As quickly as sentiment has shifted to a bearish stance when it appeared the market was poised to drop (causing short covering rallies), there are now indications that sentiment may be turning to a more bullish posture.

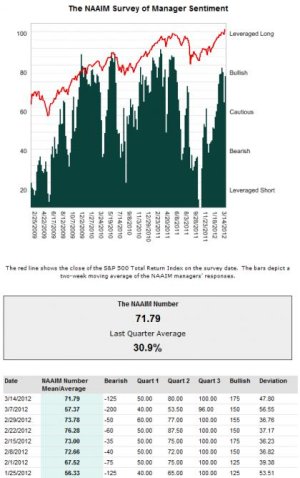

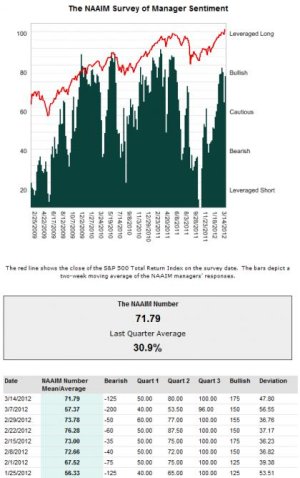

This is the The NAAIM Survey of Manager Sentiment chart. The link for this is here. Like many sentiment indicators, it has some measure of at least short term predictive value in gauging market direction. It jumped by more than 20% in the past week to a more bullish stance, which as a student of sentiment knows, is bearish. This reading means downside risk has risen.

As most of you are aware, we have our own sentiment survey, which we have seen can be highly predictive of market direction as well.

Now let me take a moment to acknowledge where I've learned some of this information over the past few years. On this message board, Tom (TSP Talk) has taught me much about the basics of sentiment as a predictive tool in gauging market direction. I have also learned a lot from Rev Shark. In addition, I have followed Mark Young on Trader's Talk for several years. His analysis is much more detailed and geared to a more trader savvy crowd so unless you're at a higher level in your understanding of market timing, that level of analysis may be a bit too much for some of you. But he's very good at sentiment analysis.

I bring this up because as I've said in the recent past, I am not a professional trader or money manager and it is not my place to provide investment advice. But these folks are a large source of much of my current knowledge in navigating the markets using sentiment as a tool. Now, sentiment aside, Don from the Seven Sentinels has taught me much about the systems approach where we allow the system to determine market direction. Collectively, they've given me enough information to make me dangerous, but I'll readily admit that I am still learning.

In the past, many of you have expressed an interest in hearing commentary from me about the markets. And like me, you are interested in better understanding why the market does what it does. That's human nature. With education comes understanding, which then helps to develop the perspective needed to make better decisions. It takes time and I wouldn't call it easy. But that's why I personally sought out people I knew were smarter than me. Over time as you learn more you'll find yourself having "a-ha" moments and things will begin to become a bit more clear.

Now, back to the analysis.

One of the things I had mentioned recently that I felt were obstacles that this market needed to overcome to get any traction to the downside was the fact that we are approaching the end of the quarter. That's the time money managers often adjust their portfolios (otherwise known as window dressing. You can bet many were underexposed this past quarter (while the market was making multi-year highs) and now need to "dress up" their holdings for the reasons cited in the link I provided.

Interestingly, CNBC ran an article that talked about this "expectation" on Friday. You can read it here.

Also in the article was mention of the rise in yields in the bond market. I mentioned that this was a potentially bullish development earlier this week, but that I would not read too much into it at this point. This too is now being touted as a reason to buy in some circles.

Now that these expectations are getting media attention, I consider it a potentially bearish development, which is why I suspect sentiment is now shifting (at least in the short term). I can see where this can be fertile ground for volatility ahead. The "risk on, risk off" action this market displayed over the past couple of years has made many traders skittish and less likely to marry their short term outlook (sentiment). They could flip back and forth quickly in fear of whipsaw action and in so doing help create just that type of market environment. News driven expectations can drive this behavior. This is at least partly why the system approach is preferred by many traders. We allow the system to determine market direction and relieve us of having to sift through emotionally charged market action.

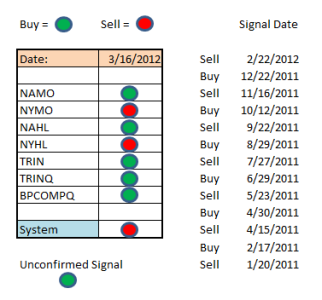

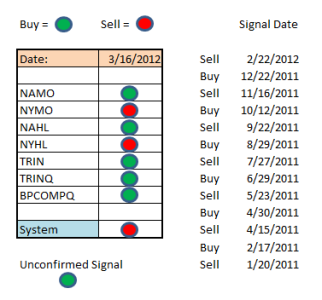

The Seven Sentinels officially remain in a sell condition. Notably, NYMO flipped to a sell, which along with the rest of Friday's developments tells me we should have some selling coming very soon. This could finally be the beginning of the real tipping point, but as always the market will make that final determination.

Stop by Sunday evening and I'll have the tracker charts posted. Happy St. Patrick's Day!

This is the The NAAIM Survey of Manager Sentiment chart. The link for this is here. Like many sentiment indicators, it has some measure of at least short term predictive value in gauging market direction. It jumped by more than 20% in the past week to a more bullish stance, which as a student of sentiment knows, is bearish. This reading means downside risk has risen.

As most of you are aware, we have our own sentiment survey, which we have seen can be highly predictive of market direction as well.

Now let me take a moment to acknowledge where I've learned some of this information over the past few years. On this message board, Tom (TSP Talk) has taught me much about the basics of sentiment as a predictive tool in gauging market direction. I have also learned a lot from Rev Shark. In addition, I have followed Mark Young on Trader's Talk for several years. His analysis is much more detailed and geared to a more trader savvy crowd so unless you're at a higher level in your understanding of market timing, that level of analysis may be a bit too much for some of you. But he's very good at sentiment analysis.

I bring this up because as I've said in the recent past, I am not a professional trader or money manager and it is not my place to provide investment advice. But these folks are a large source of much of my current knowledge in navigating the markets using sentiment as a tool. Now, sentiment aside, Don from the Seven Sentinels has taught me much about the systems approach where we allow the system to determine market direction. Collectively, they've given me enough information to make me dangerous, but I'll readily admit that I am still learning.

In the past, many of you have expressed an interest in hearing commentary from me about the markets. And like me, you are interested in better understanding why the market does what it does. That's human nature. With education comes understanding, which then helps to develop the perspective needed to make better decisions. It takes time and I wouldn't call it easy. But that's why I personally sought out people I knew were smarter than me. Over time as you learn more you'll find yourself having "a-ha" moments and things will begin to become a bit more clear.

Now, back to the analysis.

One of the things I had mentioned recently that I felt were obstacles that this market needed to overcome to get any traction to the downside was the fact that we are approaching the end of the quarter. That's the time money managers often adjust their portfolios (otherwise known as window dressing. You can bet many were underexposed this past quarter (while the market was making multi-year highs) and now need to "dress up" their holdings for the reasons cited in the link I provided.

Interestingly, CNBC ran an article that talked about this "expectation" on Friday. You can read it here.

Also in the article was mention of the rise in yields in the bond market. I mentioned that this was a potentially bullish development earlier this week, but that I would not read too much into it at this point. This too is now being touted as a reason to buy in some circles.

Now that these expectations are getting media attention, I consider it a potentially bearish development, which is why I suspect sentiment is now shifting (at least in the short term). I can see where this can be fertile ground for volatility ahead. The "risk on, risk off" action this market displayed over the past couple of years has made many traders skittish and less likely to marry their short term outlook (sentiment). They could flip back and forth quickly in fear of whipsaw action and in so doing help create just that type of market environment. News driven expectations can drive this behavior. This is at least partly why the system approach is preferred by many traders. We allow the system to determine market direction and relieve us of having to sift through emotionally charged market action.

The Seven Sentinels officially remain in a sell condition. Notably, NYMO flipped to a sell, which along with the rest of Friday's developments tells me we should have some selling coming very soon. This could finally be the beginning of the real tipping point, but as always the market will make that final determination.

Stop by Sunday evening and I'll have the tracker charts posted. Happy St. Patrick's Day!