It would seem some pockets of bullishness need to be punished before this downward move ends. Hopefully we're just about there. Our own sentiment survey is 54% bearish right now. Here's the charts:

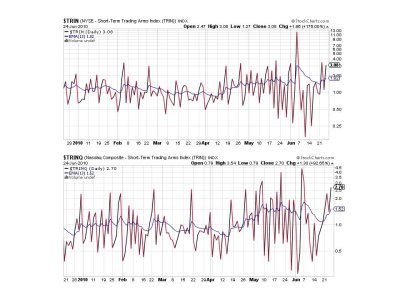

Still on sells here.

Two more sells.

Ditto.

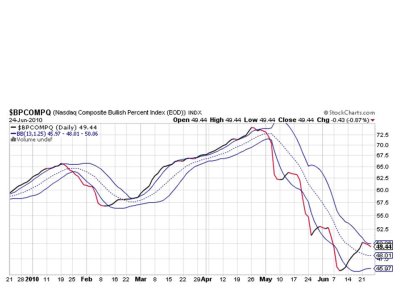

BPCOMPQ remains the lone buy signal and really hasn't deteriorated much in spite of the recent selling pressure.

So we have 6 of 7 signals flashing sells, but the system remains on a buy.

I am 100% S fund and holding tight.

See you tomorrow.

Still on sells here.

Two more sells.

Ditto.

BPCOMPQ remains the lone buy signal and really hasn't deteriorated much in spite of the recent selling pressure.

So we have 6 of 7 signals flashing sells, but the system remains on a buy.

I am 100% S fund and holding tight.

See you tomorrow.