Last week opened strong but ended on an uneasy note. While the overall weekly returns were modest, the mid-week softness and geopolitical tension was enough to drive some TSP Talk AutoTracker members out of stock funds—though not all followed suit.

The week began with strength across U.S. stock indices, particularly in small caps. The S-fund gained 1.25% on Monday, giving bulls early momentum. However, that enthusiasm did not carry through the rest of the shortened trading week. Stocks drifted lower from Monday’s highs, and only Wednesday produced another notable uptick, with the S-fund rising an additional +0.55%—standing alone as the only stock fund to post a gain that day.

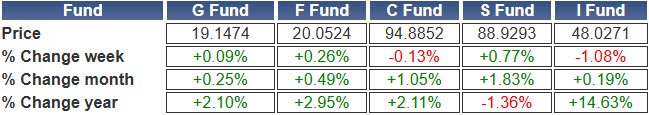

Despite the fade in momentum, the S-fund finished the week up +0.77%, making it the only stock fund to close in positive territory. The C-fund posted a mild loss of –0.13%, while the I-fund lagged significantly with a –1.08% decline.

Geopolitical developments added weekend uncertainty. On Saturday, the United States officially intervened in the conflict between Israel and Iran. So far, the market reaction has been officially unmeasured. But, as of Sunday morning, U.S. stock futures suggest a higher open coming tomorrow, particularly for the S&P 500. While futures are not always reliable, this early signal indicates that investors are not currently pricing in major downside risk due to the weekend’s events.

For TSP participants, there’s some reassurance in seeing that equity exposure has not—at least for now—been heavily punished by global developments. That said, volatility remains a factor, and Monday’s open may reveal a different tone as market participants fully digest the news.

Top AutoTracker Members' IFTs

Nine members within the Top 50 returns of 2025 made IFTs last week. Their behavior was mixed but revealed key shift. Below is the average change of percentage points (pp) made by these top nine. For example, on average these nine members increased their G-fund allocation by 13.3 percentage points:

The group showed a net reduction in risk by increasing G-fund exposure, but there was also some preference for the S-fund over the C-fund. The group increased their S-fund exposure by 11.1 percentage points over the week. The C-fund saw the greatest decrease of exposure at an average of 23.3 percentage points.

Community-Wide Allocation Trends

Across the entire TSP Talk community, 37 members made IFTs last week, including the nine highlighted above. Their moves were more defensive overall.

This broader group leaned heavily into the G-fund, showing a clear risk-off sentiment. Unlike the top members, who maintained or added to S-fund exposure, the broader group reduced S-fund holdings by 13.3 pp on average—despite it being the only stock fund to post gains for the week.

The S-fund may have posted the strongest return this week, but sentiment across TSP Talk leaned cautious. Whether driven by geopolitical uncertainty or technical signals, many investors reallocated toward the safety of the G-fund. However, top performers showed more conviction and diversity in their strategies—some going fully defensive, others buying weakness in equities.

As markets digest this weekend’s events and prepare for the next round of economic data, allocation choices made during this pullback could prove meaningful.

If you are interested in the trends of AutoTracker members, consider subscribing to the Last Look Report. The Last Look Report gives you a snapshot of TSP Talk’s most successful investors and trends across the TSP Talk AutoTracker—30 minutes before the TSP Trade deadline.

Not yet an AutoTracker member? The TSP Talk AutoTracker lets you log your TSP fund allocations, track your returns, and see how you stack up against hundreds of your peers. It’s a powerful (and free) way to stay disciplined, learn from others, and measure your performance over time.

Start Your Free AutoTracker Account Here

Thanks for reading!

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The week began with strength across U.S. stock indices, particularly in small caps. The S-fund gained 1.25% on Monday, giving bulls early momentum. However, that enthusiasm did not carry through the rest of the shortened trading week. Stocks drifted lower from Monday’s highs, and only Wednesday produced another notable uptick, with the S-fund rising an additional +0.55%—standing alone as the only stock fund to post a gain that day.

Despite the fade in momentum, the S-fund finished the week up +0.77%, making it the only stock fund to close in positive territory. The C-fund posted a mild loss of –0.13%, while the I-fund lagged significantly with a –1.08% decline.

Geopolitical developments added weekend uncertainty. On Saturday, the United States officially intervened in the conflict between Israel and Iran. So far, the market reaction has been officially unmeasured. But, as of Sunday morning, U.S. stock futures suggest a higher open coming tomorrow, particularly for the S&P 500. While futures are not always reliable, this early signal indicates that investors are not currently pricing in major downside risk due to the weekend’s events.

For TSP participants, there’s some reassurance in seeing that equity exposure has not—at least for now—been heavily punished by global developments. That said, volatility remains a factor, and Monday’s open may reveal a different tone as market participants fully digest the news.

Top AutoTracker Members' IFTs

Nine members within the Top 50 returns of 2025 made IFTs last week. Their behavior was mixed but revealed key shift. Below is the average change of percentage points (pp) made by these top nine. For example, on average these nine members increased their G-fund allocation by 13.3 percentage points:

Average Allocation Changes (Top 9 Members)

- G-fund: +13.3 percentage points

- F-fund: –1.2 pp

- C-fund: –23.3 pp

- S-fund: +11.1 pp

- I-fund: –4.4 pp

The group showed a net reduction in risk by increasing G-fund exposure, but there was also some preference for the S-fund over the C-fund. The group increased their S-fund exposure by 11.1 percentage points over the week. The C-fund saw the greatest decrease of exposure at an average of 23.3 percentage points.

Diverging Strategies Among Top Members

- CrabClaw moved from 100% G-fund to a fully invested portfolio across C, S, and I-funds.

- BigBully went all-in on the S-fund.

- Nospin, Risto73, and Greensboro retreated completely into the G-fund, abandoning equities entirely.

- Smoke made a balanced move—raising G-fund, trimming C and I-fund exposure, and initiating a modest S-fund position.

- Others like Roddhsi, Ritter_A_G, and RER754 reduced exposure broadly while still maintaining some stock positions.

Community-Wide Allocation Trends

Across the entire TSP Talk community, 37 members made IFTs last week, including the nine highlighted above. Their moves were more defensive overall.

Average Allocation Changes (All 37 IFT Members)

- G-fund: +34.9 pp

- F-fund: –1.2 pp

- C-fund: –12.8 pp

- S-fund: –13.3 pp

- I-fund: –7.6 pp

This broader group leaned heavily into the G-fund, showing a clear risk-off sentiment. Unlike the top members, who maintained or added to S-fund exposure, the broader group reduced S-fund holdings by 13.3 pp on average—despite it being the only stock fund to post gains for the week.

The S-fund may have posted the strongest return this week, but sentiment across TSP Talk leaned cautious. Whether driven by geopolitical uncertainty or technical signals, many investors reallocated toward the safety of the G-fund. However, top performers showed more conviction and diversity in their strategies—some going fully defensive, others buying weakness in equities.

As markets digest this weekend’s events and prepare for the next round of economic data, allocation choices made during this pullback could prove meaningful.

If you are interested in the trends of AutoTracker members, consider subscribing to the Last Look Report. The Last Look Report gives you a snapshot of TSP Talk’s most successful investors and trends across the TSP Talk AutoTracker—30 minutes before the TSP Trade deadline.

Not yet an AutoTracker member? The TSP Talk AutoTracker lets you log your TSP fund allocations, track your returns, and see how you stack up against hundreds of your peers. It’s a powerful (and free) way to stay disciplined, learn from others, and measure your performance over time.

Start Your Free AutoTracker Account Here

Thanks for reading!

Thomas Crowley

(TommyIV)

Writer of the Last Look Report

Weekly Wrap-Ups Archive

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.