twodaystocks

Market Tracker

- Reaction score

- 3

My account talk for both TSP and personal trades.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

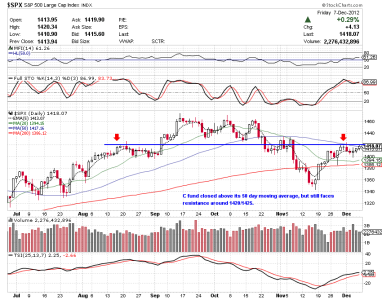

Your mention of pulling out of 'C' on your other thread may not be too bad. If you notice, there was a major pullback at close....Smart Money taking profits.

Personal portfolio holdings as of 6 dec 2012, URTY, XHB, EDC, DRN, and GILD. All with a trailing 1.5% trailing stop except GILD, which I am holding because of a HEP B drug awaiting FDA approval in 2013.

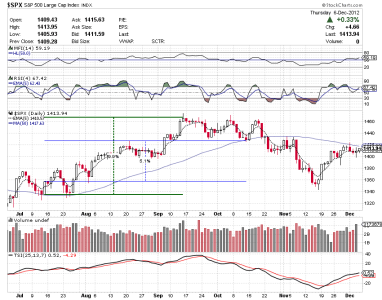

The 50 moving average has been tough resistance for the S&P. It hasn't closed above that level sincethe 18th of October. I'll be watching the 50 as a resistance level. If it closes above its 50 tomorrow, Ill probably be a buyer on Monday. The DAILY chart below shows what I am referring to.

View attachment 21394

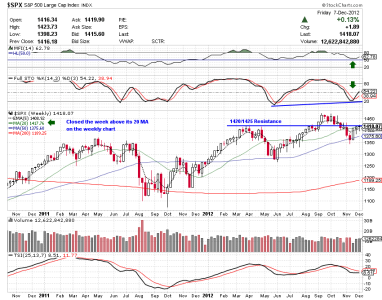

When the index closes above its own 50 day moving average, I hope for a run as strong as, or preferrably stronger than its previous run which started on 13 July 2012 and didn't close at/below its 50 until 12 Oct 2012. From the first close above its 50 ma, to its first close at/below its 50, it would have netted a 5.1% profit. Had I bought in directly at its 50 day level in July and sold at its highest close on 14 Sep 2012, which happens to by my birthday, I would have netted almost 10% return. If it clears its 50 tomorrow, I look for a price target of around 1550 by EOM Feb or mid month March. The chart below shows more clearly what I am referring to.

In a normal market...

Hi twodays - Sorry to bring this up in your thread, but you're the most recent one to use the above phrase, which always leads me to ask myself, "What is a 'normal market'?" I guess I ask the question half seriously, and half tongue-in-cheek. I've only been following the stock market since 2010, so everything about it has always been unpredictable to me. Was there ever a time when this was not the case? Looking at long term charts of the S&P 500, it seems that there were several decades of growth where you could just buy and hold and forget about even following the market, secure that you'd have more money in the end. Is that a "normal market"? If so, it doesn't seem to me like that will ever be a reality again in our country.

Thanks for contributing your charts. It's always nice to see others' perspectives.

I'm still long EDC, up almost 11%; GILD up 2.3%; JVA down almost .5%; TECL up 1.11%, and GASL up 2.75%. Sticking with my trailing stops on all of those. It's nice to see the S&P staying above its 50ma on the daily chart. I/m 100% back in C fund as of COB yesterday.