I'm not going to pretend I know what this market is going to do. The only thing I can do is change my expectations based on the price action as it reveals itself.

I spent some time over the weekend examining different bonds and could not come up with a Bullish/Bearish bias therefore I'm neutral. If you recall, back in mid September we spent some time talking about AGG and the 104.03 level in the blog titled Agg @ 104.03. Since that time we've turned 104.03 into support and it's held several times.

I've drawn in some Fibonacci levels based on the previous 105.120 swing high to 104.03 swing low. Since the last swing low, Tuesday we closed right at the 61.8% level. Then Wednesday we gap down, bounce off the 23.6% level, but somehow manage to close with a > 50% retracement. A close above 104.70 gets me back into a Bullish bias.

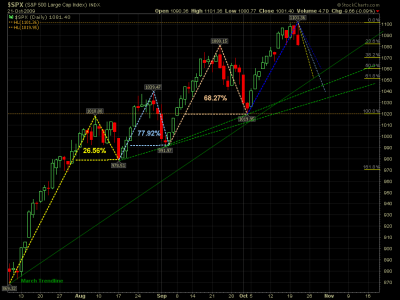

This market was overdue to find an excuse to pullback so I guess a last-minute bank downgrade was enough for the last hour to give us a significant sell-off. With time factored in and using the last three waves, I've outlined some potential levels we could retrace to. Now bear in mind we could put in a higher high tomorrow and that would break these charts.

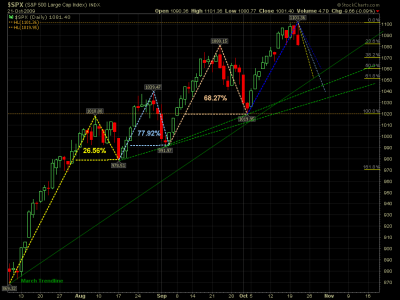

Here's a closer look at the Fibonacci levels based on the previous swing high/low. A close below 61.8% will certainly get my attention.

Here are September's Monthly Pivot Points (PP, Mid-R1 & R1) drawn over October's time frame.

Lastly, if we believe stocks are ready to drop, then we should look for the dollar to perhaps give us a bid. So here are the Dollars Fibonacci levels based on the previous swing high/low.

If we pullback from here, I'm in the S-Fund, out of IFTs and not willing to bail for fear of losing out on the next rally. Translation: I'll be taking some hits over the next 2 weeks...

Good luck!

.

I spent some time over the weekend examining different bonds and could not come up with a Bullish/Bearish bias therefore I'm neutral. If you recall, back in mid September we spent some time talking about AGG and the 104.03 level in the blog titled Agg @ 104.03. Since that time we've turned 104.03 into support and it's held several times.

I've drawn in some Fibonacci levels based on the previous 105.120 swing high to 104.03 swing low. Since the last swing low, Tuesday we closed right at the 61.8% level. Then Wednesday we gap down, bounce off the 23.6% level, but somehow manage to close with a > 50% retracement. A close above 104.70 gets me back into a Bullish bias.

This market was overdue to find an excuse to pullback so I guess a last-minute bank downgrade was enough for the last hour to give us a significant sell-off. With time factored in and using the last three waves, I've outlined some potential levels we could retrace to. Now bear in mind we could put in a higher high tomorrow and that would break these charts.

Here's a closer look at the Fibonacci levels based on the previous swing high/low. A close below 61.8% will certainly get my attention.

Here are September's Monthly Pivot Points (PP, Mid-R1 & R1) drawn over October's time frame.

Lastly, if we believe stocks are ready to drop, then we should look for the dollar to perhaps give us a bid. So here are the Dollars Fibonacci levels based on the previous swing high/low.

If we pullback from here, I'm in the S-Fund, out of IFTs and not willing to bail for fear of losing out on the next rally. Translation: I'll be taking some hits over the next 2 weeks...

Good luck!

.