Yes, it was a rough week, and statistically speaking it's not over just yet.

MONTHLY: SPX is down -2.71%, W4500 is down -2.23%, and AGG is down -1,25%

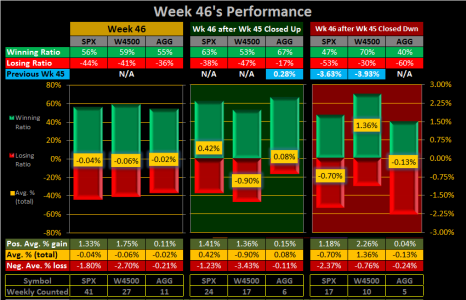

WEEKLY: Finishing out the second week of November, week 45 showed a substantial loss for SPX & W4500, with AGG giving us a bounce. SPX closed down -3.63%, W4500 down -3.93%, and AGG up .28%

To give us some perspective, for SPX, over the past 66 years, this was the 5[SUP]th[/SUP] worst week 45 and for W4500, over the past 27 years, this was the 2[SUP]nd[/SUP] worst week 45.

Referencing the 4th Quarter's 40-52-week range, for week 46, SPX ranks 13[SUP]th[/SUP] (dead last) while W4500 ranks 8[SUP]th[/SUP]. Simply put, we are within the lull of November and statistically speaking we have 1-2 more weeks of poor performing expectations. Looking out further, the following week 47 is mixed, with SPX performing well, and W4500 performing worse.

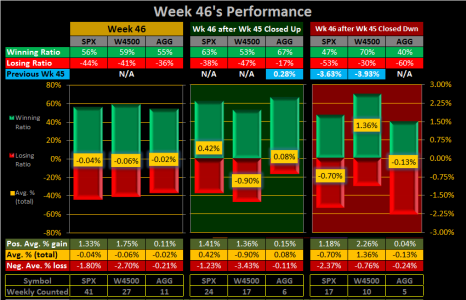

The bigger question for me, what happens to week 46 after week 45 closed down?

Looking at the first 3 bars, for week 46, the winning ratios are average, while the average gains are below average. Looking at the middle 3 bars, when AGG closed up on week 46, week 47 has stronger stats. Looking at the last 3 bars, when SPX closed down on week 45, week 46’s stats are worse, and for W4500 they are better. From this chart, I would conclude the safest play is to be in the F-Fund, but if you were willing to take on more risk, then go into the S-Fund. (keeping in mind AGG’s data is very limited, only going back 11 years)

___

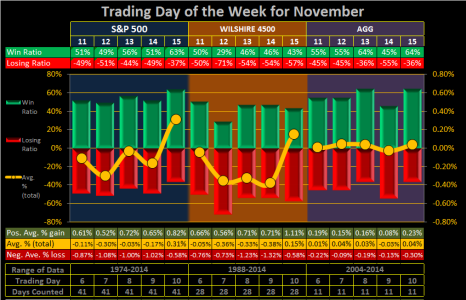

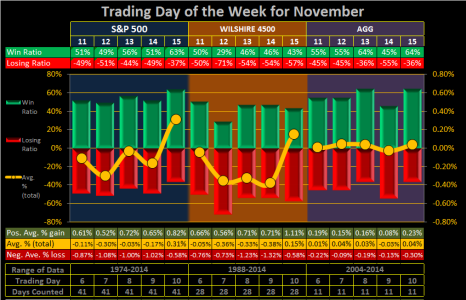

DAILY: For November, this week we have trading days 11-15. Both SPX & W4500 show significant weakness on trading days 11-14 and a pop on trading day 15. Looking at this chart, I would conclude the safest play is to be in the F-Fund, and be in the C/S funds on the 15[SUP]th[/SUP] (this Friday). This is in agreement with my system, ESD (Evolving Statistical Data) which will enter the S-Fund Pre-IFT Thursday.

___

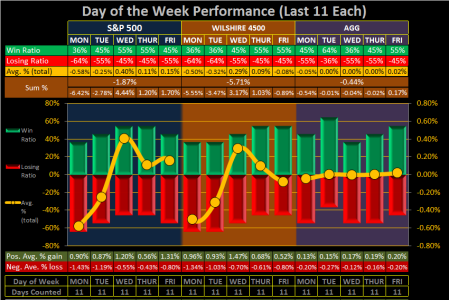

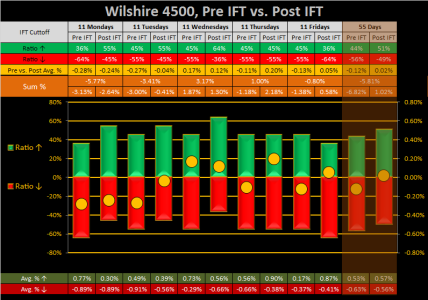

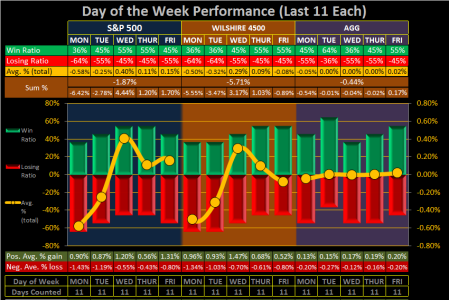

DAILY: Going into the days of the week (Monday-Friday) for SPX/4500 Monday & Tuesday are very weak, while Wednesday & Thursday are average-to-mixed. The total average % sum of all 11 Monday-Fridays is negative (meaning the last 11 weeks are negative)

___

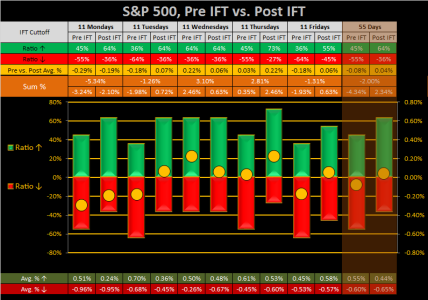

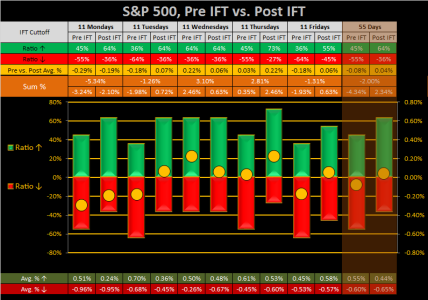

PRE IFV vs. POST IFT

SPX (C-Fund) Pre IFT vs. Post IFT: For short-term trades (within the week) enter Tuesday, exit Thursday for a .54% avg. gain

The Pre-IFT deadline has a 45% winning ratio with -.08% average gains

The Post-IFT deadline has a 64% winning ratio with .04% average gains

The Pre-IFT & Post IFT traded in the same direction 56% of the time

When the Pre-IFT closed positive, the post IFT closed positive 72% of the time

When the Pre-IFT closed negative, the post IFT closed negative 43% of the time

___

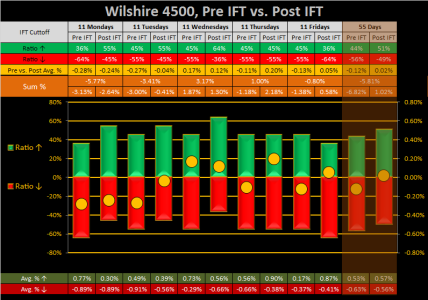

W4500 (S-Fund) Pre IFT vs. Post IFT: For short-term trades (within the week) enter Tuesday, exit Thursday for a .38% avg. gain

The Pre-IFT deadline has a 44% winning ratio with -.12% average gains

The Post-IFT deadline has a 51% winning ratio with .02% average gains

The Pre-IFT & Post IFT traded in the same direction 45% of the time

When the Pre-IFT closed positive, the post IFT closed positive 46% of the time

When the Pre-IFT closed negative, the post IFT closed negative 45% of the time

___

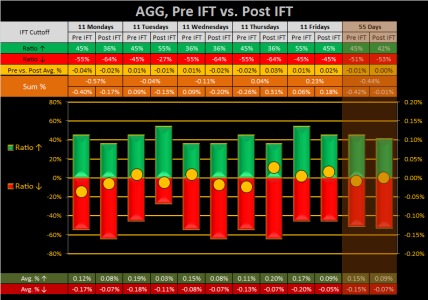

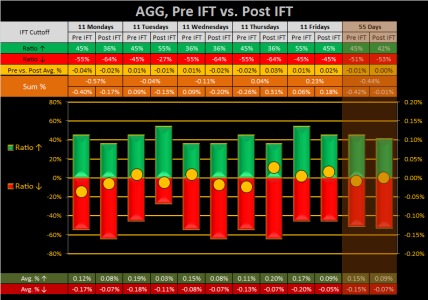

AGG (F-Fund) Pre IFT vs. Post IFT: For short-term trades (within the week) enter Wednesday, exit Friday for a .03% avg. gain

The Pre-IFT deadline has a 45% winning ratio with -.01% average gains

The Post-IFT deadline has a 42% winning ratio with .00% average gains

The Pre-IFT & Post IFT traded in the same direction 45% of the time

When the Pre-IFT closed positive, the post IFT closed positive 40% of the time

When the Pre-IFT closed negative, the post IFT closed negative 54% of the time

___

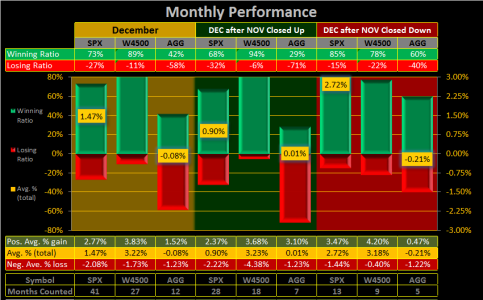

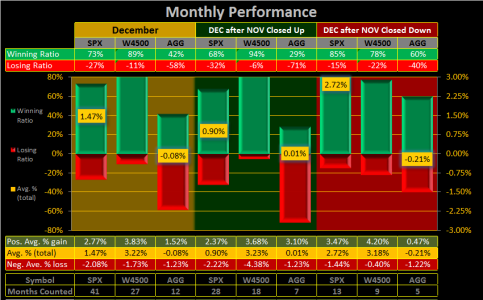

For the sake of the short-term investor, let’s take a sneak peek, making the Bearish case for a down November to see where the stats lead us into December. For SPX, over the past 41 years, November has closed down 13 times, of those 13 down Novembers, we have 11 positive Decembers, with an 85% winning ratio and 2.72% average gains. Either ways, regardless of November’s performance, the stats for December are still strong enough to warrant staying invested for the remainder of the year.

___

Crunching this week’s stats, has led to many of the same conclusions, both the historical stats covering many years, the last 11 weeks, and last 55 days, is showing weakness, which has made it difficult to find positive data for this upcoming week 46. For myself, I am expecting the low for November to be put in this week, because from this week on, most of the historical stats get better...

Stay invested…Jason

MONTHLY: SPX is down -2.71%, W4500 is down -2.23%, and AGG is down -1,25%

WEEKLY: Finishing out the second week of November, week 45 showed a substantial loss for SPX & W4500, with AGG giving us a bounce. SPX closed down -3.63%, W4500 down -3.93%, and AGG up .28%

To give us some perspective, for SPX, over the past 66 years, this was the 5[SUP]th[/SUP] worst week 45 and for W4500, over the past 27 years, this was the 2[SUP]nd[/SUP] worst week 45.

Referencing the 4th Quarter's 40-52-week range, for week 46, SPX ranks 13[SUP]th[/SUP] (dead last) while W4500 ranks 8[SUP]th[/SUP]. Simply put, we are within the lull of November and statistically speaking we have 1-2 more weeks of poor performing expectations. Looking out further, the following week 47 is mixed, with SPX performing well, and W4500 performing worse.

The bigger question for me, what happens to week 46 after week 45 closed down?

Looking at the first 3 bars, for week 46, the winning ratios are average, while the average gains are below average. Looking at the middle 3 bars, when AGG closed up on week 46, week 47 has stronger stats. Looking at the last 3 bars, when SPX closed down on week 45, week 46’s stats are worse, and for W4500 they are better. From this chart, I would conclude the safest play is to be in the F-Fund, but if you were willing to take on more risk, then go into the S-Fund. (keeping in mind AGG’s data is very limited, only going back 11 years)

___

DAILY: For November, this week we have trading days 11-15. Both SPX & W4500 show significant weakness on trading days 11-14 and a pop on trading day 15. Looking at this chart, I would conclude the safest play is to be in the F-Fund, and be in the C/S funds on the 15[SUP]th[/SUP] (this Friday). This is in agreement with my system, ESD (Evolving Statistical Data) which will enter the S-Fund Pre-IFT Thursday.

___

DAILY: Going into the days of the week (Monday-Friday) for SPX/4500 Monday & Tuesday are very weak, while Wednesday & Thursday are average-to-mixed. The total average % sum of all 11 Monday-Fridays is negative (meaning the last 11 weeks are negative)

___

PRE IFV vs. POST IFT

SPX (C-Fund) Pre IFT vs. Post IFT: For short-term trades (within the week) enter Tuesday, exit Thursday for a .54% avg. gain

The Pre-IFT deadline has a 45% winning ratio with -.08% average gains

The Post-IFT deadline has a 64% winning ratio with .04% average gains

The Pre-IFT & Post IFT traded in the same direction 56% of the time

When the Pre-IFT closed positive, the post IFT closed positive 72% of the time

When the Pre-IFT closed negative, the post IFT closed negative 43% of the time

___

W4500 (S-Fund) Pre IFT vs. Post IFT: For short-term trades (within the week) enter Tuesday, exit Thursday for a .38% avg. gain

The Pre-IFT deadline has a 44% winning ratio with -.12% average gains

The Post-IFT deadline has a 51% winning ratio with .02% average gains

The Pre-IFT & Post IFT traded in the same direction 45% of the time

When the Pre-IFT closed positive, the post IFT closed positive 46% of the time

When the Pre-IFT closed negative, the post IFT closed negative 45% of the time

___

AGG (F-Fund) Pre IFT vs. Post IFT: For short-term trades (within the week) enter Wednesday, exit Friday for a .03% avg. gain

The Pre-IFT deadline has a 45% winning ratio with -.01% average gains

The Post-IFT deadline has a 42% winning ratio with .00% average gains

The Pre-IFT & Post IFT traded in the same direction 45% of the time

When the Pre-IFT closed positive, the post IFT closed positive 40% of the time

When the Pre-IFT closed negative, the post IFT closed negative 54% of the time

___

For the sake of the short-term investor, let’s take a sneak peek, making the Bearish case for a down November to see where the stats lead us into December. For SPX, over the past 41 years, November has closed down 13 times, of those 13 down Novembers, we have 11 positive Decembers, with an 85% winning ratio and 2.72% average gains. Either ways, regardless of November’s performance, the stats for December are still strong enough to warrant staying invested for the remainder of the year.

___

Crunching this week’s stats, has led to many of the same conclusions, both the historical stats covering many years, the last 11 weeks, and last 55 days, is showing weakness, which has made it difficult to find positive data for this upcoming week 46. For myself, I am expecting the low for November to be put in this week, because from this week on, most of the historical stats get better...

Stay invested…Jason