The current rally has at least temporarily run out of steam and the Seven Sentinels did indeed issue a sell signal today so I'll be moving to G fund tomorrow.

However, this is still a bull market until proven otherwise. The underlying strength has been phenomenal and I seriously doubt we turn down for much longer or go too deep. Bearishness has been quick to rise and that's what has really kept this market moving higher. And there's no reason to think now will be any different. Having said that I would not doubt we see another buy signal within the next 3 weeks or so. Hopefully that signal gets me in at lower prices. Recent buy signals have been on strong upward thrusts and with our TSP that makes it tough to take advantage of lower prices when they occur. I can only do what I can do though, so there's no use worrying about that.

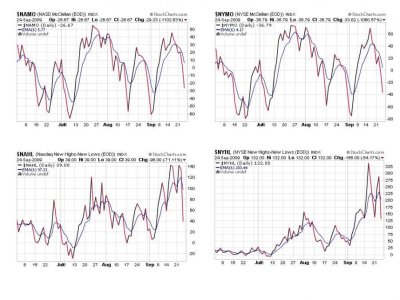

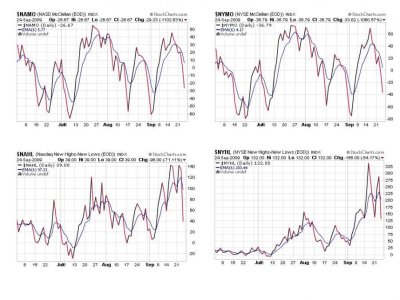

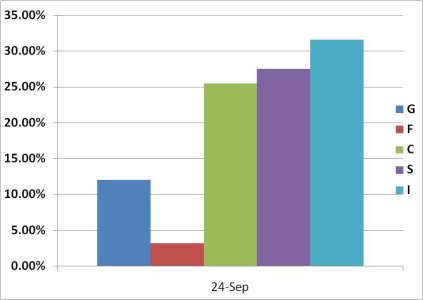

So here's the charts:

NAMO, NYMO, NAHL, and NYHL all flashing sell signals today.

TRIN, TRINQ, and BPCOMPQ flashing sells here as well. That's 7 simultaneous sell signals which means the system now goes to a sell condition.

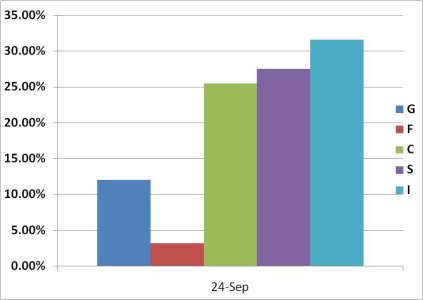

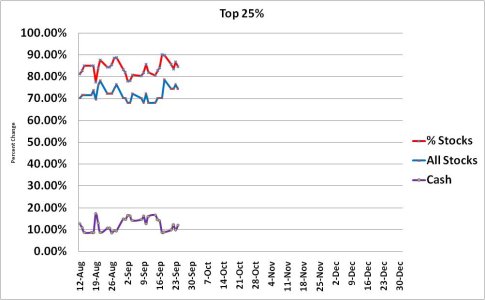

Here's how our Top 25% were position for today's action:

As I'd mentioned yesterday, I expected cash levels to rise very modestly for today's market action and it did. But it's still within a tight range on the chart. Stock holdings dipped accordingly.

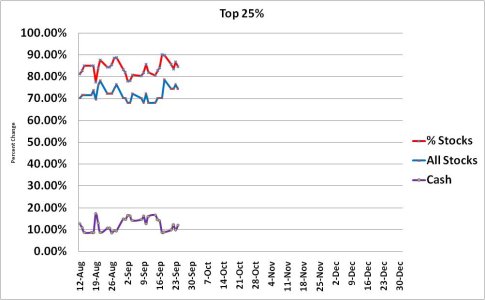

Same story here, different look.

I expect to post the Top 25% charts early tomorrow morning so everyone can see how much they might have changed. I'm not expecting a big difference, but I'm sure cash levels rose at least modestly.

I also am going to enter my IFT tonight for an all G position by close of business tomorrow. Hopefully I'll be selling into strength. Good luck everyone.

However, this is still a bull market until proven otherwise. The underlying strength has been phenomenal and I seriously doubt we turn down for much longer or go too deep. Bearishness has been quick to rise and that's what has really kept this market moving higher. And there's no reason to think now will be any different. Having said that I would not doubt we see another buy signal within the next 3 weeks or so. Hopefully that signal gets me in at lower prices. Recent buy signals have been on strong upward thrusts and with our TSP that makes it tough to take advantage of lower prices when they occur. I can only do what I can do though, so there's no use worrying about that.

So here's the charts:

NAMO, NYMO, NAHL, and NYHL all flashing sell signals today.

TRIN, TRINQ, and BPCOMPQ flashing sells here as well. That's 7 simultaneous sell signals which means the system now goes to a sell condition.

Here's how our Top 25% were position for today's action:

As I'd mentioned yesterday, I expected cash levels to rise very modestly for today's market action and it did. But it's still within a tight range on the chart. Stock holdings dipped accordingly.

Same story here, different look.

I expect to post the Top 25% charts early tomorrow morning so everyone can see how much they might have changed. I'm not expecting a big difference, but I'm sure cash levels rose at least modestly.

I also am going to enter my IFT tonight for an all G position by close of business tomorrow. Hopefully I'll be selling into strength. Good luck everyone.