10/02/25

Another day of gains as the stock market melt-up continues. The government is now shut down and that's just another brick in the wall of bearish catalysts that most believe should be taking this market down, but not only is it not going down, we are seeing new highs regularly. This bull market continues to mock those taking profits or betting against stocks. It won't last forever, but...

As far as I know, with the government in shutdown mode, there will be no Weekly Jobless Claims report today, nor a monthly jobs report for September tomorrow, but we did get another surprisingly weak labor market report with the ADP Employment Change for September.

This data is collected differently from the monthly jobs report but we can see that it came in with a loss of 32,000 jobs when they were expecting a gain of 40,000. They also lowered last month's numbers from +54,000 jobs to a loss of 3,000.

ADP Employment Change For: Sep

Actual: -32K

B.com Forecast: 65K

B.com Cons: 40K

Prior: -3K

Revised From: 54K

You would think stocks would tumble on this news, right? Well, the indices did open lower after the release of the report but the market has been on an interest rate cutting diet and right now any news that justifies more cuts from the Fed is pushing stocks higher.

How about the University of Michigan Consumer Sentiment Index? It is near its all time lows at 55.10. The catch here is, other times it has been this low, the stock market was near or at a bottom.

Here's a long-term chart of the S&P 500 to show what stocks did after those previous extremely low sentiment readings. This time it is occurring at all-time highs. So interesting.

The S&P 500 (C-fund) is making new highs again and the rally has barely blinked in months. This is a buy and hold and trend trader's dream market, and a market timer's head scratcher as they are likely underperforming. In the past I would have sold everything by now, but over the years I have learned not to sell everything (hold some stocks) until the market starts to break technically. In hindsight I wish I had been holding more, but I can't can't myself to buy up here.

Yields were down yesterday with the 10-year Treasury Yield continuing to retreat from the test of that 50-day moving average. The lower yields go, the more likely investors will opt for stocks.

The dollar was down slightly but it closed well off its lows after bouncing off if its 50-day average. Everyone is expecting the dollar to decline, and it makes sense, but the chart hasn't made that decision yet.

I am writing this on Wednesday evening but as far as I can tell, the TSP is up and running and we will get our share prices as usual. I will know shortly, as will you if the prices are updated on this website.

The DWCPF (S-fund) was down early on Wednesday but it bounced back with the large caps and it looks like the trading channel down to the blue dashed line is going to remain very much intact.

ACWX (I-fund) made another new high so the strongest trend of them all continues to plow forward. It's amazing given what is going on in the world, but that's how markets work. The market is looking down the road while we're looking at rear-view mirror headlines.

BND (bonds / F-fund) was up nicely with yields down, but it remains below some potential resistance.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

Another day of gains as the stock market melt-up continues. The government is now shut down and that's just another brick in the wall of bearish catalysts that most believe should be taking this market down, but not only is it not going down, we are seeing new highs regularly. This bull market continues to mock those taking profits or betting against stocks. It won't last forever, but...

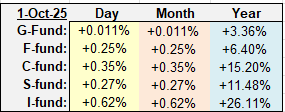

| Daily TSP Funds Return More returns |

As far as I know, with the government in shutdown mode, there will be no Weekly Jobless Claims report today, nor a monthly jobs report for September tomorrow, but we did get another surprisingly weak labor market report with the ADP Employment Change for September.

This data is collected differently from the monthly jobs report but we can see that it came in with a loss of 32,000 jobs when they were expecting a gain of 40,000. They also lowered last month's numbers from +54,000 jobs to a loss of 3,000.

ADP Employment Change For: Sep

Actual: -32K

B.com Forecast: 65K

B.com Cons: 40K

Prior: -3K

Revised From: 54K

You would think stocks would tumble on this news, right? Well, the indices did open lower after the release of the report but the market has been on an interest rate cutting diet and right now any news that justifies more cuts from the Fed is pushing stocks higher.

How about the University of Michigan Consumer Sentiment Index? It is near its all time lows at 55.10. The catch here is, other times it has been this low, the stock market was near or at a bottom.

Here's a long-term chart of the S&P 500 to show what stocks did after those previous extremely low sentiment readings. This time it is occurring at all-time highs. So interesting.

The S&P 500 (C-fund) is making new highs again and the rally has barely blinked in months. This is a buy and hold and trend trader's dream market, and a market timer's head scratcher as they are likely underperforming. In the past I would have sold everything by now, but over the years I have learned not to sell everything (hold some stocks) until the market starts to break technically. In hindsight I wish I had been holding more, but I can't can't myself to buy up here.

Yields were down yesterday with the 10-year Treasury Yield continuing to retreat from the test of that 50-day moving average. The lower yields go, the more likely investors will opt for stocks.

The dollar was down slightly but it closed well off its lows after bouncing off if its 50-day average. Everyone is expecting the dollar to decline, and it makes sense, but the chart hasn't made that decision yet.

I am writing this on Wednesday evening but as far as I can tell, the TSP is up and running and we will get our share prices as usual. I will know shortly, as will you if the prices are updated on this website.

The DWCPF (S-fund) was down early on Wednesday but it bounced back with the large caps and it looks like the trading channel down to the blue dashed line is going to remain very much intact.

ACWX (I-fund) made another new high so the strongest trend of them all continues to plow forward. It's amazing given what is going on in the world, but that's how markets work. The market is looking down the road while we're looking at rear-view mirror headlines.

BND (bonds / F-fund) was up nicely with yields down, but it remains below some potential resistance.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.