Whether you are a bull or a bear, this market looks to be making both sides work for their gains. You might think the Seven Sentinels would have improved their stance with the nice gains we had this afternoon, but you'd be wrong. We are still on a buy, but internals continue to struggle, which demands very close attention as each day unfolds.

Here's today's charts:

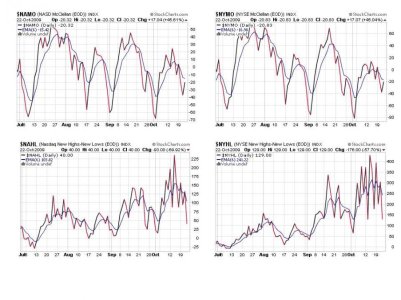

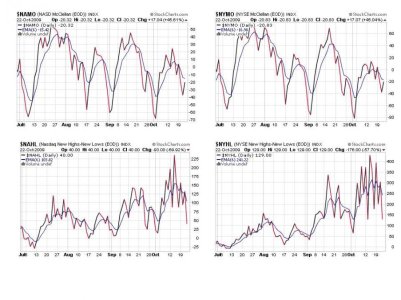

NAMO and NYMO improved today, although they remain on a sell. But the big thing to take notice of is NAHL and NYHL. They took a pretty good hit and are not far off their respective targets where I'd really begin to consider selling. However, as long as some of our signals are still flashing buys I cannot fold my cards.

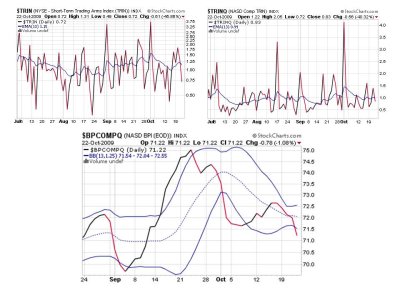

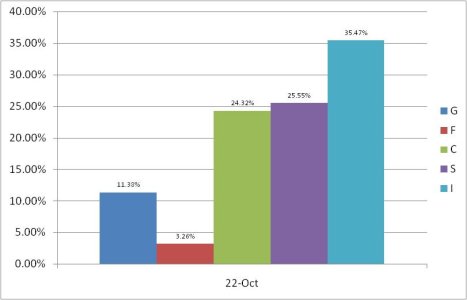

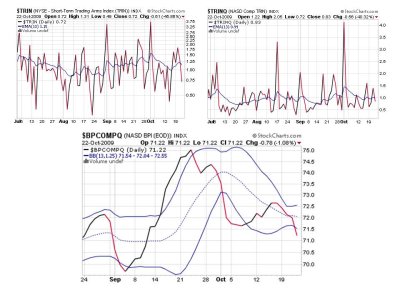

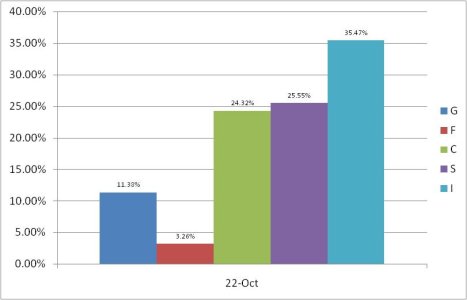

TRIN and TRINQ are the only two signals on a buy right now. By contrast, BPCOMPQ took a dip and crossed the lower bollinger band, which triggers a sell condition in that indicator.

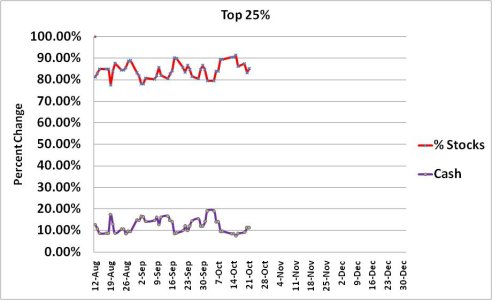

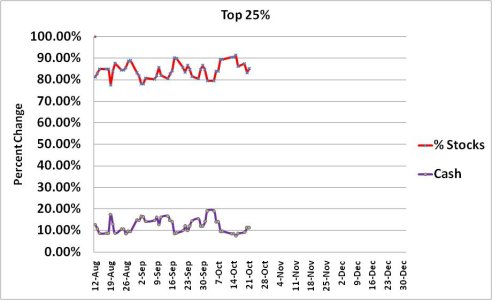

Our top 25% are still holding strong, which is notable to some extent given the difficult market conditions right now.

So we remain on buy condition according to the seven sentinels, but this market still has something to prove if we are to believe the rally will continue.

I am not surprised by the action. I have been anticipating volatility and second guessing as this bull run gets extended, but I'm fairly confident the bulk of the gains are now behind us. Now I am trying to catch whatever is left, which could still be considerable. This market could easily fool the bears at least one more time and send the market to much higher levels before this is all over, but as I said in the beginning, they won't make it easy for either the bulls or the bears if that's to be the case.

There are no economic reports being released tomorrow, but there are numerous companies reporting earnings before the open. What the market does next may depend on who reports what. So far, futures are modestly higher.

Here's today's charts:

NAMO and NYMO improved today, although they remain on a sell. But the big thing to take notice of is NAHL and NYHL. They took a pretty good hit and are not far off their respective targets where I'd really begin to consider selling. However, as long as some of our signals are still flashing buys I cannot fold my cards.

TRIN and TRINQ are the only two signals on a buy right now. By contrast, BPCOMPQ took a dip and crossed the lower bollinger band, which triggers a sell condition in that indicator.

Our top 25% are still holding strong, which is notable to some extent given the difficult market conditions right now.

So we remain on buy condition according to the seven sentinels, but this market still has something to prove if we are to believe the rally will continue.

I am not surprised by the action. I have been anticipating volatility and second guessing as this bull run gets extended, but I'm fairly confident the bulk of the gains are now behind us. Now I am trying to catch whatever is left, which could still be considerable. This market could easily fool the bears at least one more time and send the market to much higher levels before this is all over, but as I said in the beginning, they won't make it easy for either the bulls or the bears if that's to be the case.

There are no economic reports being released tomorrow, but there are numerous companies reporting earnings before the open. What the market does next may depend on who reports what. So far, futures are modestly higher.