Sunday Brief, 5 September 2010

Anything can happen

Anything can happen

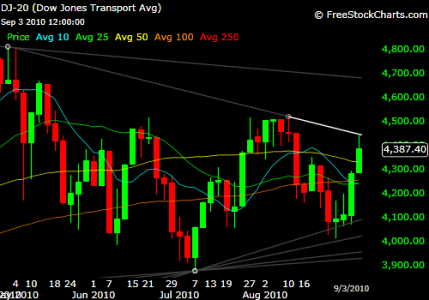

As is traditional, this year both the Transports & Small caps have been leading these markets, with usually the Transports leading by an extra day. So when I look for price direction, I look for these indexes to tell me what's going on. If we push higher, before we do we need to break some upper trendlines.

On the Bearish side, the Transports tested & were rejected by the white trendline from the May & July peaks. But on the Bullish side the Small Caps have broken and closed above this line, so now all we need is confirmation. If the S&P 500 breaks above this trendline, then I see no reason why we shouldn't test the previous 1130 top. If you're looking at the moving averages, keep in mind these are 2-day charts, so you should multiply by 2 to get the daily timeframe.

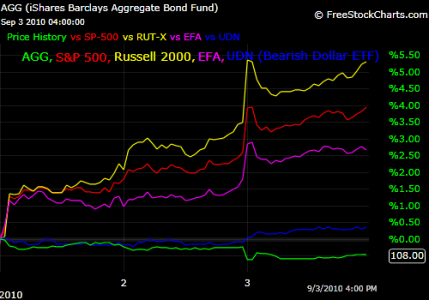

Starting the the first 3 days of the month out, the Small caps are leading the way. If you look at Tom's Returns Analysis it confirms this chart, showing MTD the S-Fund is leading, followed by the C, I, & F funds.

In last week's blog, I did mention the pre-holiday effect, but I didn't examine the potential upside, so on this 15-minute chart I've given you both the bearish & bullish view. These price projections are based on the last 3 days action, and these 3-day Fibonacci levels match well with my other Fibonacci charts, this shows us just how key these levels have been. You might also notice there's a 3 point gap I expect to see filled.

To summarize, we should watch the Indexes trendlines for confirmation of an S&P 500 breakout up to 1130. However, If we do pullback from here then let's stay in the Fibonacci green zone. If we breakdown into the red zone, then the bears have taken control of prices again.

Take care & trade safe...Jason