01/09/26

The Dow rallied 270-points on Thursday but Apple's 7th loss in a row helped keep the Nasdaq in the red. Small caps took the lead again, but investors seemed tentative in front of Friday morning's jobs report and the potential verdict from the Supreme Court on tariffs. Bond yields continue to chop in a range looking for the next major move.

We are seeing lackluster action but we have some important potential market moving catalysts coming up, and that's when investors may start getting more committed to a direction after two and half months of consolidation with the S&P 500 (C-fund) trading right about where it was at the October highs. The trend is still positive but Wednesday's negative reversal day and failed breakout changed the tone of the recent rally. There is still a lot of support between yesterday's lows near 6900, down to 6810 where the 50-day average is currently sitting.

The 10-year Treasury Yield continues to coil in a range up and, whether it's the jobs report or the Supreme Court's decision on the tariffs, it is primed for a bigger move. The bull flag suggests it is going to push higher, but if the Supreme court rules against the tariffs, it should reduce inflation fears, which should lower yields. The bond market is always a little flaky to the average investor (me) as they seem to be one step ahead of mom and pop, but everything seems to be on hold right now.

The dollar continues it's rally off of the support of the 200-day average. This looks legit for whatever reason, and that could be a breeze in the face of the I-fund .

The consensus estimates for Friday's December jobs report is looking for a gain of about 64,000 jobs. The unemployment rate is expected to be 4.5%, which would be a tick lower than the previous month.

Admin notes: I spend a lot of time in a warmer climate during the winter and I am blessed to have friends and family getting out of the cold and coming down to visit. I end up being the party pooper having to work while they're here. For the next week I am going to try to be a better host and give them a little more of my time, keeping the commentary more brief, although every time I say that, I can't seem to stop bloviating.

Last day! We have the 2026 version of Guess the Dow contest started for interested forum members. Deadline to enter is Friday at 7 PM ET. It's free, and a $100 Amazon eGift Card goes to the winner, so why not?

Also, we plan to have annual subscription sale during the week of January 19 - 23. More details to follow but we did move upcoming expiring annual subscription dates out until that day so you can renew that week without a lapse. As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on another year to your current subscriptions at the sale price. Also, we are considering a price increase after the sale, so this will lock in the lower price. As you can imagine, the costs of doing business has gone up quite a bit in the last 20 years and the TSP Talk Plus and Revshark premium service prices have remained the same since the day they started. A cure for that would be more subscribers so, spread the word and we may leave prices alone. That's a bribe.

DWCPF (S-fund) posted a moderate gain after a positive reversal at that key 2570 support area again, near the October highs.

The ACWX (I-fund index) was flat after a positive reversal day and it continues to digest recent gains. The open gaps give it a reason to take some time off, as does the rally in the dollar. But the 67 area looks like solid support, if it gets that low.

BND (bonds / F-fund) remains in the choppy ascending incline as the 50-day average holds, but the over head resistance has also been holding. There is a head and shoulders pattern in there that could be hinting at a break down.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The Dow rallied 270-points on Thursday but Apple's 7th loss in a row helped keep the Nasdaq in the red. Small caps took the lead again, but investors seemed tentative in front of Friday morning's jobs report and the potential verdict from the Supreme Court on tariffs. Bond yields continue to chop in a range looking for the next major move.

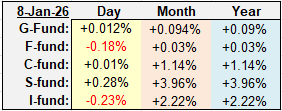

| Daily TSP Funds Return More returns |

We are seeing lackluster action but we have some important potential market moving catalysts coming up, and that's when investors may start getting more committed to a direction after two and half months of consolidation with the S&P 500 (C-fund) trading right about where it was at the October highs. The trend is still positive but Wednesday's negative reversal day and failed breakout changed the tone of the recent rally. There is still a lot of support between yesterday's lows near 6900, down to 6810 where the 50-day average is currently sitting.

The 10-year Treasury Yield continues to coil in a range up and, whether it's the jobs report or the Supreme Court's decision on the tariffs, it is primed for a bigger move. The bull flag suggests it is going to push higher, but if the Supreme court rules against the tariffs, it should reduce inflation fears, which should lower yields. The bond market is always a little flaky to the average investor (me) as they seem to be one step ahead of mom and pop, but everything seems to be on hold right now.

The dollar continues it's rally off of the support of the 200-day average. This looks legit for whatever reason, and that could be a breeze in the face of the I-fund .

The consensus estimates for Friday's December jobs report is looking for a gain of about 64,000 jobs. The unemployment rate is expected to be 4.5%, which would be a tick lower than the previous month.

Admin notes: I spend a lot of time in a warmer climate during the winter and I am blessed to have friends and family getting out of the cold and coming down to visit. I end up being the party pooper having to work while they're here. For the next week I am going to try to be a better host and give them a little more of my time, keeping the commentary more brief, although every time I say that, I can't seem to stop bloviating.

Last day! We have the 2026 version of Guess the Dow contest started for interested forum members. Deadline to enter is Friday at 7 PM ET. It's free, and a $100 Amazon eGift Card goes to the winner, so why not?

Also, we plan to have annual subscription sale during the week of January 19 - 23. More details to follow but we did move upcoming expiring annual subscription dates out until that day so you can renew that week without a lapse. As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on another year to your current subscriptions at the sale price. Also, we are considering a price increase after the sale, so this will lock in the lower price. As you can imagine, the costs of doing business has gone up quite a bit in the last 20 years and the TSP Talk Plus and Revshark premium service prices have remained the same since the day they started. A cure for that would be more subscribers so, spread the word and we may leave prices alone. That's a bribe.

DWCPF (S-fund) posted a moderate gain after a positive reversal at that key 2570 support area again, near the October highs.

The ACWX (I-fund index) was flat after a positive reversal day and it continues to digest recent gains. The open gaps give it a reason to take some time off, as does the rally in the dollar. But the 67 area looks like solid support, if it gets that low.

BND (bonds / F-fund) remains in the choppy ascending incline as the 50-day average holds, but the over head resistance has also been holding. There is a head and shoulders pattern in there that could be hinting at a break down.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.