-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax Mythbuster Speaks Out

- Thread starter FireWeatherMet

- Start date

RealMoneyIssues

TSP Legend

- Reaction score

- 101

is a healthy economic ecosystem surrounding the company

How is the Government (federal and state) doing on this subject?

You can't "create" customers by giving them money. They must earn it... (think about that for a second BEFORE you flame me)which starts with the company's customers.

WorkFE

TSP Legend

- Reaction score

- 517

All of them told me that their decision to create a new job would be based on whether the long-term cost of that new job would be offset by higher revenues and profits."

Taxes are a part of that. I don't think we can separate the different cost associated with hiring people. I own a business. All cost determine the spirit in which I expand and contract.

If tax rates were not important businesses would not be looking for special tax incentives in individual states to decide there relocation plans. There are without question many more things that go into those decisions as well.

"Rich people create jobs"

Have to disagree with ya there.

A robust economy is not made up of the 1%. It's made up of a well paid middle class with money to burn. The 1% are only interested in wealth preservation. They won't spend us back into a robust economy. They seem to be in wealth acquisition mode. Corporations are spending 400,000 a day on lobbiests to protect their wealth and get corporate handouts from their paid congressmen, not on their employees. Mr. Ford had it right so many years ago when he realized that if his employees couldn't afford his car he had to pay them enough so they could. He realized a robust middle class drives an economy. Until corporations actually start hiring and pay a decent wage the economy will continue to stagnate.

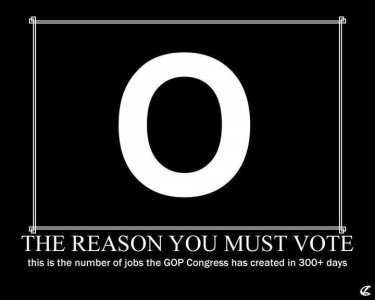

I haven't seen any proof that trickle down works. Protecting the one percent isn't the answer. Nor is bailing out Wall Street. Protecting the middle class is the only viable boost to any economy. The one percenters are shooting themselves in the foot by not creating the jobs needed to bolster their paid lackeys in congress. The GOP hasn't created one job since they came into office and continue to paint themselves into a very narrow corner by there attitude.

Attachments

k0nkuzh0n

TSP Pro

- Reaction score

- 27

Many more than you might think. Not under the "CEO" guise...but under the "healthy customer" theory mentioned in the article.

- Due to a pay raise and extra cash, I employed a landscaper to take care of my yard instead of doing it myself.

- During good economic times, I hired a housekeeper to take care of my house instead of doing it all myself.

- During good times when I had more disposable income, I had a boat and instead of storing it at home, I paid a docking fee to keep it on the water, helping keep a local docking company "afloat".

I'm not for or against either side of the arguement, but are the Rich not consumers too?

Would the rich not create more jobs storing their 7 Yachts around the world, in comparison to your boat?

Or the 5 maids being paid full time to keep a mansion clean?

Do the Rich not go on vacations just like everyone else?

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Hmmm, I think you are missing 2/3 of the government there Mr. Aireman. You are blaming the majority (55/45) of one house of Congress, ignoring the Senate (and their complete lack of a budget, etc), and the Office of the President of the United States. The House cannot enact laws without the other 2 (Senate and POTUS) being on board, and, well, they haven't.

A more truthful slogan would have included the fact that the House was run by the Democrats from 2007 to 2011, the Senate from 2007 to Present, and a Democrat President since 2009.

So, even though the GOP has plenty of blame to go around, it is not all their fault. Put your big girl panties on and take some ownership...

RealMoneyIssues

TSP Legend

- Reaction score

- 101

We just took a left down "Closing the thread road"

Sorry, was following James' lead... (yes, I used the right name)

WorkFE

TSP Legend

- Reaction score

- 517

It is extremely hard to talk about these topics without injecting, at some point, political views/beliefs. It has all been fairly civil however we have all seen the warning signs before.

The argument is old and never figured out. It is one of the fundamental differences between the parties so it will always attract an argumentative tone.

I very much enjoy reading these discussions. Kinda like watching NASCAR for the wrecks or the NFL for the big hits.

The argument is old and never figured out. It is one of the fundamental differences between the parties so it will always attract an argumentative tone.

I very much enjoy reading these discussions. Kinda like watching NASCAR for the wrecks or the NFL for the big hits.

- Reaction score

- 821

Until corporations actually start hiring and pay a decent wage the economy will continue to stagnate.

Corporations will not hire unless there is someone out there to purchase their product and paying a decent wage is one reason why our industrial base has left the good ol USA for other countries with much lower $/hour wage. It is a vicious circle. The bottom line for a corporation or business is their profit margin and that’s why a lot of companies went overseas, lower employee costs and better profits.

I may not have this story perfect because it happened many years ago but here goes. The CEO of GE was being interviewed by reporters because a big GE plant was closing and was being moved to Mexico, if I remember correctly. Anyway he was asked by one reporter why the plant was moving and what happened to the loyalty and responsibility to GE's employees. The CEO said that "the only loyalty he had was to his investors and his company’s stock holders".

RealMoneyIssues

TSP Legend

- Reaction score

- 101

"Poor People Create Jobs".

You have officially been declared a disturber of the peace...

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Thanks, I just thought that if I agreed it would promote peace and tranquility.You have officially been declared a disturber of the peace...

Warrenlm

TSP Legend

- Reaction score

- 93

CEO of BBT spent some time on CNBC this morning. He discussed a "poll" he had taken himself of hundreds of small business owners by engaging them in brief discussions. (He did not mention the 3 CEOs of NGOs who appeared on MSNBC for the above referenced "all CEOs" quote.)

From his informal "poll" he said most said their businesses were doing well because they had reduced their costs to match the demand. When hiring more workers was raised all expressed a view that they would not risk one dime to expand their businesses while Washington continued both its drive for more regulation and its attitude toward business.

So, from the above thread we need to implement Plan B and get the poor off food stamps, AFDC, TANF, Medicaid, etc. so they can go hire a cleaning person.

From his informal "poll" he said most said their businesses were doing well because they had reduced their costs to match the demand. When hiring more workers was raised all expressed a view that they would not risk one dime to expand their businesses while Washington continued both its drive for more regulation and its attitude toward business.

So, from the above thread we need to implement Plan B and get the poor off food stamps, AFDC, TANF, Medicaid, etc. so they can go hire a cleaning person.

I think we need an area with just a little more leeway that's not on the belt way talk page. And instead of closing threads all the time just remove the offending post. Keeping it clean on members pages sure, but the lounge and other pages near it should be loosened up abit.

Boghie

Market Veteran

- Reaction score

- 371

Tax Mythbuster Speaks Out - Strategies for Tax Management

I think I am going to Borg this thread .

.

WarrenLM asked me to demonstrate how I will adjust to either/both Governor Moonbeam's (Brown) and President Obama's proposed tax increased. How could I possibly ZERO OUT their gubmint mandated contribution to their spending priorities? And, the corollary, how the heck did I do it when the Terminator jacked me a couple of years ago? Well here goes:

First of all, I will take this opportunity to remove myself from the Top 1% or 2%. While I am doing fine in my TSP account I live in a condo, own a Civic, and commute to work from the cheap seats in San Diego (about 20 miles). No downtown penthouse suite and Bimmer for me - however that time will come... My family's marginal tax bracket for the Feds is 25% and for the State is 8% (second highest bracket in my fine broke state).

- however that time will come... My family's marginal tax bracket for the Feds is 25% and for the State is 8% (second highest bracket in my fine broke state).

So, let us assume that Moonbeam gazes on the obviously wealthy plutocrat families earning more than $76K taxable in his State of the Golden Goose. He wants just 2% more from folks who can easily pay more toward the 'Sorta Quick Train from Modesto to Eureka' (or whatever) that He desires. Now we get to the math. I'll split the difference to the next bracket and say $10K is taxed at 8%. That marginal tax in the top bracket is $800 now and will be $1000. So, I have to Zero Out $200 for Moonbeam's Choo Choo Fund. All I need to do is contribute $2,500 more to my TSP account - that is, about $95 per pay period. It will cost me $62 in take home pay. I can do that!!! Kinda dumb because I already have a nice nest egg. But I can become a rather rich senior citizen with a Bimmer, a Merc, a Lincoln, and a nice McMansion. Thanks Brownie.

Now, how hard will it be to Zero out the income tax changes presented by TaxAggeddon. My families marginal tax rate will increase from a 25% steal to a modest 28%. Using the same assumption this means that $16K is taxed currently at 25% for a tax of $4K. To pay for investment opportunities in Solyndra that tax take will increase to $4,480 for a Zero Out goal of $480. All I need to do is contribute $1,700 more to my TSP account - that is, about $66 per pay period. It will cost me $42 in take home pay.

The absolute beauty of this is that both tax grabs can be dealt with concurrently. When the Terminator jacked me I did the above for State (and included computations for the sales tax increase as well) and got to within a penny. Thus, no change in my State income tax:toung:. As a very nice secondary benefit I also withheld quite a bit more from the Feds as well. A double bonus. Let us play again!!!

And, concurrently, I reduced my debt load quite a bit. I have more cash flow. I can and will put it into tax advantaged vehicles just for spite. I will not support the growth of bloat. By that I mean the $700 Billion per year structural spending bloat at the Federal level and the constant garbage promoted by the State.

'Let them eat cake!!!'

P.S.: The above does not take into account 'The Marriage Penalty'. That will jack me and most of the folks on this site. There will be no recovery. We will be stuck paying thousands more to the Feds for families with two wage earners. It would be very ugly - but taking thousands out of the economy will definitely boost the private sector. Yea, that will do it...

I think I am going to Borg this thread

WarrenLM asked me to demonstrate how I will adjust to either/both Governor Moonbeam's (Brown) and President Obama's proposed tax increased. How could I possibly ZERO OUT their gubmint mandated contribution to their spending priorities? And, the corollary, how the heck did I do it when the Terminator jacked me a couple of years ago? Well here goes:

First of all, I will take this opportunity to remove myself from the Top 1% or 2%. While I am doing fine in my TSP account I live in a condo, own a Civic, and commute to work from the cheap seats in San Diego (about 20 miles). No downtown penthouse suite and Bimmer for me

So, let us assume that Moonbeam gazes on the obviously wealthy plutocrat families earning more than $76K taxable in his State of the Golden Goose. He wants just 2% more from folks who can easily pay more toward the 'Sorta Quick Train from Modesto to Eureka' (or whatever) that He desires. Now we get to the math. I'll split the difference to the next bracket and say $10K is taxed at 8%. That marginal tax in the top bracket is $800 now and will be $1000. So, I have to Zero Out $200 for Moonbeam's Choo Choo Fund. All I need to do is contribute $2,500 more to my TSP account - that is, about $95 per pay period. It will cost me $62 in take home pay. I can do that!!! Kinda dumb because I already have a nice nest egg. But I can become a rather rich senior citizen with a Bimmer, a Merc, a Lincoln, and a nice McMansion. Thanks Brownie.

Now, how hard will it be to Zero out the income tax changes presented by TaxAggeddon. My families marginal tax rate will increase from a 25% steal to a modest 28%. Using the same assumption this means that $16K is taxed currently at 25% for a tax of $4K. To pay for investment opportunities in Solyndra that tax take will increase to $4,480 for a Zero Out goal of $480. All I need to do is contribute $1,700 more to my TSP account - that is, about $66 per pay period. It will cost me $42 in take home pay.

The absolute beauty of this is that both tax grabs can be dealt with concurrently. When the Terminator jacked me I did the above for State (and included computations for the sales tax increase as well) and got to within a penny. Thus, no change in my State income tax:toung:. As a very nice secondary benefit I also withheld quite a bit more from the Feds as well. A double bonus. Let us play again!!!

And, concurrently, I reduced my debt load quite a bit. I have more cash flow. I can and will put it into tax advantaged vehicles just for spite. I will not support the growth of bloat. By that I mean the $700 Billion per year structural spending bloat at the Federal level and the constant garbage promoted by the State.

'Let them eat cake!!!'

P.S.: The above does not take into account 'The Marriage Penalty'. That will jack me and most of the folks on this site. There will be no recovery. We will be stuck paying thousands more to the Feds for families with two wage earners. It would be very ugly - but taking thousands out of the economy will definitely boost the private sector. Yea, that will do it...

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Re: Tax Mythbuster Speaks Out - Strategies for Tax Management

No, Taxes don't effect jobs.:notrust:

[h=1]ObamaCare Causes Indiana Manufacturer to Cancel Expansion: More Jobs Gone[/h]July 28, 2012 By tlmertz

By Judson Berger

(FoxNews.com) An Indiana-based medical equipment manufacturer says it’s scrapping plans to open five new plants in the coming years because of a looming tax tied to President Obama’s health care overhaul law.

Cook Medical claims the tax on medical devices, set to take effect next year, will cost the company roughly $20 million a year, cutting into money that would otherwise go toward expanding into new facilities over the next five years. [more]

ObamaCare Causes Indiana Manufacturer to Cancel Expansion: More Jobs Gone | Tracy's Right

No, Taxes don't effect jobs.:notrust:

[h=1]ObamaCare Causes Indiana Manufacturer to Cancel Expansion: More Jobs Gone[/h]July 28, 2012 By tlmertz

By Judson Berger

(FoxNews.com) An Indiana-based medical equipment manufacturer says it’s scrapping plans to open five new plants in the coming years because of a looming tax tied to President Obama’s health care overhaul law.

Cook Medical claims the tax on medical devices, set to take effect next year, will cost the company roughly $20 million a year, cutting into money that would otherwise go toward expanding into new facilities over the next five years. [more]

ObamaCare Causes Indiana Manufacturer to Cancel Expansion: More Jobs Gone | Tracy's Right

Boghie

Market Veteran

- Reaction score

- 371

Re: Tax Mythbuster Speaks Out - Strategies for Tax Management

Another thought.

Let us say that Moonbeam gazes my way and demands his $200 - resulting in me moving $2,600 more into my TSP account (amongst the millions that will surely do so). Also, let us postulate that President Obama seeks to draw down spending by $700 Billion (the actual structural increase in spending) rather than pulling money out of the private sector via tax increases (by the way, the $70 Billion in tax increases for the rich will not cover the $700 Billion in structural spending increases - just saying...).

What will Governor Moonbeam of Kalefornea cost the Federal Government?

ZEROING OUT Governor Brown's tax increase will result in decreasing the Federal tax revenue by $625. I don't really want to do that - the current code is fair. But, you gotta do what you gotta do!!!

Another thought.

Let us say that Moonbeam gazes my way and demands his $200 - resulting in me moving $2,600 more into my TSP account (amongst the millions that will surely do so). Also, let us postulate that President Obama seeks to draw down spending by $700 Billion (the actual structural increase in spending) rather than pulling money out of the private sector via tax increases (by the way, the $70 Billion in tax increases for the rich will not cover the $700 Billion in structural spending increases - just saying...).

What will Governor Moonbeam of Kalefornea cost the Federal Government?

ZEROING OUT Governor Brown's tax increase will result in decreasing the Federal tax revenue by $625. I don't really want to do that - the current code is fair. But, you gotta do what you gotta do!!!

Similar threads

- Replies

- 0

- Views

- 247

- Replies

- 0

- Views

- 245

- Replies

- 27

- Views

- 707

- Replies

- 2

- Views

- 694

- Replies

- 2

- Views

- 825