06/11/25

The headlines are giving day traders some intraday buy and sell opportunities in the short-term, but the bulls are still in charge as the indices continue to grind higher, with or without some of the more bearish individuals or money mangers out there. We saw modest to moderate gains across the board with a close at or near the intraday highs. Bonds were up on a dip in yields in front of today's CPI Report.

(The most current commentary is always posted here: www.tsptalk.com/comments.php)

The market breadth was quite positive as advancers easily outpaced the decliners, and on the Nasdaq the share volume was dramatically positive with Intel, Nvidia, and Tesla being some of the most actively traded stocks - and all were positive.

There are still many inventors on the sidelines fearing the tariff situation, inflation, the recession, the LA altercations, and they've missed the rally in stocks off the lows. Meanwhile stocks keep moving higher. I certainly don't know what is going to happen, but I can see what is happening, and right now the charts are saying stocks are going higher. That may change today or next week, but right now, there doesn't seem to be anything derailing the rally. The only question at this point seems to be if the S&P 500 will pullback at a double top near 6150, or if it will keep grinding higher and continue to leave the overly patient, underinvested, who have been waiting for a pullback behind?

The S&P 500 (C-fund) looks good, and at the moment anything above 5890 is above resistance and good for the short-term, and even a move down to the 50-day EMA near 5700 would be typical bull market activity, but that's a big enough move to perhaps try to trade that rather than hold should the upper resistance fail.

The 10-year Treasury Yield was down slightly yesterday after Monday's pullback and that's potentially creating a lower highs in the 10-year. The red channel is still pointing upward so the trend is up, but a lower high could change that.

The longer term yield chart shows a possible bearish (for yields) chart pattern with a bearish looking flag in red, and a blue head and shoulders pattern that has now tested the middle of the head twice and held, so it seems like it may want to go lower and eventually fall below 4.1%. For stocks, just staying in the 4.1% to 4.6% range seems to be working just fine.

Lower yields, lower interest rates later this year, lower taxes and deregulation all sound like the ingredients for a bullish stock market. The main thing to look for now is a possible sell the news reaction if a trade deal is made with China. As good as that news might be, the market seems to be pricing that in already.

The Dow Transportation Index looks like it may be getting ready to breakout above its neckline of the inverted head and shoulders pattern. Normally the leader, this one has been lagging, but it seems to be getting onboard the bullish train. next stop, the 200-day average?

We get the CPI report this morning and that may be a market mover, especially now that we have all become a little numb to benign inflation data. However, if it is hotter than expected, I suppose that could change the character of the stock market.

The DWCPF (S-fund) has been flirting with a breakout of its inverted head and shoulders. It is now basically where it was before this whole tariff debacle started to hit the stock market, but it is still a long way from it's all time highs. A definitive breakout here would put 2400+ as a potential upside target.

The ACWX (I-fund) continues to grind higher and the US indices can only hope that they follow this same path. Support here is getting thinner, however.

BND (bonds / F-fund) rallied after holding at the 50-day EMA and creating a possible higher low, which could be the start of a trend change, but is has not been able to hold above the top of that channel.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.

The headlines are giving day traders some intraday buy and sell opportunities in the short-term, but the bulls are still in charge as the indices continue to grind higher, with or without some of the more bearish individuals or money mangers out there. We saw modest to moderate gains across the board with a close at or near the intraday highs. Bonds were up on a dip in yields in front of today's CPI Report.

(The most current commentary is always posted here: www.tsptalk.com/comments.php)

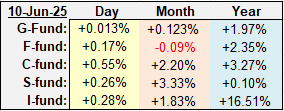

| Daily TSP Funds Return More returns |

The market breadth was quite positive as advancers easily outpaced the decliners, and on the Nasdaq the share volume was dramatically positive with Intel, Nvidia, and Tesla being some of the most actively traded stocks - and all were positive.

There are still many inventors on the sidelines fearing the tariff situation, inflation, the recession, the LA altercations, and they've missed the rally in stocks off the lows. Meanwhile stocks keep moving higher. I certainly don't know what is going to happen, but I can see what is happening, and right now the charts are saying stocks are going higher. That may change today or next week, but right now, there doesn't seem to be anything derailing the rally. The only question at this point seems to be if the S&P 500 will pullback at a double top near 6150, or if it will keep grinding higher and continue to leave the overly patient, underinvested, who have been waiting for a pullback behind?

The S&P 500 (C-fund) looks good, and at the moment anything above 5890 is above resistance and good for the short-term, and even a move down to the 50-day EMA near 5700 would be typical bull market activity, but that's a big enough move to perhaps try to trade that rather than hold should the upper resistance fail.

The 10-year Treasury Yield was down slightly yesterday after Monday's pullback and that's potentially creating a lower highs in the 10-year. The red channel is still pointing upward so the trend is up, but a lower high could change that.

The longer term yield chart shows a possible bearish (for yields) chart pattern with a bearish looking flag in red, and a blue head and shoulders pattern that has now tested the middle of the head twice and held, so it seems like it may want to go lower and eventually fall below 4.1%. For stocks, just staying in the 4.1% to 4.6% range seems to be working just fine.

Lower yields, lower interest rates later this year, lower taxes and deregulation all sound like the ingredients for a bullish stock market. The main thing to look for now is a possible sell the news reaction if a trade deal is made with China. As good as that news might be, the market seems to be pricing that in already.

The Dow Transportation Index looks like it may be getting ready to breakout above its neckline of the inverted head and shoulders pattern. Normally the leader, this one has been lagging, but it seems to be getting onboard the bullish train. next stop, the 200-day average?

We get the CPI report this morning and that may be a market mover, especially now that we have all become a little numb to benign inflation data. However, if it is hotter than expected, I suppose that could change the character of the stock market.

The DWCPF (S-fund) has been flirting with a breakout of its inverted head and shoulders. It is now basically where it was before this whole tariff debacle started to hit the stock market, but it is still a long way from it's all time highs. A definitive breakout here would put 2400+ as a potential upside target.

The ACWX (I-fund) continues to grind higher and the US indices can only hope that they follow this same path. Support here is getting thinner, however.

BND (bonds / F-fund) rallied after holding at the 50-day EMA and creating a possible higher low, which could be the start of a trend change, but is has not been able to hold above the top of that channel.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We may use additional methods and strategies to determine fund positions.