There were any number of titles I could have used for today's blog as the follow through downside action was impressive. But while we've been here before in the equities market, the bond market is setting new records.

Today, the 10-year note closed with at an eye-popping yield of just 1.715%. The driving factor behind the move was continued global growth fears along with the European debt crisis. The 20-year saw its yield fall to 2.786%; its lowest level since January 2009, while the 30-yr yield fell to 2.519%. The bond market has been defying all the bond bears for some time now. And that includes Mr. Gross himself.

And while bonds were enjoying their rally, the stock market was plunging. At one point the S&P 500 was down well over 4%, but managed to retrace at least some of its losses towards the close to end the day with a 3.19% loss.

The energy sector was especially hit hard as crude futures fell to $80.50 per barrel. That's a loss of 6.3%. And gold didn't escape the sell-off either. It dropped 3.8% to $1739 per ounce.

The rally in the Dollar Index continued as the greenback soared more than 1%.

Today's action also came on robust volume with advancing volume outpacing declining volume by more than 50-to-1. NAHL and NYHL were particularly telling in this regard as you'll see below.

Here's today's charts:

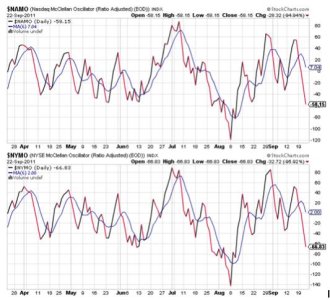

NAMO and NYMO are now well into negative territory and NYMO easily tagged a fresh 28 day trading low.

Huge spike lower in NAHL and NYHL as I mentioned above with respect to advancing and declining volume.

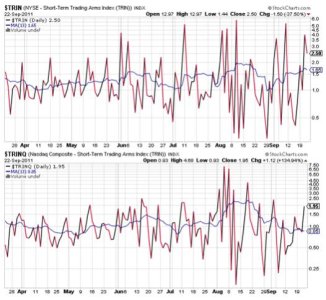

TRIN and TRINQ are both now on sells, but interestingly neither is showing more than somewhat modest oversold conditions.

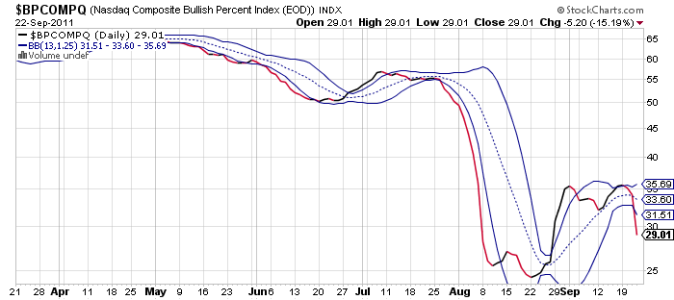

BPCOMPQ plunged. It is now in a longer term oversold condition now that it fell back below 30. I believe this is an ominous sign for weeks ahead.

So all signals are now on sells and with NYMO tagging a new 28 day trading high the system officially flips to a sell condition. That could be a buy signal in a bear market. But only in the short term. I suspect sentiment is getting fairly beared up too, which supports my notion of a rally in the very short term. That's not a given, only a reasonable expectation. And currently, our sentiment survey is showing 63% bears, so if you have any IFTs left and are willing to take some serious risk, you may want to consider buying into some stock funds soon if you like the set up.

I took a very modest position in C and S today (3% each) while keeping 94% in the F fund. I am willing to increase that allocation (stocks) on any further downward pressure over the next couple of days, but I don't think I'll ramp my position up too much. How much will depend on what happens tomorrow and whether we fall through major support, because we're technically still in reasonable shape in that regard. I'll also be watching sentiment. If the bulls get froggy in some pockets as a result of today's fairly modest end-of-day rally thinking we've just bounced off that support line, things could get much uglier in a hurry. So we'll have to see what happens over the next trading day or two.