12/11/25

Stocks rallied on Wednesday after the Federal Reserve cut interest rates by 25 basis points, and Powell's more dovish press conference than most expected. Bond yields and the dollar came down helping small caps and the I-fund post gains over 1% on the day. The Russell 2000 closed at an all time high. There was some late selling that took the indices off their highs.

I can't interpret everything the Fed said with any kind of expertise, but here are some key things I heard or observed.

The Fed Funds rate range was lowered from 3.75% - 4.0% to 3.5% - 3.75%. There were a few dissenting votes on the cut.

The Fed says the jobs market is slowing, partially because of AI, but Powell suggested that the government shutdown delayed some employment data making for some uncertainty.

He says that the current inflation rate of 2.9% should come down to 2.5% next year because most of the excess inflation caused by the tariffs will be a non factor in 2026 as it was a one time price hike. Their inflation target is still 2%.

They said the economy is growing moderately.

They said their balance sheet has declined to ample levels and they will initiate purchases of shorter-term Treasuries as needed to maintain ample reserves on an ongoing basis. $40 billion a month. Many interpret this as QE, but the Fed isn't calling it that.

All of this is bullish news, and the stock market may have a green light with those fundamentals, but perhaps a speed bump in the charts to get over first.

I wish I could say this is a no-brainer buy signal, but the S&P 500 (C-fund) still has to get over a double top. Double tops are very obvious and it gives anyone who bought the previous peak, an opportunity to get their money back, and often that leads to resistance and a pullback. But Fed actions can have the ability to make investors "chart-blind", as investors and portfolio managers react and adjust their investments based on the new monetary policy. By the way, yesterday was a positive outside reversal day (lower low, higher high, and a close above previous high.) That's meaningful. We had a negative outside reversal day on the prior Fed meeting day, although the S&P closed flat that day.

The close of 6886.68 is interesting. Any numerologists out there have an idea what they're trying to tell us? It was a long time ago but someone once said to me that every closing price has a meaning or a message. We just need the decoder ring.

The 10-year Treasury Yield was up early yesterday, but that was a smoke screen and it reversed lower after the Fed's more dovish comments than expected. There is some support at yesterday's lows so we'll see if yields can resume their rally after yesterday's Fed dip.

The dollar was also down and closed at its lowest level since October 28.

How did the market leading Dow Transportation Index react? Boom!

After the bell yesterday Oracle reported earnings and the stock was getting hit hard after hours. This could put pressure on the Tech sector today, although the bears may get a battle from those repositioning for the Fed's new dovish outlook. The futures did open modestly lower on Wednesday night.

The release of the November PPI report, which was scheduled to be released today, has been postponed until January 14 because of the government shutdown. -- "BLS will not produce an October 2025 Producer Price Index (PPI) news release. BLS is collecting October reference period data on a delay due to the lapse in appropriations. BLS plans to publish October data with the November 2025 PPI news release on January 14, 2026."

The DWCPF Index (S-Fund) rallied big, but it hit that wall of resistance at the previous highs and backed off. Totally normal, but whether we get a double top pullback, or how much we get, is the question on timing this one. If we see yields fall and the Transports hold their gains, this will have a better chance of breaking out sooner than later. But we shouldn't be surprised by a double top pullback on any chart.

ACWX (I-fund) also hit its wall before stalling, but this is a triple top. While a right shoulder could form on a dip here, the triple top has a higher success rate than a double top. And if we do see a dip and a 4th test of the highs, it will be go time.

BND (bonds / F-fund) rallied biggly on the Fed decision, and as we talked about yesterday, the breakdown recently could have been shenanigans to get investors leaning the wrong way before the Fed meeting. So far that looks like a legitimate theory as it trades back above the support line.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks rallied on Wednesday after the Federal Reserve cut interest rates by 25 basis points, and Powell's more dovish press conference than most expected. Bond yields and the dollar came down helping small caps and the I-fund post gains over 1% on the day. The Russell 2000 closed at an all time high. There was some late selling that took the indices off their highs.

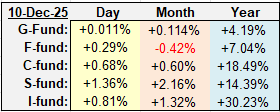

| Daily TSP Funds Return More returns |

I can't interpret everything the Fed said with any kind of expertise, but here are some key things I heard or observed.

The Fed Funds rate range was lowered from 3.75% - 4.0% to 3.5% - 3.75%. There were a few dissenting votes on the cut.

The Fed says the jobs market is slowing, partially because of AI, but Powell suggested that the government shutdown delayed some employment data making for some uncertainty.

He says that the current inflation rate of 2.9% should come down to 2.5% next year because most of the excess inflation caused by the tariffs will be a non factor in 2026 as it was a one time price hike. Their inflation target is still 2%.

They said the economy is growing moderately.

They said their balance sheet has declined to ample levels and they will initiate purchases of shorter-term Treasuries as needed to maintain ample reserves on an ongoing basis. $40 billion a month. Many interpret this as QE, but the Fed isn't calling it that.

All of this is bullish news, and the stock market may have a green light with those fundamentals, but perhaps a speed bump in the charts to get over first.

I wish I could say this is a no-brainer buy signal, but the S&P 500 (C-fund) still has to get over a double top. Double tops are very obvious and it gives anyone who bought the previous peak, an opportunity to get their money back, and often that leads to resistance and a pullback. But Fed actions can have the ability to make investors "chart-blind", as investors and portfolio managers react and adjust their investments based on the new monetary policy. By the way, yesterday was a positive outside reversal day (lower low, higher high, and a close above previous high.) That's meaningful. We had a negative outside reversal day on the prior Fed meeting day, although the S&P closed flat that day.

The close of 6886.68 is interesting. Any numerologists out there have an idea what they're trying to tell us? It was a long time ago but someone once said to me that every closing price has a meaning or a message. We just need the decoder ring.

The 10-year Treasury Yield was up early yesterday, but that was a smoke screen and it reversed lower after the Fed's more dovish comments than expected. There is some support at yesterday's lows so we'll see if yields can resume their rally after yesterday's Fed dip.

The dollar was also down and closed at its lowest level since October 28.

How did the market leading Dow Transportation Index react? Boom!

After the bell yesterday Oracle reported earnings and the stock was getting hit hard after hours. This could put pressure on the Tech sector today, although the bears may get a battle from those repositioning for the Fed's new dovish outlook. The futures did open modestly lower on Wednesday night.

The release of the November PPI report, which was scheduled to be released today, has been postponed until January 14 because of the government shutdown. -- "BLS will not produce an October 2025 Producer Price Index (PPI) news release. BLS is collecting October reference period data on a delay due to the lapse in appropriations. BLS plans to publish October data with the November 2025 PPI news release on January 14, 2026."

The DWCPF Index (S-Fund) rallied big, but it hit that wall of resistance at the previous highs and backed off. Totally normal, but whether we get a double top pullback, or how much we get, is the question on timing this one. If we see yields fall and the Transports hold their gains, this will have a better chance of breaking out sooner than later. But we shouldn't be surprised by a double top pullback on any chart.

ACWX (I-fund) also hit its wall before stalling, but this is a triple top. While a right shoulder could form on a dip here, the triple top has a higher success rate than a double top. And if we do see a dip and a 4th test of the highs, it will be go time.

BND (bonds / F-fund) rallied biggly on the Fed decision, and as we talked about yesterday, the breakdown recently could have been shenanigans to get investors leaning the wrong way before the Fed meeting. So far that looks like a legitimate theory as it trades back above the support line.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.