Sunday Brief, 25 July 2010.

Key Fibonacci & Linear Regression Levels over multiple time-frames.

Key Fibonacci & Linear Regression Levels over multiple time-frames.

Over the last 2 years I've found my blogs have been somewhat "all over the place" so in an effort to give you more focus, I'm going to start consolidating my charts. What I've done here is combine Fibonacci & Linear Regression lines over separate Monthly, Weekly, Daily, & Hourly charts. This gives the trader the opportunity to decide which time frame works for them. The last chart merges together Fibonacci levels from all time-frames, to show you the current "most important" levels.

Monthly

On the Monthly chart I see prices as neutral with a bearish bias. Downside target is 1014, upside target is 1121, with a 34 Month Linear Regression price target of 934.

Weekly

On the Weekly chart I see prices as bullish with a bullish bias. Downside target is 1008, upside target is 1219, with a 73 Week Linear Regression price target of 1194.

Daily

On the Daily chart I see prices as bearish with a bearish bias. Downside target is 1090, then 1060, upside target is 1115, with a 63 Day Linear Regression price target of 1046.

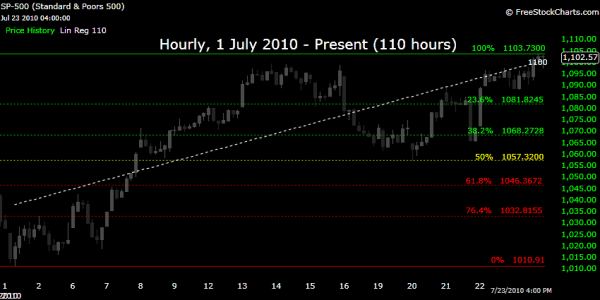

Hourly

On the Hourly chart I see prices as bullish with a bullish bias. Downside target is 1081, upside target is 1103 and will change if prices move higher. Here we have a 110 Hour Linear Regression price target of 1100.

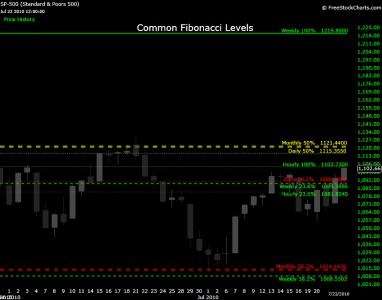

Common Levels

Combining all time frames we can see the first Resistance level runs from 1115-1121. We have support from 1090 to 1081 and we need to hold these levels throughout next week. If we do, I can see the bulls taking control of prices going onto August.

Summery

Monthly: Neutral/Bearish/1014-1121/LR 934.

Weekly: Bullish/Bullish/1008-1219/LR 1194.

Daily: Bearish/Bearish/1060-1090/LR 1046.

Hourly: Bullish/Bullish/1081-1103/LR 1100.

Common Support: 1090-1081

Common Resistance: 1115-1121

Thanks for reading, take care and trade safe...Jason