Boghie

Market Veteran

- Reaction score

- 383

Tax Mythbuster Speaks Out - Will a Tax Increase make a difference...

To All,

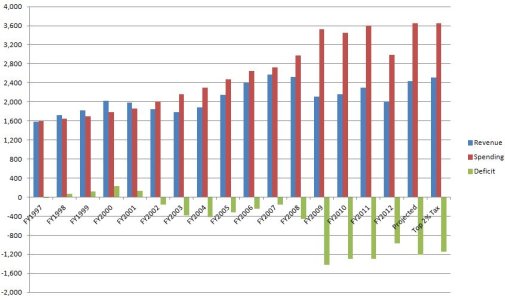

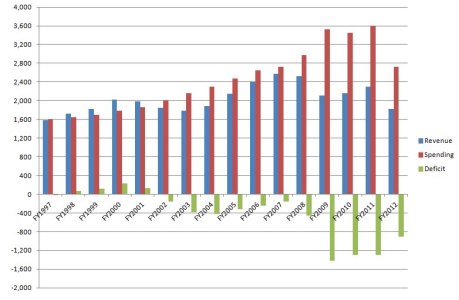

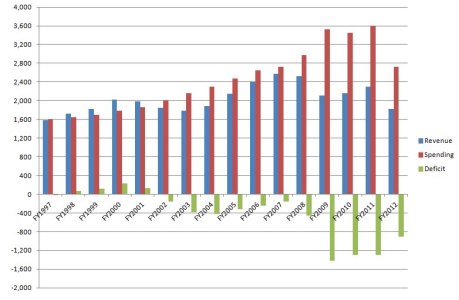

The proposed tax increase on the Top 2% will generate about $70 Billion per year if the rich do not adjust their finances to remediate against the increase. Thus, the $70 Billion is a best case scenario. Here is a Federal Revenue/Spending/Deficit chart from FY1996 through June of FY2012 (There are three months left in FY2012 with a best deficit estimate of -$1.2 Trillion):

I could not even freehand the affect of an additional $70 Billion in revenue. The FY1998 surplus was actually $70 Billion - see the green bar for how much that affects things...

The only way to resolve this mess is to cut spending to FY2007 inflation adjusted, and then initiate a wide band tax increase till we close the gap. The tax increase is necessary because we absolutely have to pay for the recent largess. However, I will not freely accept a tax increase unless it is something everyone pays into (no credits and no write-offs) and only after I see real and substantial cuts. I have not seen ANY real and substantial cuts.

And, I can watch you

To All,

The proposed tax increase on the Top 2% will generate about $70 Billion per year if the rich do not adjust their finances to remediate against the increase. Thus, the $70 Billion is a best case scenario. Here is a Federal Revenue/Spending/Deficit chart from FY1996 through June of FY2012 (There are three months left in FY2012 with a best deficit estimate of -$1.2 Trillion):

I could not even freehand the affect of an additional $70 Billion in revenue. The FY1998 surplus was actually $70 Billion - see the green bar for how much that affects things...

The only way to resolve this mess is to cut spending to FY2007 inflation adjusted, and then initiate a wide band tax increase till we close the gap. The tax increase is necessary because we absolutely have to pay for the recent largess. However, I will not freely accept a tax increase unless it is something everyone pays into (no credits and no write-offs) and only after I see real and substantial cuts. I have not seen ANY real and substantial cuts.

And, I can watch you