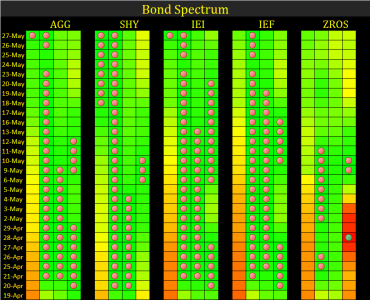

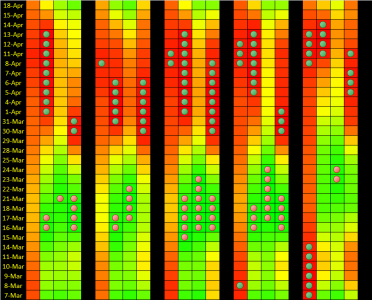

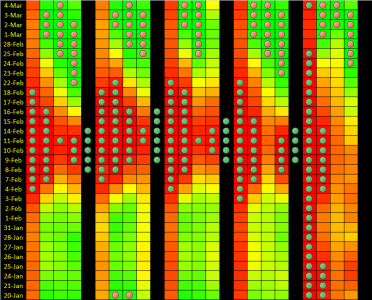

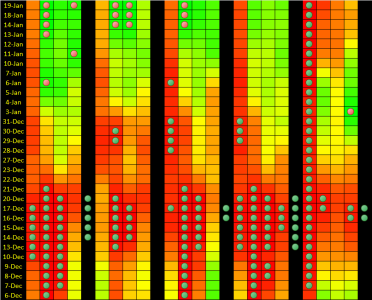

The Bond Spectrum

Bullish going into June

Bullish going into June

This week the F-Fund is the clear winner with an 80% reading and the trend is clearly up with prices above 75% within the 6-month chart. This trend is strong, as are the internals with the stochastic having managed an unbelievable 25 days above 80. This is what I'd call embedded to the upside (not overbought.) We've also closed in a huge gap from the left red square. The major moving average deviations I watch are gaining positive momentum confirming a strong trend (not volatility.) I"m expect a Golden Cross 50/200 SMA crossover on or about 21 June. This last wave of prices is twice the height and width of the previous wave, that's indicative we are getting ripe for a pullback. We also have 3 higher swing highs, but the last low is a lower swing low. I call this an outside pattern, reminiscent of a broadening wedge, but time and price aren't lining up for this type of pattern so I'm somewhat perplexed as to what is going to happen next. My overall impression is this chart is getting toppy, if I were in I'd stay in, and pick your "exit price." If I were out I'd stay out looking for a bounce off the bottom trendline in the first week of July. You might also consider an entry at 106, this would be a 50% retracement off the current 107.51 high wave.

The Bond Spectrum is a collection of charts representative of the the highest weighted treasuries covering AGG. I feel these 5 charts give us a singular outlook as to the long-term outlook of TSP's F-Fund. Green & Red circles within the black columns represent buy/sell signals, the last buy signal was triggered on 9 Feb 2011, 1 day before AGG put in its bottom.

Take care and trade safe...Jason