02/13/26

Weaker than expected housing market data, plus continued concerns over AI taking business away from vulnerable industries, sent stocks lower on Thursday as tech and economically sensitive equities led the way lower. Yields fell sharply on the housing data, helping the bond fund rally.

The housing market has been under pressure and yesterday's weak existing home sales report showed a dramatic decline in January. It was an 8.4% decrease from December.

You can see what that did to some real estate stocks. Is this a bubble bursting, or an opportunity for investors - and perhaps home buyers?

The weak data sent the 10-Year Treasury Yield down to 4.1%, and if there's was a silver lining, the odds of the Federal Reserve cutting interest rates more than 0.50% went up by about 8% or so.

The S&P 500 (C-fund) continues to flounder under the all time highs while once again testing some rising support. So here we go again with the chart under the bearish Wyckoff Distribution pattern watch.

The Nasdaq 100 rolled back over so the 50-day average has been tough resistance this time around suggesting the index is getting weaker, not better.

The recently hot, economically sensitive Dow Transportation Index plummeted. The question is whether investors are selling first and asking questions later after the housing market data.

The small caps of the Russell 2000 (IWM) also fell sharply but it is still above its 50-day average, which has been holding for the last few months. I made some red circles to show a possible bearish head and shoulders-like formation with the recent lower higher being made - although the lower high won't be official unless or until the early February lows get taken out.

We get the CPI report this morning. This will be interesting considering the recent decline in yields. Any hint of stronger than expected inflation could send them right back up.

Holiday Closing: From tsp.gov - "Some financial markets will be closed on Monday, February 16, in observance of Washington's Birthday (President's Day). The Thrift Savings Plan will also be closed. Transactions that would have been processed Monday night (February 16) will be processed Tuesday night (February 17) at Tuesday's closing share prices."

Additional TSP Fund Charts:

The DWCPF (S-fund) took a 2% haircut on Thursday but so far the 50-day EMA is holding after an intraday test. Like the IWM chart up top, this could be forming the right shoulder of a bearish head and shoulders pattern, so support needs to hold.

ACWX (I fund) lost 1% on the day, which outperformed the US funds, but I had to widen the trading channel and there is now more room on the downside if this wants to continue to pullback.

BND (bonds / F-fund) held onto the top of its trading channel as support, and rebounded strongly yesterday on the weak housing data. What a difference a day makes after it fell sharply on the strong jobs report on Wednesday.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Weaker than expected housing market data, plus continued concerns over AI taking business away from vulnerable industries, sent stocks lower on Thursday as tech and economically sensitive equities led the way lower. Yields fell sharply on the housing data, helping the bond fund rally.

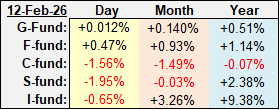

| Daily TSP Funds Return More returns |

The housing market has been under pressure and yesterday's weak existing home sales report showed a dramatic decline in January. It was an 8.4% decrease from December.

You can see what that did to some real estate stocks. Is this a bubble bursting, or an opportunity for investors - and perhaps home buyers?

The weak data sent the 10-Year Treasury Yield down to 4.1%, and if there's was a silver lining, the odds of the Federal Reserve cutting interest rates more than 0.50% went up by about 8% or so.

The S&P 500 (C-fund) continues to flounder under the all time highs while once again testing some rising support. So here we go again with the chart under the bearish Wyckoff Distribution pattern watch.

The Nasdaq 100 rolled back over so the 50-day average has been tough resistance this time around suggesting the index is getting weaker, not better.

The recently hot, economically sensitive Dow Transportation Index plummeted. The question is whether investors are selling first and asking questions later after the housing market data.

The small caps of the Russell 2000 (IWM) also fell sharply but it is still above its 50-day average, which has been holding for the last few months. I made some red circles to show a possible bearish head and shoulders-like formation with the recent lower higher being made - although the lower high won't be official unless or until the early February lows get taken out.

We get the CPI report this morning. This will be interesting considering the recent decline in yields. Any hint of stronger than expected inflation could send them right back up.

Holiday Closing: From tsp.gov - "Some financial markets will be closed on Monday, February 16, in observance of Washington's Birthday (President's Day). The Thrift Savings Plan will also be closed. Transactions that would have been processed Monday night (February 16) will be processed Tuesday night (February 17) at Tuesday's closing share prices."

Additional TSP Fund Charts:

The DWCPF (S-fund) took a 2% haircut on Thursday but so far the 50-day EMA is holding after an intraday test. Like the IWM chart up top, this could be forming the right shoulder of a bearish head and shoulders pattern, so support needs to hold.

ACWX (I fund) lost 1% on the day, which outperformed the US funds, but I had to widen the trading channel and there is now more room on the downside if this wants to continue to pullback.

BND (bonds / F-fund) held onto the top of its trading channel as support, and rebounded strongly yesterday on the weak housing data. What a difference a day makes after it fell sharply on the strong jobs report on Wednesday.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last edited: