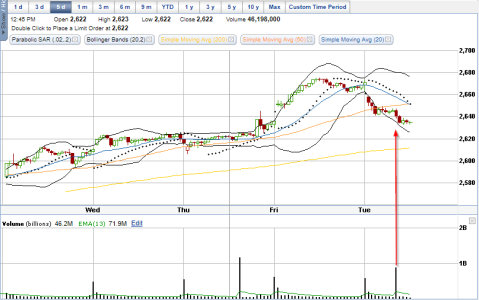

Low volume doji day. Might not seem exciting but it's sometimes telling when it comes to what the market is doing. Think of volume as the level of exertion. If there's no selling pressure, a low volume day, should be a low price move. So when I see a low vol doji, it's basically saying that the opportunity was there for sellers to jump in and reverse it, and didn't (therefore, the current trend is still intact). I hear people saying the rally looks exhausted, and the price action alone may appear that way, but exhaustion moves are usually associated with HIGH volume and small / no moves. If today was a high volume day with this nonexistent price movement, then alarms would be going off. But it's not that time yet, in my opinion.

I'm still leaning bullish and holding S fund and the SPXL shares, as well as the GRNTF position. It's already been a wild ride with GRNTF, up 8% currently, but within a matter of a few days it's also at one point been down -14%. That one is the guardians of the galaxy ride at Disneyland lol :nuts: