For this week, there are more charts covering the S&P 500, Wilshire 4500, and AGG. I've also added more data (meaning longer timeframes. For next week, based on the first three charts posted below, the C-Fund is statistically the strongest

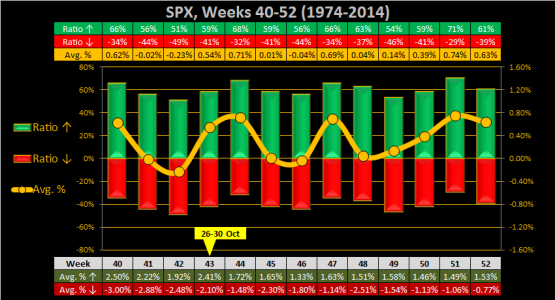

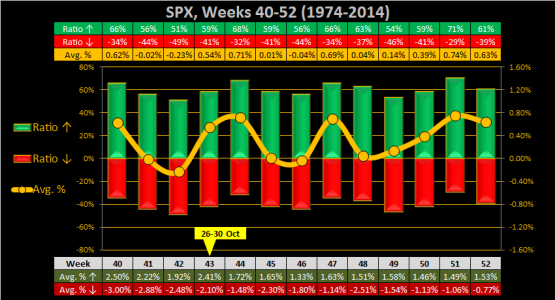

S&P 500 update (C-Fund)

Closing the week up 2.07%, from 1974-2015 (42 years) this is the 9th best week 42

For the 4th Quarter’s 13 weeks, week 43 has the 7th best winning ratio, 6th best average gains, 2nd best positive gains and 8th best negative gains. Overall, week 43 ranks as the 6th best week over the 4th quarter

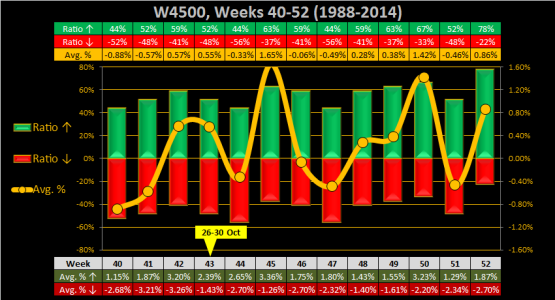

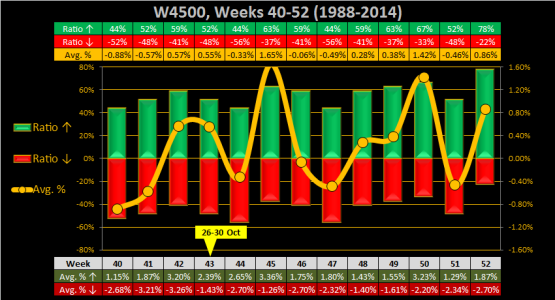

Wilshire 4500 update (S-Fund)

Closing the week up .32%, from 1988-2015 (28 years) this is the 17th best week 42

For the 4th Quarter’s 13 weeks, week 43 has the 8th best winning ratio, 5th best average gains, 5th best positive gains and 3rd best negative gains. Overall, week 43 ranks as the 4th best week over the 4th quarter

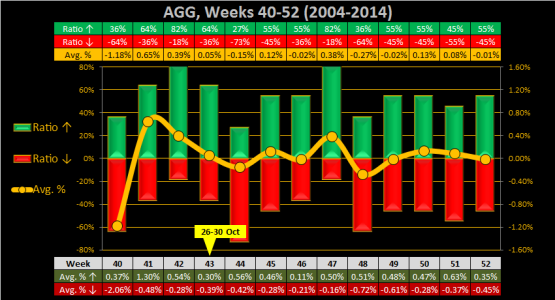

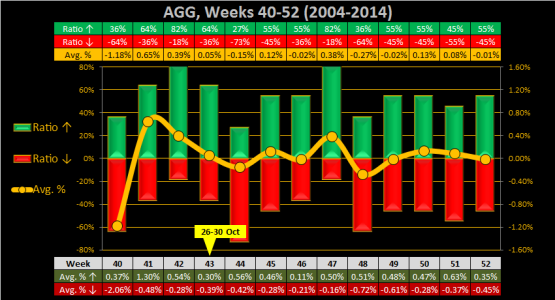

AGG update (F-Fund)

Note: Limited historical data

Closing the week down -.02%, from 2004-2015 (12 years) this is the 3rd worst week 42

For the 4th Quarter’s 13 weeks, week 43 has the 3rd best winning ratio, 7th best average gains, 12th best positive gains and 7th best negative gains. Overall, week 43 ranks as the 7th best week over the 4th quarter

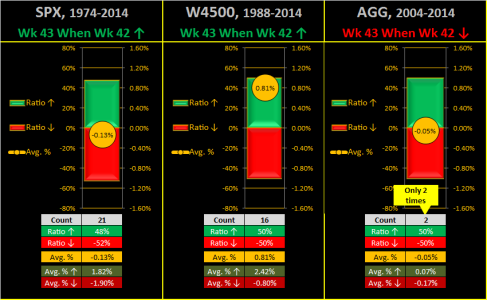

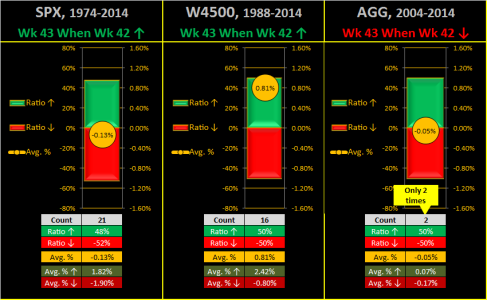

This week’s results, based off last week closing up or down

While all 3 funds have below average winning ratios, the Wilshire 4500 has a significant edge in average gains (partially due to a 5.64% gain in 2002)

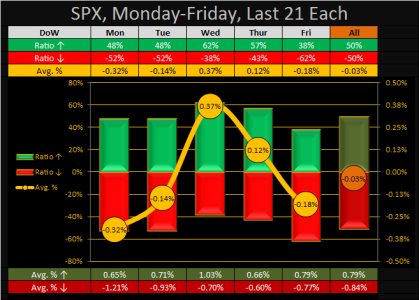

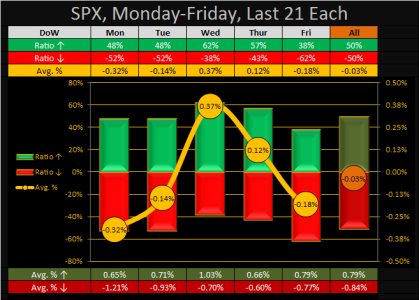

S&P 500, Day of the Week (last 105 days are below the .03% average gains)

Wednesday has been the best day to sell, with a 62% winning ratio and .37% average gains

Tuesday has been the best day to buy, with a 47% winning ratio and -.32% average gains

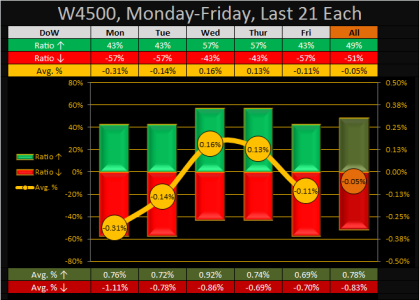

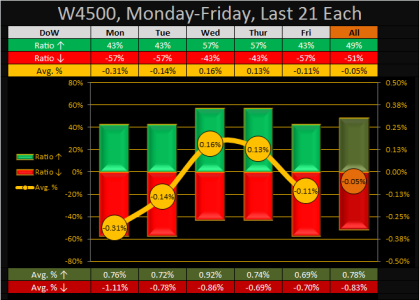

Wilshire 4500, Day of the Week (last 105 days are below the .04% average gains)

Wednesday has been the best day to sell, with a 57% winning ratio and .16% average gains

Monday has been the best day to buy, with a 43% winning ratio and -.31% average gains

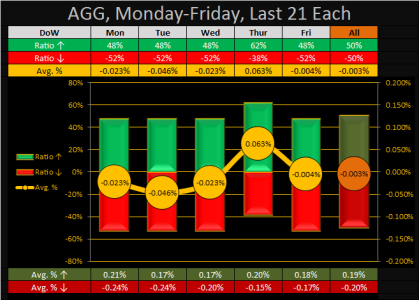

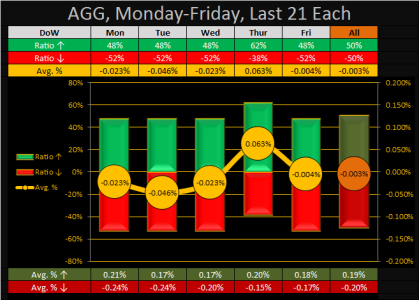

AGG, Day of the Week (last 105 days are below the .003% average gains)

Thursday has been the best day to sell, with a 62% winning ratio and .06% average gains

Tuesday has been the best day to buy, with a 48% winning ratio and -.05% average gains

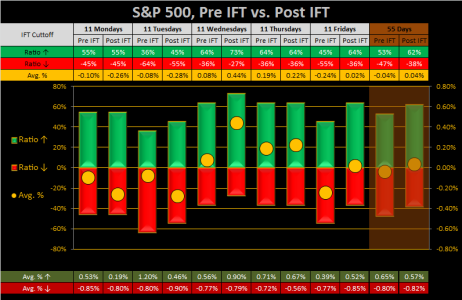

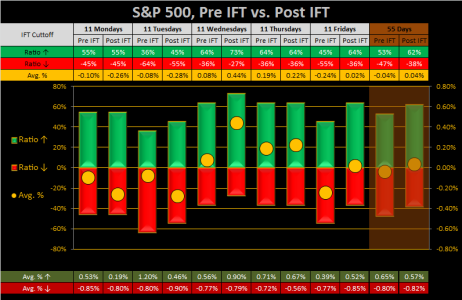

S&P 500’s Pre IFT vs. Post IFT (last 11 Mon-Fri & Last 55 days)

The Pre-IFT deadline has a 53% winning ratio with -.04% average gains

The Post-IFT deadline has a 62% winning ratio with .04% average gains

When the Pre-IFT closed positive, the post IFT closed positive 69% of the time

When the Pre-IFT closed negative, the post IFT closed negative 46% of the time

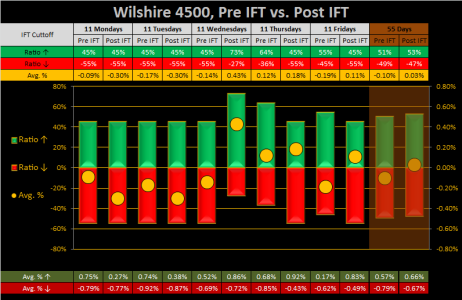

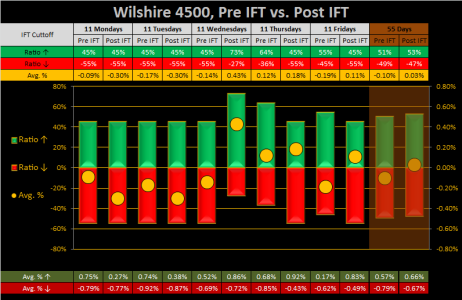

Wilshire 4500’s Pre IFT vs. Post IFT (last 11 Mon-Fri & Last 55 days)

The Pre-IFT deadline has a 51% winning ratio with -.10% average gains

The Post-IFT deadline has a 53% winning ratio with .03% average gains

When the Pre-IFT closed positive, the post IFT closed positive 54% of the time

When the Pre-IFT closed negative, the post IFT closed negative 48% of the time

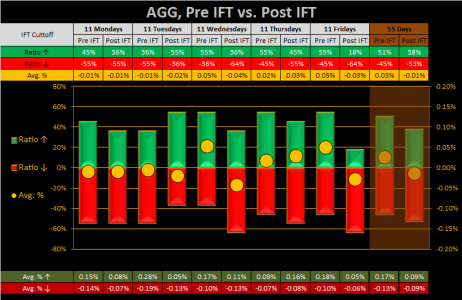

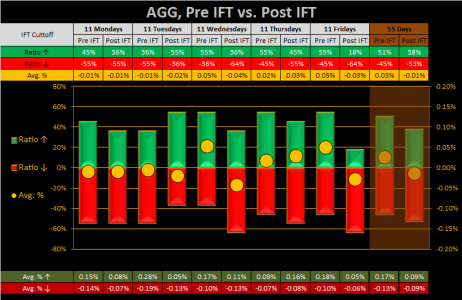

AGG’s Pre IFT vs. Post IFT (last 11 Mon-Fri & Last 55 days)

The Pre-IFT deadline has a 51% winning ratio with .03% average gains

The Post-IFT deadline has a 38% winning ratio with -.01% average gains

When the Pre-IFT closed positive, the post IFT closed positive 36% of the time

When the Pre-IFT closed negative, the post IFT closed negative 52% of the time

Trade hard...Jason

S&P 500 update (C-Fund)

Closing the week up 2.07%, from 1974-2015 (42 years) this is the 9th best week 42

For the 4th Quarter’s 13 weeks, week 43 has the 7th best winning ratio, 6th best average gains, 2nd best positive gains and 8th best negative gains. Overall, week 43 ranks as the 6th best week over the 4th quarter

Wilshire 4500 update (S-Fund)

Closing the week up .32%, from 1988-2015 (28 years) this is the 17th best week 42

For the 4th Quarter’s 13 weeks, week 43 has the 8th best winning ratio, 5th best average gains, 5th best positive gains and 3rd best negative gains. Overall, week 43 ranks as the 4th best week over the 4th quarter

AGG update (F-Fund)

Note: Limited historical data

Closing the week down -.02%, from 2004-2015 (12 years) this is the 3rd worst week 42

For the 4th Quarter’s 13 weeks, week 43 has the 3rd best winning ratio, 7th best average gains, 12th best positive gains and 7th best negative gains. Overall, week 43 ranks as the 7th best week over the 4th quarter

This week’s results, based off last week closing up or down

While all 3 funds have below average winning ratios, the Wilshire 4500 has a significant edge in average gains (partially due to a 5.64% gain in 2002)

S&P 500, Day of the Week (last 105 days are below the .03% average gains)

Wednesday has been the best day to sell, with a 62% winning ratio and .37% average gains

Tuesday has been the best day to buy, with a 47% winning ratio and -.32% average gains

Wilshire 4500, Day of the Week (last 105 days are below the .04% average gains)

Wednesday has been the best day to sell, with a 57% winning ratio and .16% average gains

Monday has been the best day to buy, with a 43% winning ratio and -.31% average gains

AGG, Day of the Week (last 105 days are below the .003% average gains)

Thursday has been the best day to sell, with a 62% winning ratio and .06% average gains

Tuesday has been the best day to buy, with a 48% winning ratio and -.05% average gains

S&P 500’s Pre IFT vs. Post IFT (last 11 Mon-Fri & Last 55 days)

The Pre-IFT deadline has a 53% winning ratio with -.04% average gains

The Post-IFT deadline has a 62% winning ratio with .04% average gains

When the Pre-IFT closed positive, the post IFT closed positive 69% of the time

When the Pre-IFT closed negative, the post IFT closed negative 46% of the time

Wilshire 4500’s Pre IFT vs. Post IFT (last 11 Mon-Fri & Last 55 days)

The Pre-IFT deadline has a 51% winning ratio with -.10% average gains

The Post-IFT deadline has a 53% winning ratio with .03% average gains

When the Pre-IFT closed positive, the post IFT closed positive 54% of the time

When the Pre-IFT closed negative, the post IFT closed negative 48% of the time

AGG’s Pre IFT vs. Post IFT (last 11 Mon-Fri & Last 55 days)

The Pre-IFT deadline has a 51% winning ratio with .03% average gains

The Post-IFT deadline has a 38% winning ratio with -.01% average gains

When the Pre-IFT closed positive, the post IFT closed positive 36% of the time

When the Pre-IFT closed negative, the post IFT closed negative 52% of the time

Trade hard...Jason