Hey ShowMe,

With your "chart analysis" lately, I didn't think you would be in stocks at all, let alone buying more soon. Your analysis seems to point out what I have been thinking lately, we need to break out above the highs of late October to validate a small bull run.......

LOL, you got me a little. I'm more neutral than bearish. I am front running the chart a bit but in farness the charts are showing more strength and conformation than weakness. With limited IFT it is almost imposible to DCA, which is how I made money before the IFT limits. So I am trying to do a weak DCA by rolling into Jan. with 20% in the market, adding another 40% yesterday and keeping 40% in reserve if we drop.

Some quick notes.

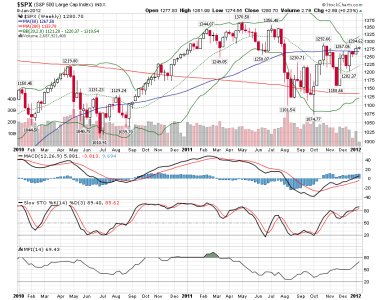

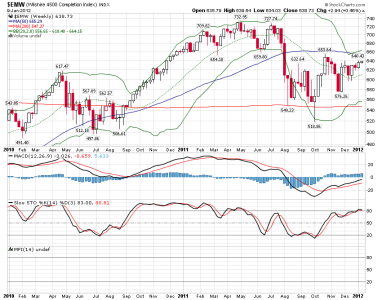

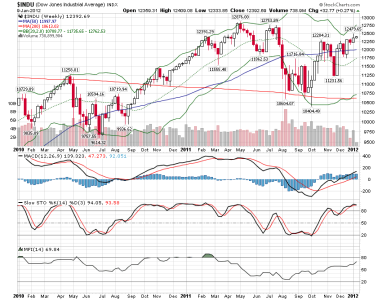

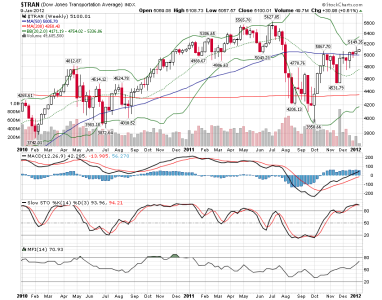

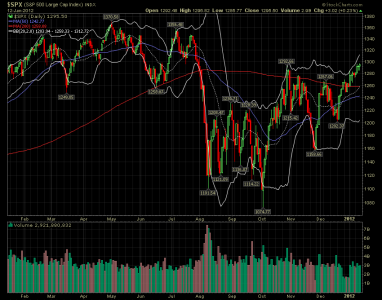

1. We are at a convergence of moving averages. Good or bad.

2. We broke above the old trend lines. Good.

3. We did get a conformation on the S&P, DOW, and TRANS. Dow and Trans are already trending up. Good!!!!

4. I fund and Euro still have problems FTSE and DAX need to rally to confirm a leg up, they are in position to do so with the USD topped out on the upper Bollinger Band (BB). The FTSE is finding some support at the 200 sma, the DAX has consolidated the last three day and is due a pop in tandem with a rally of the Euro. Good or bad.

5. Earning season. Good.

6. January effect, first week of January, and seasonality. Good.

One other silly note, last year should have been a positive year according to the Stock Traders Almanac (STA). Many outside influences blew that out of the water IMO. Politics, FED zero interest rate policy, jobs, etc.

I believe this year will rally as the market, economy and the voters are still looking for hope and change...............

So the markets will think that there will be a change coming in November and it might front run the election.

Factoid is that there have been 4 flat years in the S&P since WWII and the following years rallied. That may not mean anything in these turbulent times and with all of the electronic trading, credit swap mess, mortgage back security mess, etc. My point is that all of the old historical trend could mean nothing because the game dynamics and manipulation has changed so much. Another reason to NOT be a buy and holder.

Please do your own chart studies and don't believe a word I write. I spent almost the entire year at the bottom of the tracker last year and had two horrible years before that. I'm just pointing out simple chart observations and seasonality. I believe that any news can influence the market one way or the other and that new can come at any time.