For the S&P 500, the second week of March (week 10 of 52) closed down -.86% this is below the .50% average week 10 returns, is the 14th best week over the past 21 years, and the 51st best over the past 66 years. Once again, it was basically a bad week

___

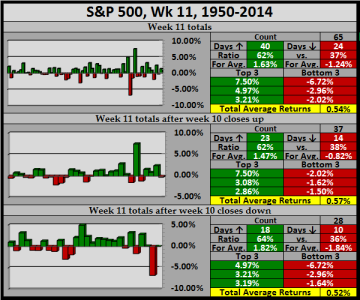

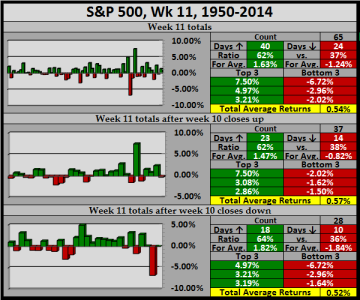

Contrasting upcoming week 11 against an up/down week 10 from 1950-2014

___

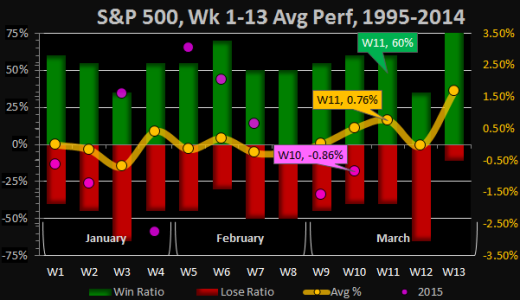

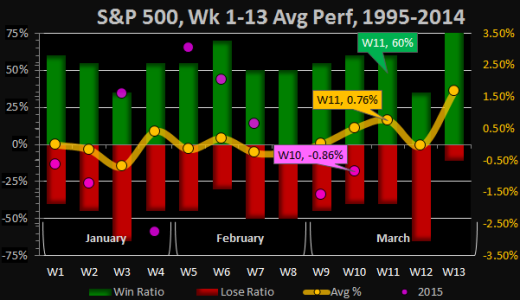

Contrasting week 11 against the 52 weeks of the year, from 1995-2014

Note: Week 13 only has 9 years of data instead of 20

___

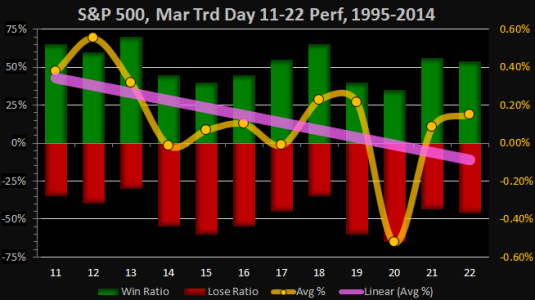

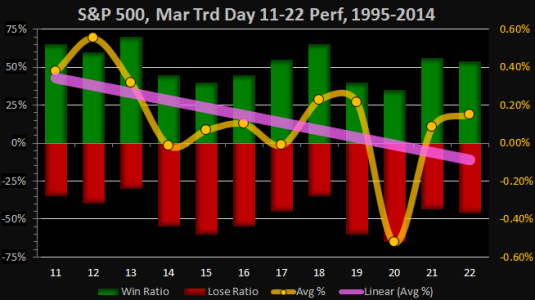

For week 11, we have trading days 11-15

___

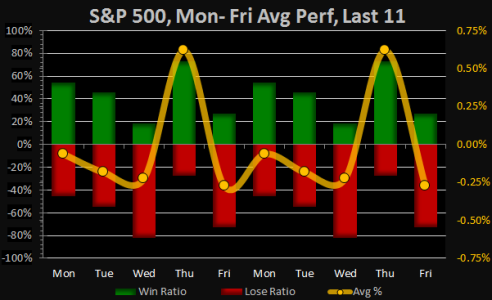

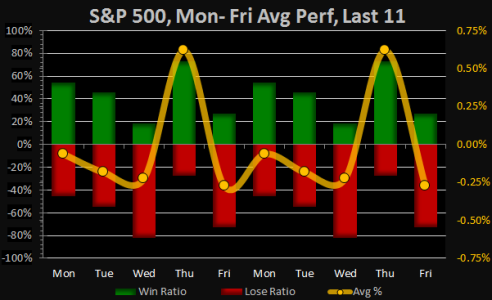

For the last 11 Monday through Fridays

___

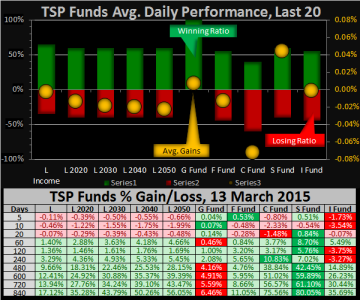

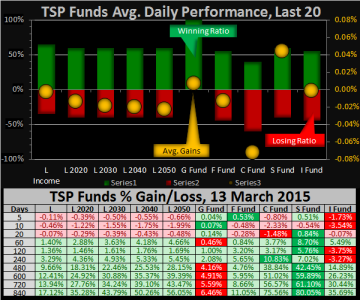

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

___

Next week should give us some awesome price action, I'm looking forward to it.

Take care…Jason

___

Contrasting upcoming week 11 against an up/down week 10 from 1950-2014

- We show the last 65 week 11s have an average 62% winning ratio with .54% average returns

- For the 37 years when week 10 closed up, week 11 shows a 62% winning ratio with .57% average returns

- For the 28 years when week 10 closed down, week 11 shows a 64% winning ratio with .52% average returns

- Under current conditions, week 11 has a positive bias with strong average returns

___

Contrasting week 11 against the 52 weeks of the year, from 1995-2014

- We show a 60% winning ratio, which is above average, ranking in a 11-way tie for 13th

- We show .76% average returns, which is above average, ranking 8th

- We show 2.47% average positive returns, which is above average, ranking 5th

- We show -1.81% average negative returns, which is above average, ranking 23rd

- Correction: In the previous blog, I incorrectly stated week 11 was the 3rd best when it is actually the 7th best

- There is a nice historical positive bias for week 11, it ranks 7th best of 52 weeks of the year.

Note: Week 13 only has 9 years of data instead of 20

___

For week 11, we have trading days 11-15

- The average 5-day winning ratio is 56%

- The cumulative 5-day average return is 1.30%

___

For the last 11 Monday through Fridays

- Last 2 Mondays closed up (2nd best day)

- Last 2 Tuesdays closed down (3rd best day)

- Last 7 Wednesdays closed down (worst day, crap that's bad)

- Last 2 Thursdays closed up, last 8 of 11 closed up (best day to exit)

- Last 3 Fridays closed down (2nd worst day)

___

TSP Fund Price Performance over the past 20 days (only discussing the F/C/S/I funds)

- S-Fund ranks 1st with a 60% winning ratio and .04% average returns

- I -Fund ranks 2nd with a 55% winning ratio and .00% average returns

- F-Fund ranks 3rd with a 55% winning ratio and -.01% average returns

- C-Fund ranks 3rd with a 40% winning ratio and -.07% average returns

- The S-Fund leads YTD

___

Next week should give us some awesome price action, I'm looking forward to it.

Take care…Jason