-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Time to Refinance Mortgage?

- Thread starter pmaloney

- Start date

1965Vintage

TSP Strategist

- Reaction score

- 11

2.75% is awesome, and yes, I think it could go lower but not by much. Maybe 2.4% but that's not a sure thing. I'd jump on it.... You know what they say about getting greedy!

Sent from my moto z3 using TSP Talk Forums mobile app

Sent from my moto z3 using TSP Talk Forums mobile app

Tsunami

TSP Pro

- Reaction score

- 62

We bought our retirement home a few months ago with a NFCU loan. We locked in mid-May at 3.625% (with zero points/fees)...now just 3 months later we could have got 3.375% or maybe 3.25%, argh.

Note that the rates they show online are basically teaser rates and the rate you'll actually get will be a quarter percent or so higher.

https://www.navyfederal.org/loans-cards/mortgage/mortgage-rates/va-loans.php

I think rates will go even lower based on the predictions now for the Fed to cut at least 3 more times...that doesn't affect mortgages much though, but long term rates should continue to edge lower as well, I'm hoping to refinance at 3% or lower next year. The times they are a changin'!

Note that the rates they show online are basically teaser rates and the rate you'll actually get will be a quarter percent or so higher.

https://www.navyfederal.org/loans-cards/mortgage/mortgage-rates/va-loans.php

I think rates will go even lower based on the predictions now for the Fed to cut at least 3 more times...that doesn't affect mortgages much though, but long term rates should continue to edge lower as well, I'm hoping to refinance at 3% or lower next year. The times they are a changin'!

Last edited:

Wow! I just noticed I can refinance to a 15 year fixed mortgage at 2.75% at Navy Federal Credit Union. I think I'm going for it. Anone have thoughts that it may go lower soon or by next month with new rate cuts?

Thanks!:smile:

Nice PM! What are their closing costs like? Some lenders will do a no closing cost refi- for a 1/4 to 1/2% higher interest rate. I like that option because if you decide to move you haven't paid the closing costs without getting the full benefit of the interest rate cut. I.E. if you decide to move before you get the full benefit of the interest reduction.

pmaloney

TSP Analyst

- Reaction score

- 22

Nice PM! What are their closing costs like? Some lenders will do a no closing cost refi- for a 1/4 to 1/2% higher interest rate. I like that option because if you decide to move you haven't paid the closing costs without getting the full benefit of the interest rate cut. I.E. if you decide to move before you get the full benefit of the interest reduction.

Good question and I appreciate your reply. They say that their closing costs are between 2 and 4%. I don't have all the details yet but I can use NFCU to close so I don't think my simple refi should cost that much especially since the cost of the 2.75% rate is contingent on a origination fee of 1% and 0.25 % points. However, I can get a 3.125% 15 year fixed by not paying any points and hence, no origination fee. This would mean that I will pay less than $50 more a month for 15 years than I am paying for 20 more years at 4.85%.

I would consider the points and origination fee for 2.75% but I live in Reston and it is going full tilt high rise so my great lake view may easily get bought out in the next five years. What lenders offer a no closing cost loan?

Thanks again! :smile:

PM, most mortgage brokers will offer the no closing cost option. Credit unions and banks generally have fixed procedures and don't like to deviate from them. You may have to check around some to get the best combination for you. Lending Tree has a lot of options but can be really annoying to deal with. Also, they will wear your phone out calling from their call center if you ever contact them. Best of luck to you!

Tsunami

TSP Pro

- Reaction score

- 62

Have you looked into the streamlined refi program for VA loans? That's what I plan to do. They roll over all closing costs into the new loan.

https://www.militaryvaloan.com/va-streamline-refinance.html

I also read that with VA loans you have to wait 210 days after making your first payment before you can refinance. So that clock runs out for us on about 2/10/2020, and until then I'll be hoping for rates to keep dropping, which looks likely since the recession is only just now getting underway.

https://www.militaryvaloan.com/va-streamline-refinance.html

I also read that with VA loans you have to wait 210 days after making your first payment before you can refinance. So that clock runs out for us on about 2/10/2020, and until then I'll be hoping for rates to keep dropping, which looks likely since the recession is only just now getting underway.

Bullitt

Market Veteran

- Reaction score

- 75

Some people at work talking about refinancing the past few weeks. Many of them aren't on solid financial footing. When everyone's looking to refinance, it makes me wonder who's swimming naked.

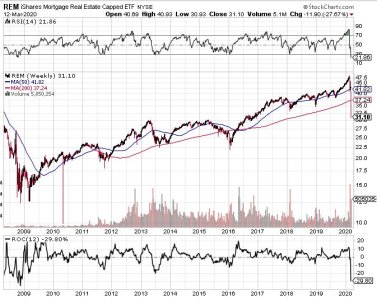

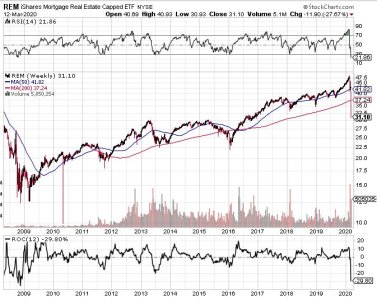

REM ETF. Basically these are mortgage backed securities, aka Bonds. Cratering. Down almost 30% in the past four days.

REM ETF. Basically these are mortgage backed securities, aka Bonds. Cratering. Down almost 30% in the past four days.

This investment seeks to track the investment results of the FTSE NAREIT All Mortgage Capped Index composed of U.S. real estate investment trusts ("REITs") that hold U.S. residential and commercial mortgages.

Rod

Market Veteran

- Reaction score

- 407

Fed just cut interest rate to 0, I wonder if that will lower mortgage rate even further? I'm thinking of my refinancing my place, got in about 7-8 years ago @ 2.125% for 15 years, paying the mortgage sucks but I'm half way there.

Mortgage rates have actually increased recently due to a logjam in mortgage applications. Too many applying! Thus, affecting mortgage-backed securities. Therefore, banks have increased rates in order to combat that. So, I doubt rates will decrease significantly any time soon. They must first clear up that logjam. We need to give rates time to settle into the new environment.

Bullitt

Market Veteran

- Reaction score

- 75

uscfanhawaii

TSP Pro

- Reaction score

- 18

I refi’d last year, Jumbo Loan, 30 yr, 3.375%.

Is 3.0% a good target?

Is 3.0% a good target?

bmneveu

TSP Pro

- Reaction score

- 91

I refi’d last year, Jumbo Loan, 30 yr, 3.375%.

Is 3.0% a good target?

Depends on a lot of factors. If you plan to sell anytime soon then probably not worth it. If you are planning on stay there for 30 years, maybe. Look up some mortgage calculators online to get an idea if its worth it. 0.375% is not much, so it would take staying in the house for a long time to break even on the closing costs. I wouldn't do it personally for that small of a gain.

uscfanhawaii

TSP Pro

- Reaction score

- 18

Thanks for the response! Yeah, I was thinking the same thing.Depends on a lot of factors. If you plan to sell anytime soon then probably not worth it. If you are planning on stay there for 30 years, maybe. Look up some mortgage calculators online to get an idea if its worth it. 0.375% is not much, so it would take staying in the house for a long time to break even on the closing costs. I wouldn't do it personally for that small of a gain.

USC sounds like you got a great interest rate. Keep watching! May go lower yet. You can occasionally get the larger mortgage brokers to forgo the closing costs on a refinance. Usually in exchange for a slightly higher new rate. The new rate w/o closing costs usually ranges between 3/8 and 1/2 % higher than the normal refi rate w/ closing costs. No closing cost plan benefit is more for homeowners who may be selling before the mortgage is paid off. Even if the closing costs are wrapped into the new mortgage you still have to pay it. JMHO I always ask for no closing costs.

Rod

Market Veteran

- Reaction score

- 407

We currently have two refinance applications (VA IRRRL) in the pipeline... trying to decide which one to go with. Our current 30-Yr VA fixed is @ 3.75%. We have 25 more years to go on it. But, we do plan to move (back to the Carolinas) in about 5 years. Our "break-even" (recouping closing costs) on both of these mortgages would be within 3 years. If we do indeed move at the 5 year mark, we would pocket close to an additional $4,000.00 due to the refinance after we broke even.

Pentagon Federal Credit Union (who we "bank" with): Locked in @ 2.75% (Closing costs: $4,820.80) Close within 60-90 days. If interest rates drop within this time, we can "float" down to it for a $750.00 fee.

Freedom Mortgage (our current lender): Locked in @ 2.625% (Closing costs: $5,358.92) They want to close by 13 July.

Although PFCU does not have a 1% Origination Fee (like Freedom Mortgage does), their "service fees" add up. Freedom Mortgage does not have as many service fees because our current mortgage is already with them.

We wanted to decline escrow, but the VA requires it because of COVID. At least that's what PFCU said.

As of now, we are leaning towards PFCU because communication with Freedom Mortgage has been lacking. I sent the agent an email on 1 Jul with some questions that needed answered before we moved forward. I have not received a reply, but have received many automated texts/voicemails urging us to call and move forward with the refinance. That's crappy customer service.

In the end, we may decide not to go with either of these lenders. But, at least we have the ball rolling.

Pentagon Federal Credit Union (who we "bank" with): Locked in @ 2.75% (Closing costs: $4,820.80) Close within 60-90 days. If interest rates drop within this time, we can "float" down to it for a $750.00 fee.

Freedom Mortgage (our current lender): Locked in @ 2.625% (Closing costs: $5,358.92) They want to close by 13 July.

Although PFCU does not have a 1% Origination Fee (like Freedom Mortgage does), their "service fees" add up. Freedom Mortgage does not have as many service fees because our current mortgage is already with them.

We wanted to decline escrow, but the VA requires it because of COVID. At least that's what PFCU said.

As of now, we are leaning towards PFCU because communication with Freedom Mortgage has been lacking. I sent the agent an email on 1 Jul with some questions that needed answered before we moved forward. I have not received a reply, but have received many automated texts/voicemails urging us to call and move forward with the refinance. That's crappy customer service.

In the end, we may decide not to go with either of these lenders. But, at least we have the ball rolling.

Similar threads

- Article

- Replies

- 4

- Views

- 433

- Replies

- 2

- Views

- 189