Well, today wasn't quite as boring as the last two days, but that's not saying a whole lot. Dollar weakness in the early going gave stocks a boost, but that weakness faded as trading wore on towards the FOMC policy statement. As expected that statement held no new information, which gave the market some measure of relief, but it didn't translate into big gains. The dollar ended the day slightly lower.

The CPI data came in pretty much as expected, so no surprises there either.

I've been expecting a closing new high in the S&P since the beginning of the month, but so far, despite a positive seasonal bias, it hasn't been able to hit it. The NAZ on the other hand has been doing better, as has our own S fund.

But we are bouncing around at the top of a channel and trading has been contained in a tight range. Many are expecting a SC rally, and we may still get one, but the other fly in the ointment that I've mentioned in previous posts is pockets of high bullish readings. At best sentiment is neutral overall, but I'm inclined to think there's still too many bulls to have a lasting rally.

So while we closed positive today, it wasn't a breakout rally. Had I known we'd trade lower in the afternoon, I'd have held my position until tomorrow, because I still think we have a pop higher coming. But we are now entering the second half of the month. How much rally can we expect at this point?

Yes, the market is inching higher, but I'm starting to feel we are due for another reversal. And not just because of sentiment. Let's look at the charts.

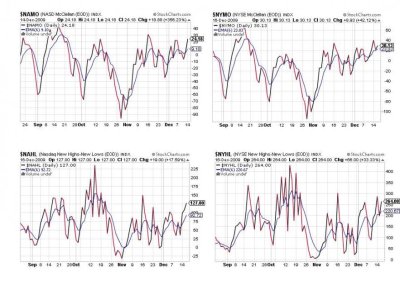

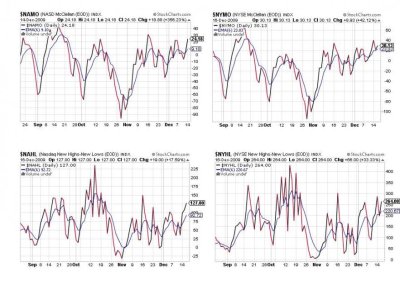

All four on a buy here today. But NYMO and NAMO are looking toppy. The 6 day EMA is crawling higher and we are entering the top of the range for this signal as measured over the past three and half months. NAHL and NYHL are closer to their average. So there's room to go higher in these charts, but how much higher?

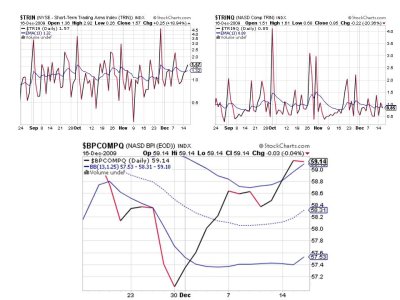

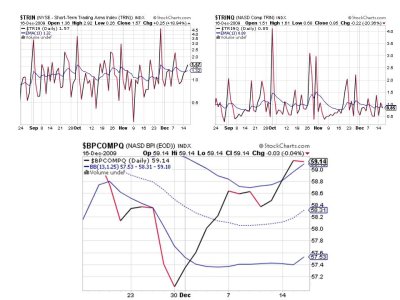

TRIN flipped to a sell, and TRINQ is just barely a buy. BPCOMPQ has turned slightly lower, is very close to crossing the upper bollinger band, which would trigger a sell for that signal.

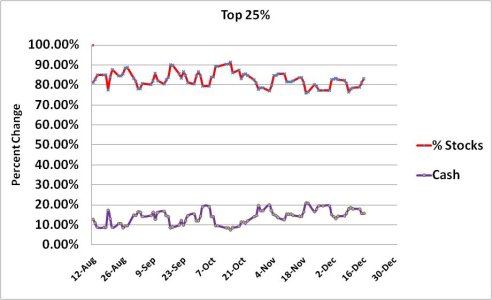

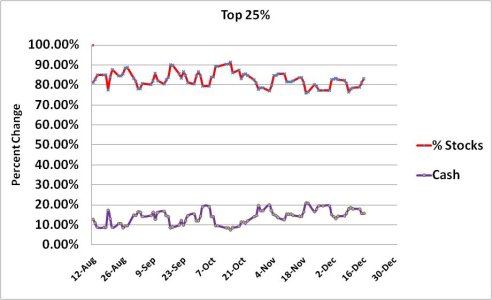

Same story, different day for our Top 25%.

So the SS remain on a buy. But understand that all seven signals are close their respective exponential moving average. It would not take a lot of selling pressure to get a sell signal from the SS, so if your long and following the SS beware of any significant selling pressure as we move forward.

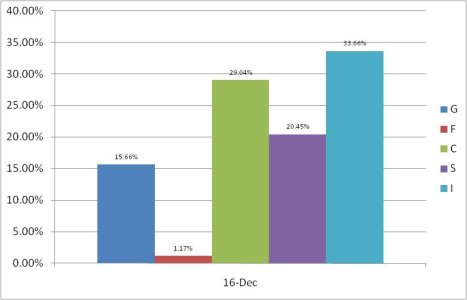

I moved to the G fund today, expecting a big rally that turned out to be moderate at best. I have not liked sentiment since last week and that elevates risk in my opinion. NAMO and NYMO also look toppy. But while I decided to cash in my chips till January, this market may still push higher. I'm of the opinion that if it does, it may not last long. But the second half of this month is not a normal trading environment either.

There isn't many more trading days before we see whether a good SC rally is in the cards or not. See you tomorrow.

The CPI data came in pretty much as expected, so no surprises there either.

I've been expecting a closing new high in the S&P since the beginning of the month, but so far, despite a positive seasonal bias, it hasn't been able to hit it. The NAZ on the other hand has been doing better, as has our own S fund.

But we are bouncing around at the top of a channel and trading has been contained in a tight range. Many are expecting a SC rally, and we may still get one, but the other fly in the ointment that I've mentioned in previous posts is pockets of high bullish readings. At best sentiment is neutral overall, but I'm inclined to think there's still too many bulls to have a lasting rally.

So while we closed positive today, it wasn't a breakout rally. Had I known we'd trade lower in the afternoon, I'd have held my position until tomorrow, because I still think we have a pop higher coming. But we are now entering the second half of the month. How much rally can we expect at this point?

Yes, the market is inching higher, but I'm starting to feel we are due for another reversal. And not just because of sentiment. Let's look at the charts.

All four on a buy here today. But NYMO and NAMO are looking toppy. The 6 day EMA is crawling higher and we are entering the top of the range for this signal as measured over the past three and half months. NAHL and NYHL are closer to their average. So there's room to go higher in these charts, but how much higher?

TRIN flipped to a sell, and TRINQ is just barely a buy. BPCOMPQ has turned slightly lower, is very close to crossing the upper bollinger band, which would trigger a sell for that signal.

Same story, different day for our Top 25%.

So the SS remain on a buy. But understand that all seven signals are close their respective exponential moving average. It would not take a lot of selling pressure to get a sell signal from the SS, so if your long and following the SS beware of any significant selling pressure as we move forward.

I moved to the G fund today, expecting a big rally that turned out to be moderate at best. I have not liked sentiment since last week and that elevates risk in my opinion. NAMO and NYMO also look toppy. But while I decided to cash in my chips till January, this market may still push higher. I'm of the opinion that if it does, it may not last long. But the second half of this month is not a normal trading environment either.

There isn't many more trading days before we see whether a good SC rally is in the cards or not. See you tomorrow.