Ok, it's been a bloody week for stocks, and at this moment I do believe we are on the cusp of flipping over to a correction. As you hopefully know, I've been talking about the 18 April low and its importance, so having seen price reach these levels was no surprise for me. However, what does have me somewhat alarmed is that my timeframe expectations have been exceeded because price has gotten to these levels faster than I thought they should have. Now I'm not prepared to tell everyone to hit the eject button just yet, but you better have a plan or you could end up having that 2008 feeling all over again. I'm not trying to get you into a state of panic but I am trying to get you into a heightened state of reality.

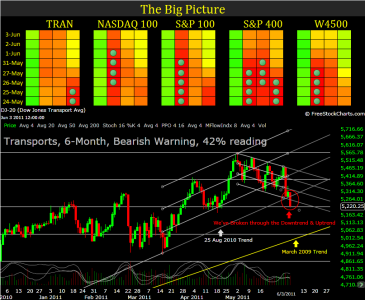

Below: The Big Picture is telling me that the internals are in conflict with price, this is what I call volatility (the opposite of trending.) While I don't have a sell signal (last issued 2 May) we are perhaps within a week of a buy signal (last issued 15 Mar.) My interpretations tell me there are lower prices to be had, therefore I'll wait for perhaps a better buying opportunity.

Above: The Transports put in a successful test of the 50% retracement within the 6-month timeframe. If you look at the large green candlestick on the far left, you can see that on Monday's close it will disappear from view within the 6-month window. This will push the prices down, and last Friday's close will then be below the 50% level. I'm also going to be re-drawing the rising & descending channel if the price violation continues.

Below: Ok, so you need some good news right? How about the potential of a bullish descending triangle with a 745-760 price objective? But don't take my word for it, do your own homework and decide for yourself. Now as you might know by now, that hourly inverted H&S I posted last week, has busted, it can't happen because the right shoulder is lower than the Head. I just like to show patterns so you know what they are, but I almost never trade them within TSP because the end of day prices add on additional risk.

Stay nimble and trade safe...Jason