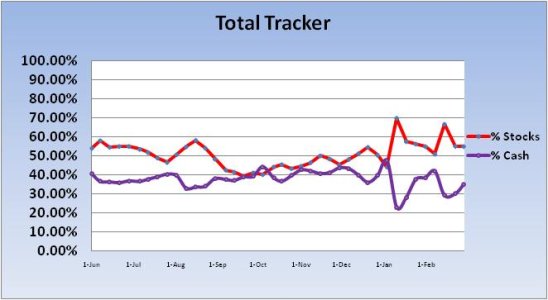

Last weekend, I noted that the herd had sold about 11.5% of their stock holdings going into the new week. The Top 50 had dipped too, but not by as much. Then the market promptly took a moderate nosedive.

This coming week, we have gotten more defensive in some pockets.

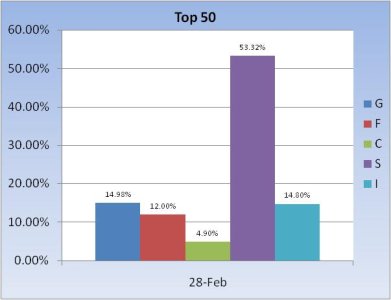

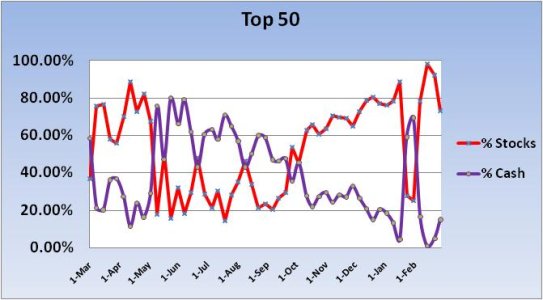

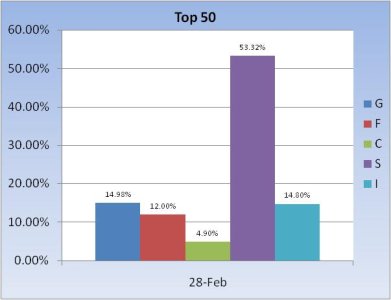

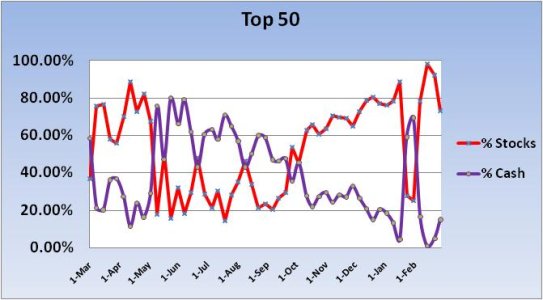

The Top 50 lightened up much more after last week's decline. About 19% was taken from stocks and shifted to the F and G funds.

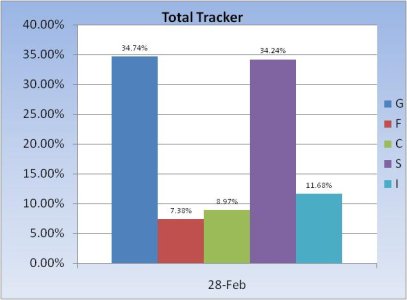

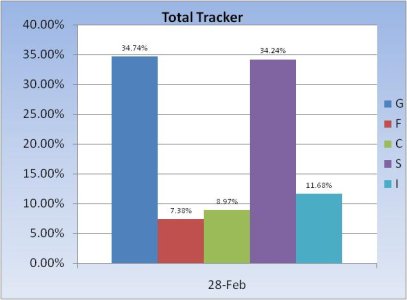

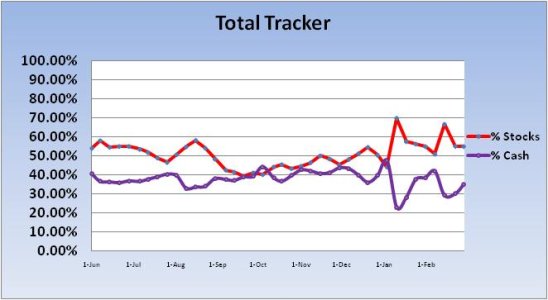

The stock position of the herd has not changed much since last week, but the F fund saw some selling, while the G fund picked up some gains.

Friday's buying interest may have surprised some given geopolitical fears haven't changed all that much. But that rally only cut losses in half, which means we're not out of the woods yet. Caution flags are out, but as we saw several times during this 6 month bull run another leg higher can materialize in spite of technicals suggesting otherwise.

The Seven Sentinels remain on a buy and our sentiment survey remained in the S fund for this coming week. Are we getting ready to run again?

This coming week, we have gotten more defensive in some pockets.

The Top 50 lightened up much more after last week's decline. About 19% was taken from stocks and shifted to the F and G funds.

The stock position of the herd has not changed much since last week, but the F fund saw some selling, while the G fund picked up some gains.

Friday's buying interest may have surprised some given geopolitical fears haven't changed all that much. But that rally only cut losses in half, which means we're not out of the woods yet. Caution flags are out, but as we saw several times during this 6 month bull run another leg higher can materialize in spite of technicals suggesting otherwise.

The Seven Sentinels remain on a buy and our sentiment survey remained in the S fund for this coming week. Are we getting ready to run again?