There's no shortage of traders on most message boards who like to accentuate their bullish disposition with over-the-top phrases like that, but this week's action might be an exception. I had been calling for higher prices this week, but what we got went well beyond my expectations as the market served up a moon shot by having its best one week performance in two years.

Along with all the other well established reasons for this weeks advance, the market got some economic data this morning that kept traders pushing up prices. The June ISM Manufacturing Index came in at 55.3, which was better than economists forecast of 51.1.

And then the final June Consumer Sentiment Survey was released which saw its number fall modestly to 71.5, while May construction spending fell 0.6%, but that was of little interest to a market bent on space exploration.

Volume was thin again, but there's more than ample buying pressure to send bears reeling for a fifth consecutive day.

Here's today's charts:

I don't think I have to explain this one today. As impressive as they looked yesterday, it only got more impressive today. There was a lot of momentum behind this week's rally and it shows on these two charts.

Same with NAHL and NYHL.

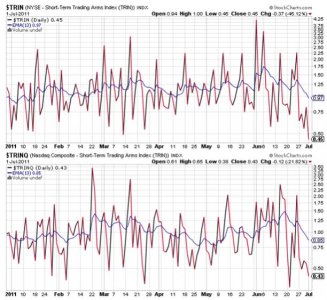

Getting overbought doesn't always mean selling interest is near and this week proves it. Both TRIN and TRINQ are showing very bullish readings, which often result in at least some token downside pressure, but not this week. I don't know how long the market can continue like this, but I'm starting to believe there's more upside coming and it will probably happen next week.

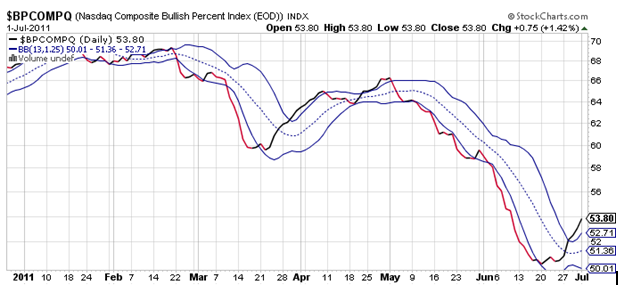

Not surprisingly, BPCOMPQ continued its ascent past that upper bollinger band.

So all signals remain on buys, which keeps the system in a buy condition.

After seeing the kind of strength we saw this week, it's hard not to be bullish. And I suspect if July does see another leg down, it probably won't start next week. I think the market will have to go through a set-up process to get anything going on the downside now, and that will take some time. For now, the trend is indeed back up. See you either Sunday or Monday when I post next week's tracker charts and enjoy the fourth of July weekend.