Well, the Seven Sentinels official sell signal yesterday certainly seems a bit prophetic at the moment, but this market could be trying to fake out the bears again, so I'm not ready to fully embrace this sell signal. Although with only a 20% exposure to the market I'm not taking a whole lot of risk anyway.

The market spent most of the morning session chopping around the neutral line (mostly lower) until about noon time EST, and then the selling pressure kicked in and took the major averages down below support. They never recovered and ended the day not far from their lows of the day. The downside volume was a bit higher than the anemic trading volume we've been seeing in the past few trading days too.

There was some market data today. Initial jobless claims came in at 388,000 which was the lowest total since April and certainly a positive.

Housing starts for October came in at an annualized rate of 628,000. That was very close to estimates. Building permits totaled 653,000, which was well above the 603,000 number analysts were looking for.

Here's today's charts:

NAMO and NYMO moved further into negative territory today and remain in sell conditions.

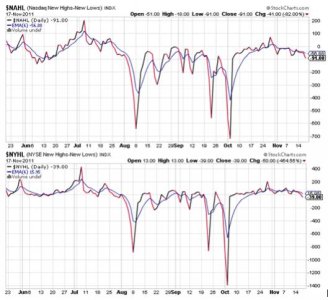

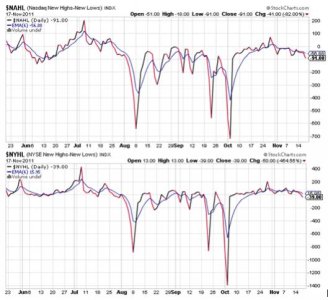

NAHL and NYHL also moved lower and remain on sells.

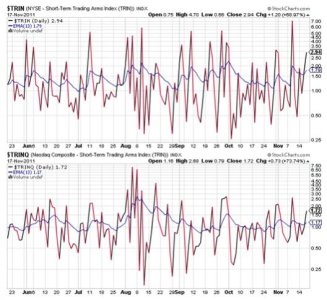

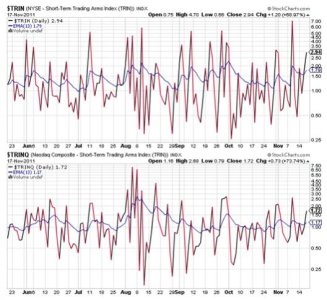

Both TRIN and TRINQ are on sells today. TRIN is suggesting a modestly oversold condition, but TRINQ is less so. That's not much help.

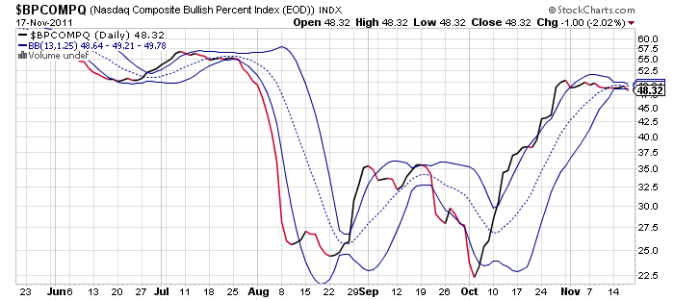

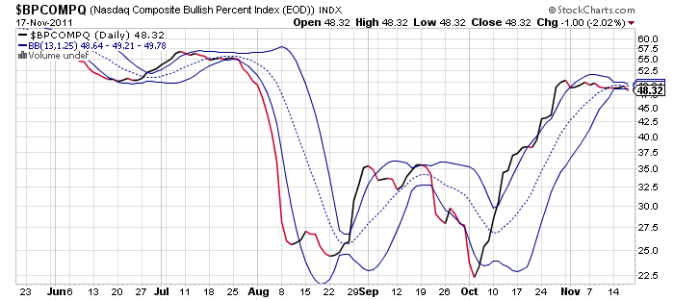

BPCOMPQ crossed through the lower bollinger band today and dipped in potentially ominous fashion. In other words, more downside "may" be coming.

So all signals are on sells, which keeps the system in an intermediate term sell condition.

In a "normal" market I'd be very inclined to seek safety, but this market hasn't been normal for quite some time. It's a risk on, risk off market where it's estimated that up to 70% of volume is computer generated trading (not human). And headline risk (up or down) continues to be present, although we do have seasonality in our favor. So even if we get more downside pressure over the coming days, we could be setting up for another run to the upside. That's why I'm not overly confident that this sell signal will be particularly lasting.

Time will certainly tell, but some measure of risk management may be in order just in case the big lady has started to sing.

The market spent most of the morning session chopping around the neutral line (mostly lower) until about noon time EST, and then the selling pressure kicked in and took the major averages down below support. They never recovered and ended the day not far from their lows of the day. The downside volume was a bit higher than the anemic trading volume we've been seeing in the past few trading days too.

There was some market data today. Initial jobless claims came in at 388,000 which was the lowest total since April and certainly a positive.

Housing starts for October came in at an annualized rate of 628,000. That was very close to estimates. Building permits totaled 653,000, which was well above the 603,000 number analysts were looking for.

Here's today's charts:

NAMO and NYMO moved further into negative territory today and remain in sell conditions.

NAHL and NYHL also moved lower and remain on sells.

Both TRIN and TRINQ are on sells today. TRIN is suggesting a modestly oversold condition, but TRINQ is less so. That's not much help.

BPCOMPQ crossed through the lower bollinger band today and dipped in potentially ominous fashion. In other words, more downside "may" be coming.

So all signals are on sells, which keeps the system in an intermediate term sell condition.

In a "normal" market I'd be very inclined to seek safety, but this market hasn't been normal for quite some time. It's a risk on, risk off market where it's estimated that up to 70% of volume is computer generated trading (not human). And headline risk (up or down) continues to be present, although we do have seasonality in our favor. So even if we get more downside pressure over the coming days, we could be setting up for another run to the upside. That's why I'm not overly confident that this sell signal will be particularly lasting.

Time will certainly tell, but some measure of risk management may be in order just in case the big lady has started to sing.