Greetings

A quick review of August: This was the first month we've closed down since last February.

While we did close down -1.77%, this isn't bad when you consider off the 18-Aug bottom we were down -5.53% intra-month. For ranking all Aug from 1960, we finished 46th best of 64, placing Aug-2023 in the bottom 28%.

The chart below shows we dipped below -4.06% (the average-of-loses), but managed to recover a portion of the loss with a -1.77% finish.

______

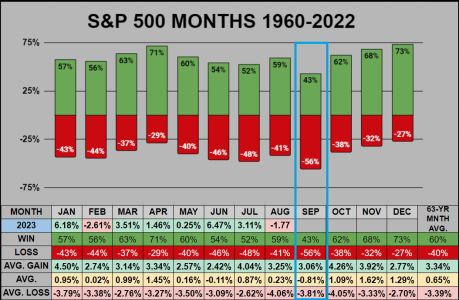

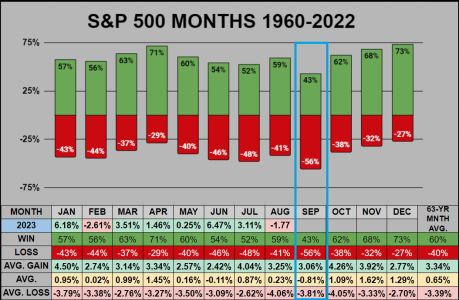

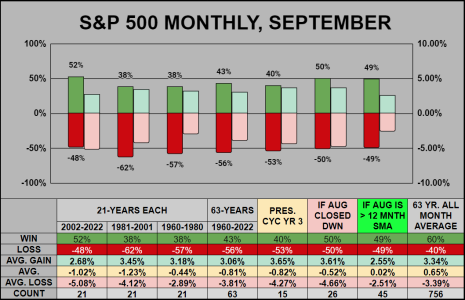

Looking ahead to September: We'll have 20 trading days with a holiday on this Monday Sep 4th, Labor Day. While not a given, historically September is the worst performing of the 12 months.

It has the worst win ratio with 43% (35 of 63 months closing down)

The 8th best average-of-gains at 3.06% (with the least months in the Top 20%)

The worst total average at -.81% (Only June & Sep have a negative average)

The 3rd worst average-of-loses at -3.81% (with the most months in the Bottom 20%)

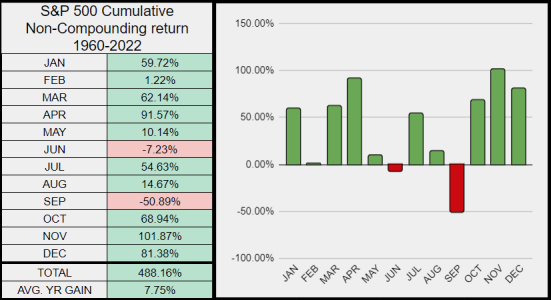

The chart below shows us the general weakness displayed when comparing September to the other 11 months.

______

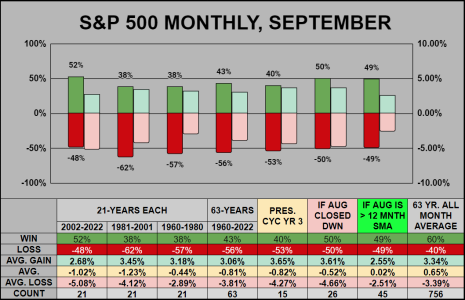

Digging down further into September:

The chart below shows the win ratios are generally unimpressive. Not one win ratio met the 63-Year All-Month 60% average win ratio. The good news, this does not predict the September ahead of us, the past 21 years have had a higher win ratio than the previous 42. Additionally, of the 35 times September closed down, October closed up 23 times, from this perspective, when September closed down, October closed up 66% of the time.

______

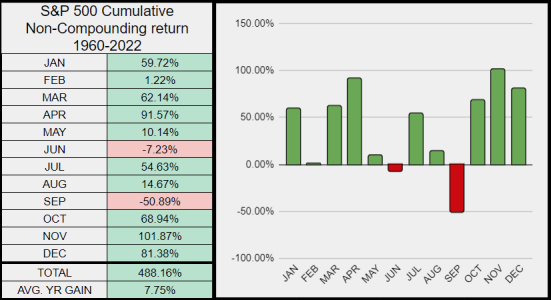

Interestingly: There are 2 months (June & September) which have a negative non-compounded return. Simple percentage adding of the 63 September gives you a loss of -50.89%

______

Here are some random September stats from 1960-2022:

Our 63 September have a downside lean.

The best 21 averaged 3.70%

The 21 in the middle averaged -.38%

The worst 21 averaged -5.75%

When the September Top-3 were its best, October was also good.

Sep 2010 was the 19th best, gaining 8.76% (the following Oct gained 3.69%)

Sep 1998 was the 57th best, gaining 6.22% (the following Oct gained 8.03%)

Sep 1996 was the 79th best, gaining 5.42% (the following Oct gained 2.61%)

When the September Bottom-3 were bad, October was much better.

Sep 1974 was the 5th worst, losing -11.93% (the following Oct ranked 1st gaining 16.30%)

Sep 2002 was the 7th worst, losing -11.01% (the following Oct ranked 20th gaining 8.65%)

Sep 2022 was the 11th worst, losing -9.34% (the following Oct ranked 28th gaining 7.99%)

______

Next Month's Projection based on the previous historical range.

For the chart below, I've added an average Intra-Month High/Low to give us more perspective on where prices can flow throughout the month (not just the close). For September buyers may want to step in (at or below) the average-of-losses at 4336, while sellers may want to step out (at or above) the average-of gains at 4645.

Thanks for reading, have a great month!

A quick review of August: This was the first month we've closed down since last February.

While we did close down -1.77%, this isn't bad when you consider off the 18-Aug bottom we were down -5.53% intra-month. For ranking all Aug from 1960, we finished 46th best of 64, placing Aug-2023 in the bottom 28%.

The chart below shows we dipped below -4.06% (the average-of-loses), but managed to recover a portion of the loss with a -1.77% finish.

______

Looking ahead to September: We'll have 20 trading days with a holiday on this Monday Sep 4th, Labor Day. While not a given, historically September is the worst performing of the 12 months.

It has the worst win ratio with 43% (35 of 63 months closing down)

The 8th best average-of-gains at 3.06% (with the least months in the Top 20%)

The worst total average at -.81% (Only June & Sep have a negative average)

The 3rd worst average-of-loses at -3.81% (with the most months in the Bottom 20%)

The chart below shows us the general weakness displayed when comparing September to the other 11 months.

______

Digging down further into September:

The chart below shows the win ratios are generally unimpressive. Not one win ratio met the 63-Year All-Month 60% average win ratio. The good news, this does not predict the September ahead of us, the past 21 years have had a higher win ratio than the previous 42. Additionally, of the 35 times September closed down, October closed up 23 times, from this perspective, when September closed down, October closed up 66% of the time.

______

Interestingly: There are 2 months (June & September) which have a negative non-compounded return. Simple percentage adding of the 63 September gives you a loss of -50.89%

______

Here are some random September stats from 1960-2022:

Our 63 September have a downside lean.

The best 21 averaged 3.70%

The 21 in the middle averaged -.38%

The worst 21 averaged -5.75%

When the September Top-3 were its best, October was also good.

Sep 2010 was the 19th best, gaining 8.76% (the following Oct gained 3.69%)

Sep 1998 was the 57th best, gaining 6.22% (the following Oct gained 8.03%)

Sep 1996 was the 79th best, gaining 5.42% (the following Oct gained 2.61%)

When the September Bottom-3 were bad, October was much better.

Sep 1974 was the 5th worst, losing -11.93% (the following Oct ranked 1st gaining 16.30%)

Sep 2002 was the 7th worst, losing -11.01% (the following Oct ranked 20th gaining 8.65%)

Sep 2022 was the 11th worst, losing -9.34% (the following Oct ranked 28th gaining 7.99%)

______

Next Month's Projection based on the previous historical range.

For the chart below, I've added an average Intra-Month High/Low to give us more perspective on where prices can flow throughout the month (not just the close). For September buyers may want to step in (at or below) the average-of-losses at 4336, while sellers may want to step out (at or above) the average-of gains at 4645.

Thanks for reading, have a great month!