First things first. Thank-you to all you Veterans out there.

While it is great to see our country largely behind our troops today, that has not always been the case in the past. I especially want to recognize our Veterans who served in unpopular wars. Your service to our country was no less noble than any other. I pray this country never again forgets its heroes.

In the beginning of a change, the patriot is a scarce man, and brave, and hated and scorned. When his cause succeeds, the timid join him, for then it costs nothing to be a patriot. ~Mark Twain, Notebook, 1935

Here's tonight's charts:

NAMO and NYMO are on buys.

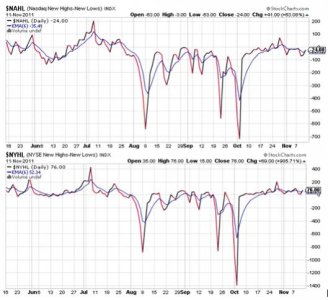

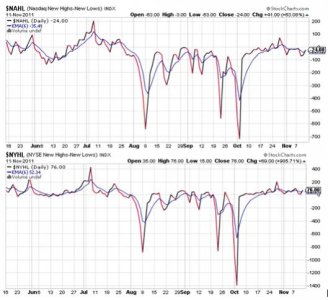

NAHL and NYHL are also on buys.

TRIN and TRINQ are also in buy conditions, but TRIN is suggesting a moderately overbought market.

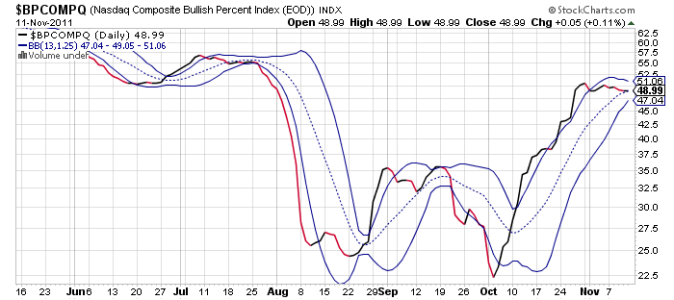

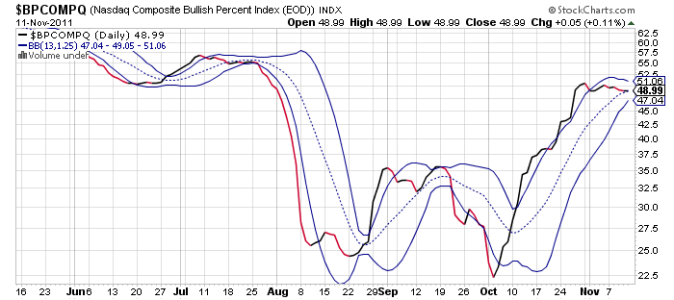

BPCOMPQ ebbed just a tad higher, remains in a sell condition.

So the Seven Sentinels are mixed, but officially remain in a buy condition.

I am not comfortable with this market, which is why I remain in the G fund. That and the fact that I have few options in managing my account in such volatility.

This remains a bear market in my opinion and I feel that this bull run is getting long in the tooth. But we're now approaching the holiday season so it's certainly possible prices run higher in the coming weeks. But after two unconfirmed sell signals in the past two trading weeks I am suspicious of this market. The one signal that bothers me is BPCOMPQ. It has been on a sell since the beginning of the month and has tracked sideways since triggering that sell condition. The bollinger bands are now collapsing around that signal.

We are either going to break out to the upside or downside fairly soon. If we break out to the upside, 1300 on the S&P will probably come. How far it runs I'm not sure. But if that happens, I'd not be complacent about it.

We could also break out to the downside first before launching into an end-of-year rally. But either way I suspect we'll see higher prices before years end. I tend to favor a breakout lower first, followed by another run to the upside based on the unconfirmed sell signals that have recently been triggered by the Seven Sentinels. This holiday rally has largely retraced Wednesday's losses and it feels overdone. We'll see how next week plays out. I'm wondering how the market is going to set-up prior to Thanksgiving.

While it is great to see our country largely behind our troops today, that has not always been the case in the past. I especially want to recognize our Veterans who served in unpopular wars. Your service to our country was no less noble than any other. I pray this country never again forgets its heroes.

In the beginning of a change, the patriot is a scarce man, and brave, and hated and scorned. When his cause succeeds, the timid join him, for then it costs nothing to be a patriot. ~Mark Twain, Notebook, 1935

Here's tonight's charts:

NAMO and NYMO are on buys.

NAHL and NYHL are also on buys.

TRIN and TRINQ are also in buy conditions, but TRIN is suggesting a moderately overbought market.

BPCOMPQ ebbed just a tad higher, remains in a sell condition.

So the Seven Sentinels are mixed, but officially remain in a buy condition.

I am not comfortable with this market, which is why I remain in the G fund. That and the fact that I have few options in managing my account in such volatility.

This remains a bear market in my opinion and I feel that this bull run is getting long in the tooth. But we're now approaching the holiday season so it's certainly possible prices run higher in the coming weeks. But after two unconfirmed sell signals in the past two trading weeks I am suspicious of this market. The one signal that bothers me is BPCOMPQ. It has been on a sell since the beginning of the month and has tracked sideways since triggering that sell condition. The bollinger bands are now collapsing around that signal.

We are either going to break out to the upside or downside fairly soon. If we break out to the upside, 1300 on the S&P will probably come. How far it runs I'm not sure. But if that happens, I'd not be complacent about it.

We could also break out to the downside first before launching into an end-of-year rally. But either way I suspect we'll see higher prices before years end. I tend to favor a breakout lower first, followed by another run to the upside based on the unconfirmed sell signals that have recently been triggered by the Seven Sentinels. This holiday rally has largely retraced Wednesday's losses and it feels overdone. We'll see how next week plays out. I'm wondering how the market is going to set-up prior to Thanksgiving.