Greetings

Generally speaking it was an average middle of the road January. Ranking 33rd of 63, this January closed up 1.59%, our MTD intra-high ranked 26th at 3.92% and our MTD intra-low ranked 23rd best at -1.33%.

While we did close Jan above the average of closes, thus far this quarter we are under-performing this same metric on the weekly chart for the 1st quarter averages. Further reading can be found in the Stats for Q1 Blog.

The January Trifecta didn't trigger all three indicators, but our last indicator which is the month of January (The January Barometer) did close up. Of these three indicators, I'd consider the last to be the most relevant, because it uses a full month of data.

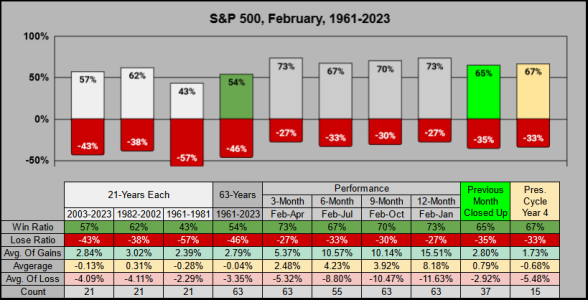

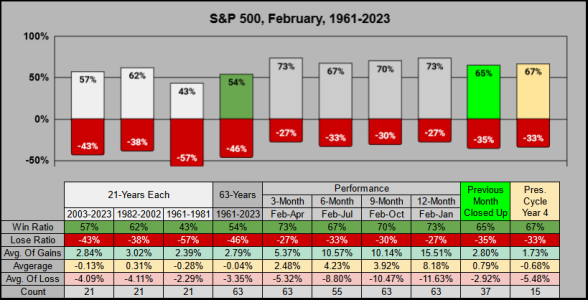

Looking ahead, I'd grade the Month of February as a below average month. It’s one of the four months which have a below average win ratio and one of the three months with a negative average gain.

There is good news: Of the 37 times January closed up, February closed up 65% of the time, and of the 15 Presidential cycles (year four) February closed up 67% of the time.

Here’s the February averages across the past 63 years correlated with Feb 2024. From a historical perspective, a seller may want to protect their gains above SPX 4981 while a buyer may want to increase their allocations below SPX 4694.

Thanks for reading, have a great month… Jason

Generally speaking it was an average middle of the road January. Ranking 33rd of 63, this January closed up 1.59%, our MTD intra-high ranked 26th at 3.92% and our MTD intra-low ranked 23rd best at -1.33%.

While we did close Jan above the average of closes, thus far this quarter we are under-performing this same metric on the weekly chart for the 1st quarter averages. Further reading can be found in the Stats for Q1 Blog.

The January Trifecta didn't trigger all three indicators, but our last indicator which is the month of January (The January Barometer) did close up. Of these three indicators, I'd consider the last to be the most relevant, because it uses a full month of data.

Looking ahead, I'd grade the Month of February as a below average month. It’s one of the four months which have a below average win ratio and one of the three months with a negative average gain.

There is good news: Of the 37 times January closed up, February closed up 65% of the time, and of the 15 Presidential cycles (year four) February closed up 67% of the time.

Here’s the February averages across the past 63 years correlated with Feb 2024. From a historical perspective, a seller may want to protect their gains above SPX 4981 while a buyer may want to increase their allocations below SPX 4694.

Thanks for reading, have a great month… Jason