Chop. We're down, we're up, we're down again. That's what I expected to see this week and so far that's what's happening. We gave back a good portion of yesterday's gains on the Fed announcement, but as expected no revelations were forthcoming.

The Seven Sentinels continue to hold their buy signal, which of course I'm happy to see as we now only have one more week till October 1st and two new Interfund Transfers (IFT).

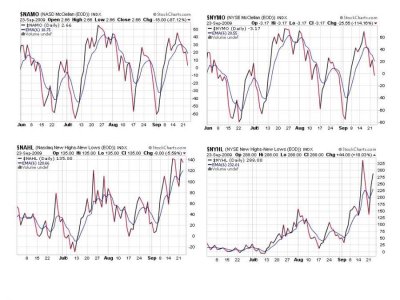

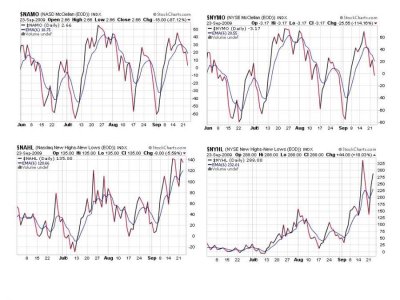

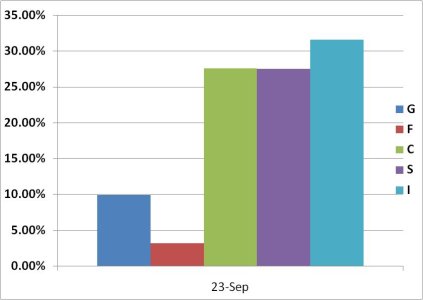

Today's charts:

No change here. Two buys, two sells. I was surprised though to see NYHL actually moved higher. And although NAHL didn't advance, it didn't lose much ground either. Interesting.

We did see both TRIN and TRINQ flip to sells today, but BPCOMPQ is holding its buy signal, although it appears to be getting closer to a sell signal.

Be that as it may the system still has 3 buys out 7 and that means the system remains on a buy.

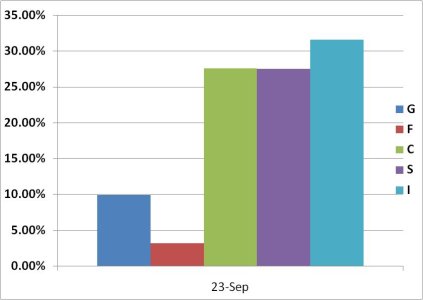

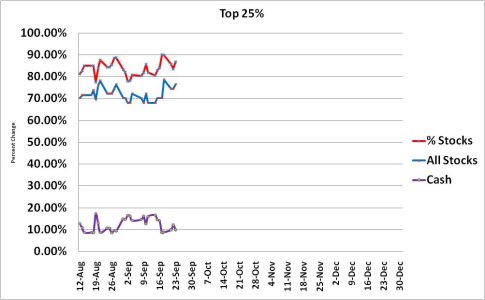

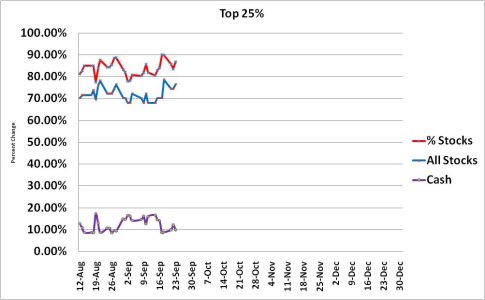

Our Top 25% are as bullish as ever too. Their position this morning had them increasing their equity holdings and dropping their cash level, but after today we may see that flip back a little in the other direction, but not much. Here's the charts:

So you can see it's business as usual for our top performers. Can't argue with success. See you tomorrow.

The Seven Sentinels continue to hold their buy signal, which of course I'm happy to see as we now only have one more week till October 1st and two new Interfund Transfers (IFT).

Today's charts:

No change here. Two buys, two sells. I was surprised though to see NYHL actually moved higher. And although NAHL didn't advance, it didn't lose much ground either. Interesting.

We did see both TRIN and TRINQ flip to sells today, but BPCOMPQ is holding its buy signal, although it appears to be getting closer to a sell signal.

Be that as it may the system still has 3 buys out 7 and that means the system remains on a buy.

Our Top 25% are as bullish as ever too. Their position this morning had them increasing their equity holdings and dropping their cash level, but after today we may see that flip back a little in the other direction, but not much. Here's the charts:

So you can see it's business as usual for our top performers. Can't argue with success. See you tomorrow.