I'm always trying to get a "feel" for what the markets are going to do next. Every day, every week it's some new concern(s). Check this, check that, measure this, measure that. Day after day. It can be enjoyable, but can it be profitable? Can you keep your emotion out of the way while taking it all in? It's not as easy as it may seem.

As we saw today, in spite of the concerns of many traders, selling continues to remain in check. Not only did we not get any selling today, but the DOW made a new yearly high!

That's why I'm using a system. It's already proven to me that it's smarter than I am. Or maybe I'm just not smarter than a fifth grader. :laugh:

So fear has been allayed once again for nervous bulls. And we even have two new buy signals from the Seven Sentinels, although one did go to a sell today. But that's a net gain of one.

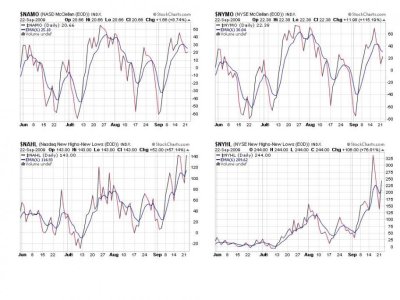

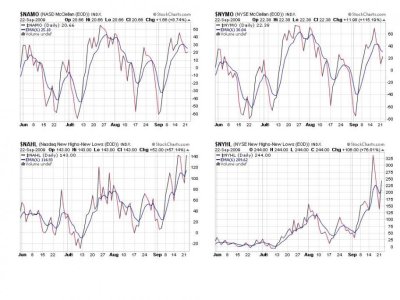

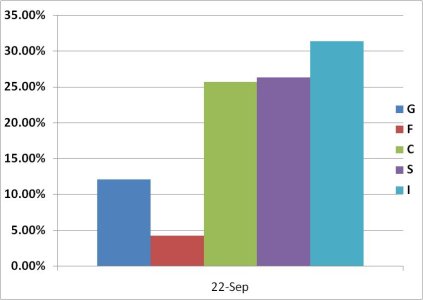

Here's the first four signals.

NAHL and NYHL both switched to buy mode today and NAMO and NYMO curled back up towards their 6 day EMA.

TRIN remains on a buy, but TRINQ flipped to a sell. BPCOMPQ curled down towards the upper bollinger band, but still remains on a buy.

So we've picked up one more buy signal in each of the first two trading days this week. That really doesn't matter a whole lot in the big scheme of things, but it does provide more support to the current buy signal. And that's a good thing.

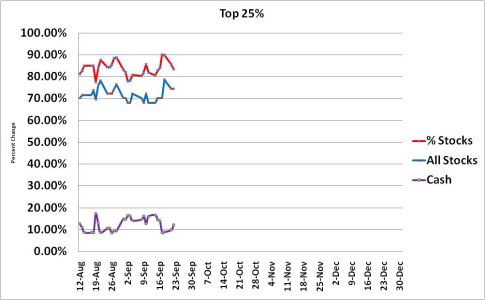

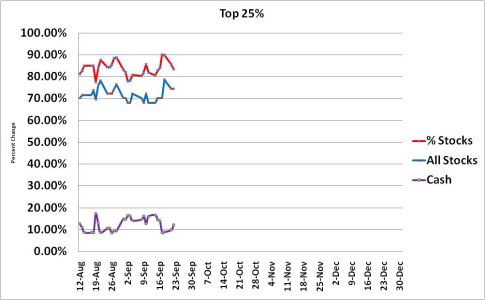

Our top 25% is still holding their position too. Here is how it looked this morning.

Look familiar?

Some drop in equity level with a corresponding rise in cash, but not really noteworthy.

Tomorrow we get the FOMC announcement. No surprises are expected, but it's always watched carefully by the market in any event. I am not expecting significant market volatility at this point, but we will probably get some chop. See you tomorrow.

As we saw today, in spite of the concerns of many traders, selling continues to remain in check. Not only did we not get any selling today, but the DOW made a new yearly high!

That's why I'm using a system. It's already proven to me that it's smarter than I am. Or maybe I'm just not smarter than a fifth grader. :laugh:

So fear has been allayed once again for nervous bulls. And we even have two new buy signals from the Seven Sentinels, although one did go to a sell today. But that's a net gain of one.

Here's the first four signals.

NAHL and NYHL both switched to buy mode today and NAMO and NYMO curled back up towards their 6 day EMA.

TRIN remains on a buy, but TRINQ flipped to a sell. BPCOMPQ curled down towards the upper bollinger band, but still remains on a buy.

So we've picked up one more buy signal in each of the first two trading days this week. That really doesn't matter a whole lot in the big scheme of things, but it does provide more support to the current buy signal. And that's a good thing.

Our top 25% is still holding their position too. Here is how it looked this morning.

Look familiar?

Some drop in equity level with a corresponding rise in cash, but not really noteworthy.

Tomorrow we get the FOMC announcement. No surprises are expected, but it's always watched carefully by the market in any event. I am not expecting significant market volatility at this point, but we will probably get some chop. See you tomorrow.