I have a hard time getting Bullish, until we break through the previous 930 high. The fact is we are still stuck in the 880-930 trading range until proven otherwise. Even if I wanted to IFT in right now, we are already on the high side of the current trading range, so the current upside potential is 11 points.

But I will admit that Friday’s charts did get more Bullish. We did break up through the original (lower red line) descending triangle but because we failed to get above 930, we still have a descending triangle, (upper red line) it’s just bigger now. Also, we still haven’t seen a surge in volume to break us out of the triangle.

<O

But to be fair and objective I have to show you the Bullish potential. The S&P 500 Monthly chart closed with a Three White Soldiers candlestick pattern, that’s bullish.

<O

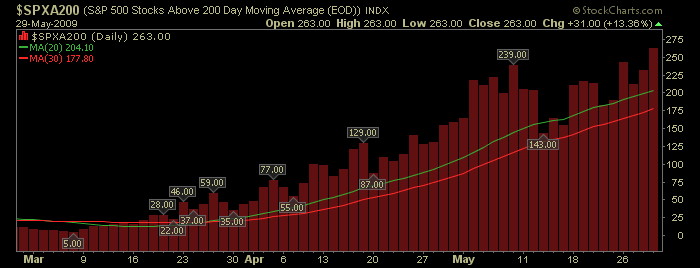

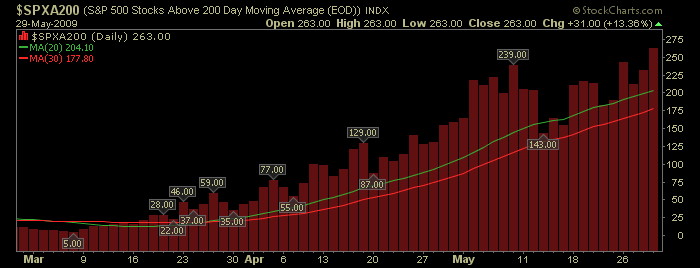

The number of S&P 500 stocks above their 200 moving average closed above 250 for the first time this year, that’s bullish.

<O

The Wilshire 4500 Completion Index ($EMW or S-Fund) has its 2nd close above the 200 MA, that’s bullish.

<O

Nasdaq has its 4th close above the 200 MA and made a higher high, that’s bullish.

<O

The Dow Jones Transportation Average has bounced off the 50 MA twice and just closed above the 20 MA, that’s bullish.

<O

If you printed out a chart of the US Dollar and hung it upside down, that’s bullish.

<O

Ok so you get my point, it’s getting bullish out there. My hunch is this market is waiting for the sale of the 10-Year Treasury notes on 10 June. Here is a clue as to the direction.

<O

"Rates are going higher, not because of economic buoyancy, but because people are choking on our debt," Manzara said.

That’s all I got, I wish I had spent more time going over the charts this weekend, but I was out of town Saturday buying a Ford, and spent most of today installing a GPS & DVD system. To top it off, I’ll be out of the office this morning, so it’s not likely I’ll IFT.

<O

Cheers

But I will admit that Friday’s charts did get more Bullish. We did break up through the original (lower red line) descending triangle but because we failed to get above 930, we still have a descending triangle, (upper red line) it’s just bigger now. Also, we still haven’t seen a surge in volume to break us out of the triangle.

<O

But to be fair and objective I have to show you the Bullish potential. The S&P 500 Monthly chart closed with a Three White Soldiers candlestick pattern, that’s bullish.

<O

The number of S&P 500 stocks above their 200 moving average closed above 250 for the first time this year, that’s bullish.

<O

The Wilshire 4500 Completion Index ($EMW or S-Fund) has its 2nd close above the 200 MA, that’s bullish.

<O

Nasdaq has its 4th close above the 200 MA and made a higher high, that’s bullish.

<O

The Dow Jones Transportation Average has bounced off the 50 MA twice and just closed above the 20 MA, that’s bullish.

<O

If you printed out a chart of the US Dollar and hung it upside down, that’s bullish.

<O

Ok so you get my point, it’s getting bullish out there. My hunch is this market is waiting for the sale of the 10-Year Treasury notes on 10 June. Here is a clue as to the direction.

<O

"Rates are going higher, not because of economic buoyancy, but because people are choking on our debt," Manzara said.

That’s all I got, I wish I had spent more time going over the charts this weekend, but I was out of town Saturday buying a Ford, and spent most of today installing a GPS & DVD system. To top it off, I’ll be out of the office this morning, so it’s not likely I’ll IFT.

<O

Cheers