Sunday Brief, 29 August 2010

Can it get worse?

Can it get worse?

After 3 weeks of bearish action, this market appears inclined to test SPX 1010, and many believe Friday's bounce is just a short-term play at best. As for me, my last entry is at 1079, and if I could break even, I'll take an exit.

First up is the hourly July chart I've changed to a 2-hour chart, to consolidate space. If the bounce continues, I can see a test of 1070, which is a 50% retracement of the July Fibonacci levels, and a 50% retracement from the recent 17-25 August swing high/low. I do at a minimum expect to fill the gap at 1067.08.

The daily May channel is now a 2-day chart, once again I wanted to consolidate space. On this timeframe we are on target within the regression channel, sitting at 1062. Based on Mr. Fibonacci, if we were to break under 1011, I'd gander a -23.6% projection at 963. I've added volume so we can see the dramatic slide down since the May peak.

The weekly chart remains bullish, but it does seem to suggest a pending test of 1008. Anything below this level, and this chart turns neutral.

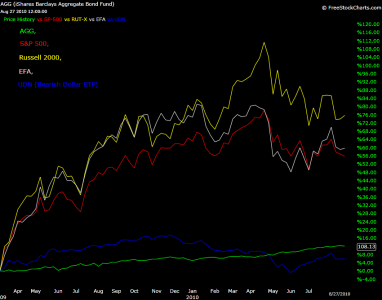

Here is a weekly price performance chart going back to March 2009. Like most of our top performing Autotrackers have figured out, the S-Fund (represented by the Russell 2000) is clearly outperforming all others. But don't let this chosen time frame fool you too much, here are the current winners from some other timeframes.

5 Year - AGG

1 Year - AGG

YTD - AGG

6 Month - AGG

3 Month - EFA/UDN

1 Month - AGG

1 Week - Russell 2000

Here is another 2-day chart, if you look at the moving average, just mulitiply by 2 and you'll get the daily timeframe. I've drawn in the key trendlines to watch for. As you can see, we closed above those trends for the week, and this is great news for the bull camp. The 2-day 250SMA (daily 500SMA) is sitting at 1001, and I'm calling this a line in the sand.

Projecting out for the week, I think we may continue the bounce but most likely close flat to positive. Do keep in mind with Labor Day approaching we may get the Pre-Holiday effect. I won't go into that as Tom already does a great job with it.

Take care and stop safe...Jason