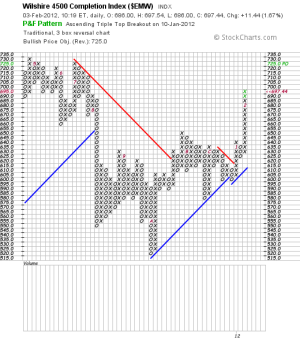

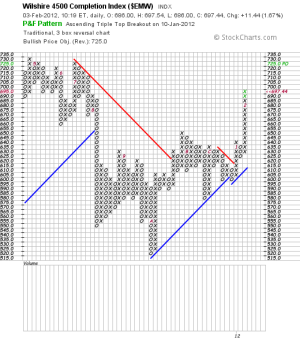

#2. If you believe the "S" fund P&F chart, then we are going upward to 725 on this cycle. That's the smallest of the three, and still represents about another 4% higher move from where we are today.

and

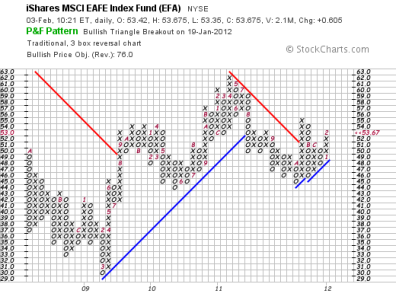

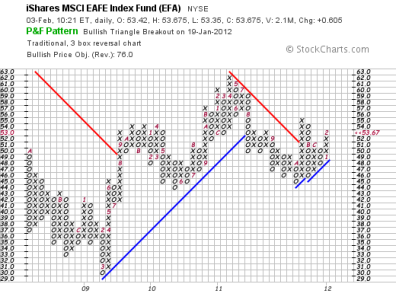

#3 - IF you belive the "I" fund P&F chart, then we are going upward to 76 on this I fund chart:

Wow. That's expecting a 40% gain from where we are today. That's what the technicals are saying!

20% higher-

or

4% higher-

or

40% higher?

Wow.

I don't know if we'll make any of those three targets.

What I DO know- is that there is still a LOT of steam pushing this all upwards right now.

I don't know why, but it appears to be happening, so I'll take it and be grateful!