For the investor October was an awesome month with an 8.30% gain

For the S&P 500 this was the 5[SUP]th[/SUP] best over the past 66 Octobers, and the 22[SUP]nd[/SUP] best over the past 789 months

This leads us to the key question many of us are asking, with such a strong October, what does this mean for November? Well, there are only 10 months of October which have closed 5% or greater and of those 10 occasions, 8 of 10 Novembers closed positive.

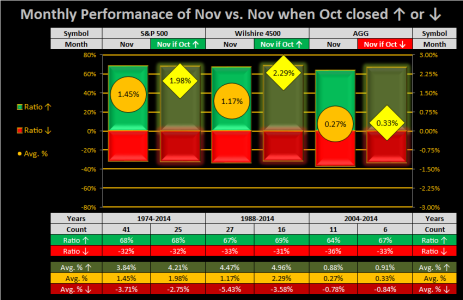

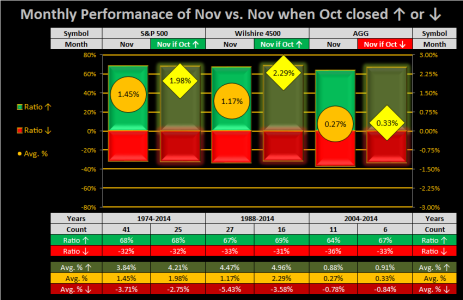

MONTHLY: Listed below is November’s statistical performance for the S&P 500, Wilshire 4500, and AGG. We can see the S&P 500 has a strong 68% winning ratio and 1.45% average gains. What’s interesting is when October closes positive, then November’s average gains are stronger at 1.98% and the same holds true for the Wilshire 4500. AGG’s data is very limited on this timeframe, but it does show a respectable winning ratio and is the 4[SUP]th[/SUP] best month of the year.

___

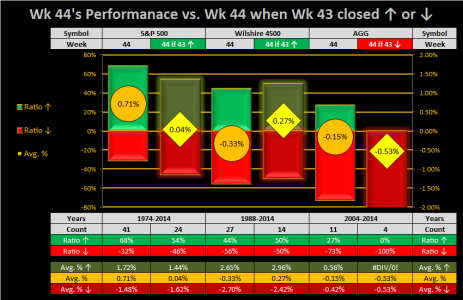

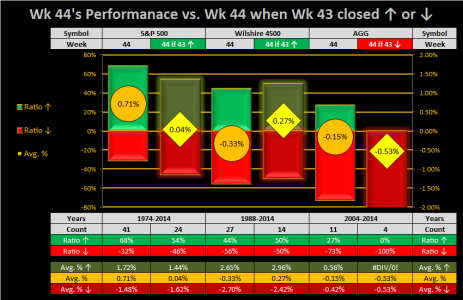

WEEKLY: Going into week 44 (the 1[SUP]st[/SUP] week of November) the S&P 500 has a strong statistical edge over the Wilshire 4500 & AGG. What I find interesting, for the S&P 500, week 44 ranks as the best of the 40-52 13-week range, while the Wilshire 4500 ranks as the 9[SUP]th[/SUP] best, and AGG ranks as 11[SUP]th[/SUP] best.

Note: For week 46 it’s the inverse, meaning the S&P 500 slightly underperforms.

___

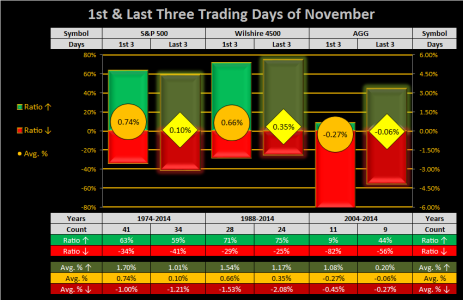

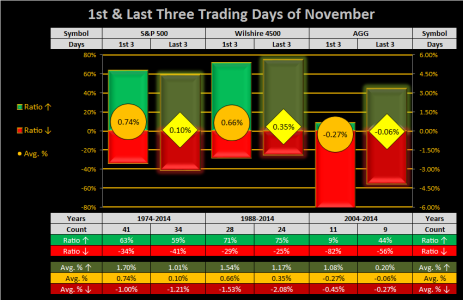

DAILY: This next charts shows both the first & last 3 days of November. Both the S&P 500 & Wilshire 4500 have a strong winning ratios and average gains.

Note: Something every TSPer should know, for AGG the 1[SUP]st[/SUP] trading day of the month is statistically the worst, with a meager 16% winning ratio and -.31% average gains over the past 145 1[SUP]st[/SUP] trading days of the month.

___

My expectations for the remainder of the year are simple

Stay invested…Jason

For the S&P 500 this was the 5[SUP]th[/SUP] best over the past 66 Octobers, and the 22[SUP]nd[/SUP] best over the past 789 months

This leads us to the key question many of us are asking, with such a strong October, what does this mean for November? Well, there are only 10 months of October which have closed 5% or greater and of those 10 occasions, 8 of 10 Novembers closed positive.

MONTHLY: Listed below is November’s statistical performance for the S&P 500, Wilshire 4500, and AGG. We can see the S&P 500 has a strong 68% winning ratio and 1.45% average gains. What’s interesting is when October closes positive, then November’s average gains are stronger at 1.98% and the same holds true for the Wilshire 4500. AGG’s data is very limited on this timeframe, but it does show a respectable winning ratio and is the 4[SUP]th[/SUP] best month of the year.

___

WEEKLY: Going into week 44 (the 1[SUP]st[/SUP] week of November) the S&P 500 has a strong statistical edge over the Wilshire 4500 & AGG. What I find interesting, for the S&P 500, week 44 ranks as the best of the 40-52 13-week range, while the Wilshire 4500 ranks as the 9[SUP]th[/SUP] best, and AGG ranks as 11[SUP]th[/SUP] best.

Note: For week 46 it’s the inverse, meaning the S&P 500 slightly underperforms.

___

DAILY: This next charts shows both the first & last 3 days of November. Both the S&P 500 & Wilshire 4500 have a strong winning ratios and average gains.

Note: Something every TSPer should know, for AGG the 1[SUP]st[/SUP] trading day of the month is statistically the worst, with a meager 16% winning ratio and -.31% average gains over the past 145 1[SUP]st[/SUP] trading days of the month.

___

My expectations for the remainder of the year are simple

- The majority of market timers are underperforming the markets and they will need to play catch up

- Due to large cap “window dressing” Large caps & Tech will continue to outperform, the rotation with small caps, should take place next year

- I expect a 1-2 week pullback in November, but I also expect it to be shallow and difficult to time.

Stay invested…Jason