Significant losses across the major averages were the story of the day, but the underlying issues that were blamed for today's stunning drop were nothing new. European Union financial ills continue to hit the headlines with the current concern centering around the possibility of including Italy in any new bailout packages.

Today's weakness first hit the overseas market and then carried over to here, where our own domestic market is still reeling from a poor jobs report from late last week.

While it's not front and center in the financial headlines, our own debt issues are probably going to hit this market as well; assuming the big money isn't already positioning itself for it. It may take Congress some time yet to come to an agreement over how to address our debt ceiling limit along with all the political baggage that goes with it. The closer we come to the wire, the more nervous traders and investors will probably get.

I know some of you have noticed, but I'll confirm it in my blog; the Dollar Index is soaring after the greenback hit its highest level since March. Concerns over the euro were the primary reason, but that's an old story too. Once our own troubles take center stage again, the dollar will probably move back down. But it was an impressive gain for the day as the greenback tacked on a 1.2% gain overall.

What a difference two trading days make. Here's today's charts:

It's been fairly predictable over the past few months that when NAMO and NYMO get extended at higher positive levels the market tends to reverse before too long. And so far that's been case this time around too. Both signals remain North of the neutral line, but any more moderate downside pressure could push them into negative territory. Both remain on sells.

Two more sells here for NAHL and NYHL. Internals have really been hit hard.

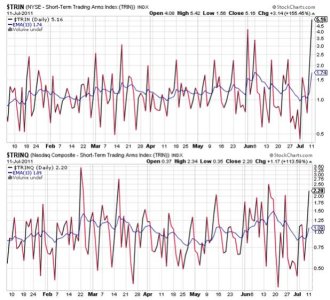

TRIN is highly suggestive of an oversold market and TRINQ is too, although not to the same degree. I would expect the market to find some level of support tomorrow, if not a gain just based on these two signals. That doesn't mean we won't go lower later this week should that happen, but for one day I would expect these levels to moderate somewhat. Both signals are well into sell territory.

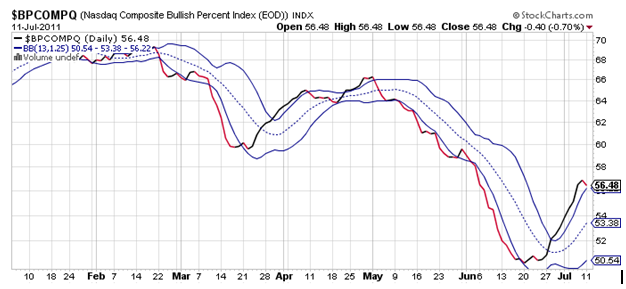

BPCOMPQ has now turned down, but it remains above that upper bollinger band, which keeps it on a buy.

So all signals except BPCOMPQ are flashing sells, but the system remains in a buy condition. At least for now.

We saw some serious selling pressure today and that could be an ominous sign, but it could also simply be a short term correction after such a large run to the upside. It's very difficult to gauge which way the market may go after today, but I'm holding my 100% G fund position until I see a good reason to get reinvested. Simply buying dips right now does not appear to be a good short term strategy. I also think sentiment is too complacent in various pockets and that too many folks who missed out on that last ramp higher are overly eager to get back in. That's a good way to get punished for being prematurely bullish. I also don't think this is the same market we had a few months ago. It's character appears to be slowly changing.