Here are some tidbits I find amusing.

During this last wave, AGG has closed at 105.02 twice, and 105.02 just so happens to be a 38.2% Fibonacci retracement.

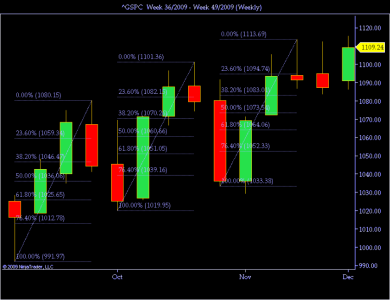

For the S&P 500 check out this cool weekly chart. Those three Fibonacci waves share some similar traits.

Wave 1: 88.18 points

Wave 2: 81.41 points

Wave 3: 80.31 points

But wait, it gets weirder...

Each wave has 2 outer red candles and 2 inner green candles.

Now look at the last two orphaned candlesticks, do you see a trend??? Well if we count last weeks candlestick as the bottom and add 80 points, we get 1163

Seriously though, if you buy based on this chart you may want to have your head examined....Jason