jpcavin

TSP Legend

- Reaction score

- 97

Afraid I don't have this sub-section of stats anymore, I lost them when my OS crashed, I'll have to rebuild them, but that takes some time because each holiday is unique.

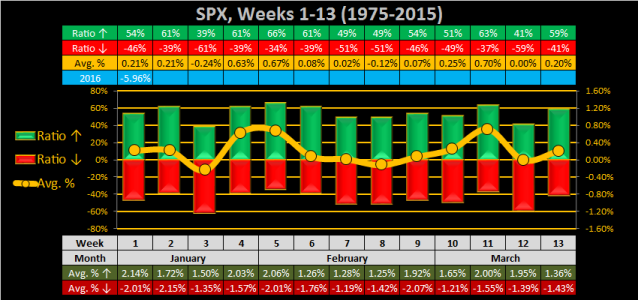

Looking at last year's almanac trader, it states: "Every down January on the S&P since 1950, without exception, was followed by a new or continuing bear market, a flat year, or a 10% correction. Down January's were followed by substantial declines averaging minus 13.9% providing excellent buying opportunities later in most years.

You guys have been investing much, much longer than me. How much weight do you put into statistics? Is this something that you take with a grain of salt or is it another part of the equation used to arrive at a decision?