Last week, the herd increased its equity (C, S, and I) holdings by more than 11.5% to begin trade last Monday. That was a healthy shift, but prices ended relatively flat for the week so unless one managed to pull out on Tuesday by the close (that was the one big rally day), there wasn't much to be gained. By contrast, the Top 50 only increased their stock position by 2.46%, so they weren't looking to hit any home runs last week.

This week neither group made any particularly big moves. Here's the charts:

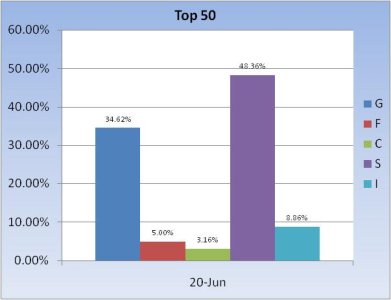

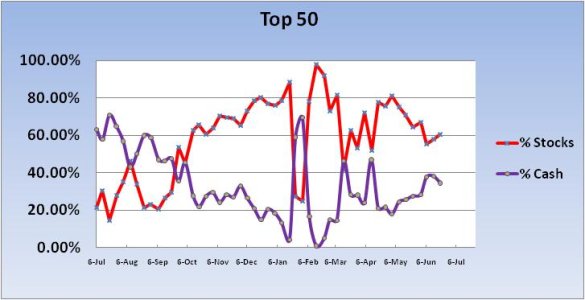

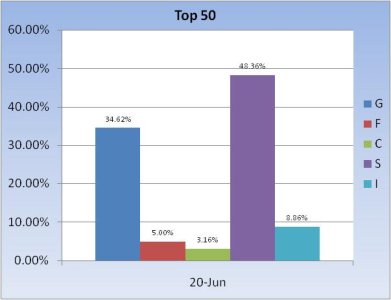

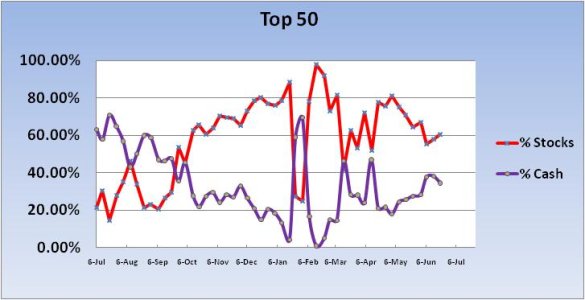

While the Top 50 didn't increase their stock exposure by all that much (it was up 2.48%), it was the second week in a row where they added to those positions. The week before their stock allocations were up 2.46%, so they've increased that position by almost 5% over the past two weeks. They still have a lot of cash (G fund) on the sidelines though at 34.62%.

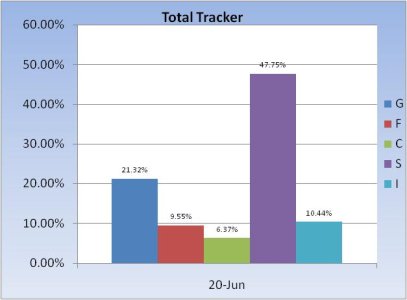

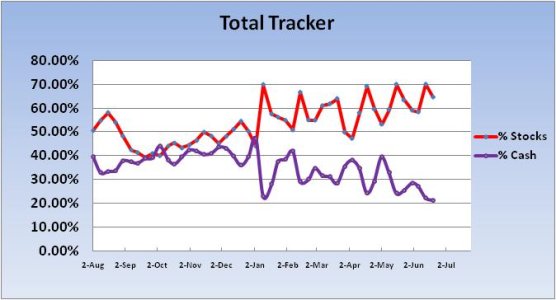

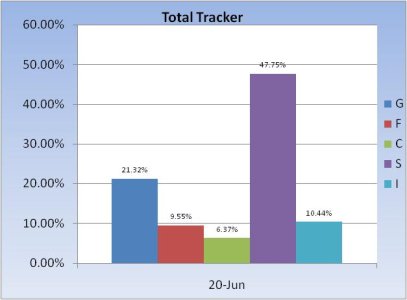

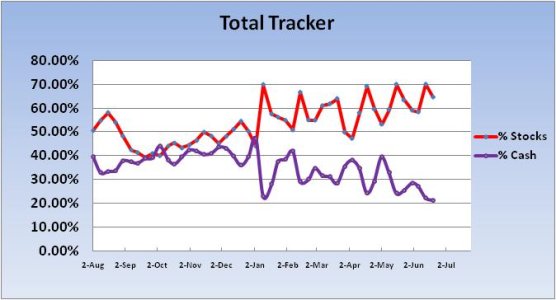

The herd actually got a bit more bearish for the coming week. After increasing their stock allocations by over 11.5% the week before, this week they dropped that exposure by 5.34%. Given the relentless reporting of negative news of late, I'm not surprised by that. But they still have a higher stock exposure than the Top 50 (about 5%).

I can't read anything into this week's allocations. There's a lot going on across the globe in terms of economic issues, and it seems that most of them are decidedly negative. The market has been largely in decline since May 1st and QE2 is coming to end by 30 June, so there's a lot of uncertainty out there and risk appears to be rising. But bearish sentiment is rising too. So far, that by itself has not been enough to drive another sustained rally.

The big event for this week appears to be the FOMC policy announcement, which will be released 1230 on Wednesday. Expect more volatility in the days and weeks ahead.

This week neither group made any particularly big moves. Here's the charts:

While the Top 50 didn't increase their stock exposure by all that much (it was up 2.48%), it was the second week in a row where they added to those positions. The week before their stock allocations were up 2.46%, so they've increased that position by almost 5% over the past two weeks. They still have a lot of cash (G fund) on the sidelines though at 34.62%.

The herd actually got a bit more bearish for the coming week. After increasing their stock allocations by over 11.5% the week before, this week they dropped that exposure by 5.34%. Given the relentless reporting of negative news of late, I'm not surprised by that. But they still have a higher stock exposure than the Top 50 (about 5%).

I can't read anything into this week's allocations. There's a lot going on across the globe in terms of economic issues, and it seems that most of them are decidedly negative. The market has been largely in decline since May 1st and QE2 is coming to end by 30 June, so there's a lot of uncertainty out there and risk appears to be rising. But bearish sentiment is rising too. So far, that by itself has not been enough to drive another sustained rally.

The big event for this week appears to be the FOMC policy announcement, which will be released 1230 on Wednesday. Expect more volatility in the days and weeks ahead.