How many times has it happened before? Just as we get overly beared up, the market moves higher. Last week, the TSP Talk sentiment survey had 61% bears. And the Top 50 came very close to giving a buy signal. I thought it might be enough, but given the overall dip buying I wasn't quite sure. But it's a weekly signal, not a daily signal. That's key. Early in the week not all sentiment surveys were as bearish as ours, but by mid-week, that was changing. And as sentiment moved more to the bearish side, the market moved higher. It took longer than I expected, but not a whole lot longer.

This week, our sentiment survey came in at 40% bulls to 52% bears vs. 30% bulls to 61% bears the previous week. That’s a jump in the number of bulls and a drop in bears, which is still a modestly bullish reading. But while we got more bullish, AAII got more bearish and came in at 29.0% bulls to 42.9% bears vs. 34.5% bulls to 28.2% bears last week. That’s less bulls and a lot more bears. This is a bullish reading.

Our TSP allocations didn't change enough to generate any signals this week, but overall sentiment supports more upside in the short term. Here's this week's charts:

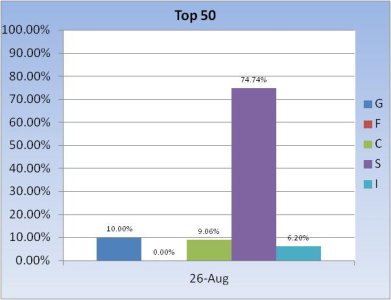

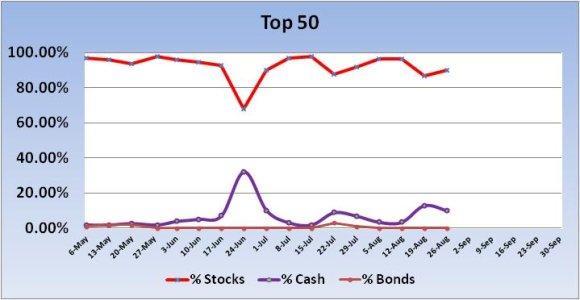

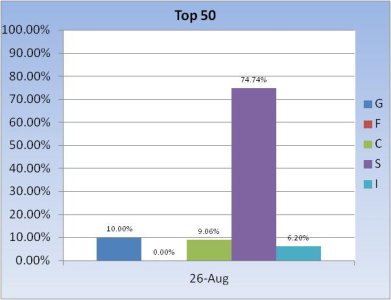

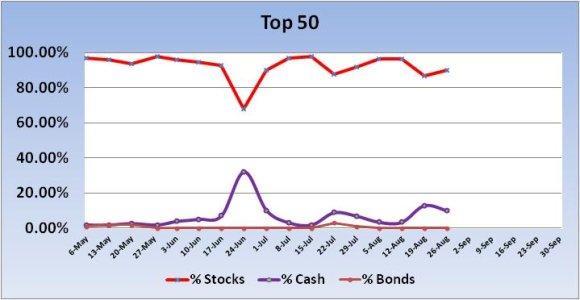

Last week this group had dropped their total stock allocations by 9.38%, which was very close to a buy signal. I thought it might be enough, especially given our sentiment survey was so bearish. As it turned out, it was enough as the C fund rose 0.5% and S fund jumped 1.35%. Total stock allocations this week rose by 3% to a total stock allocation of 90%.

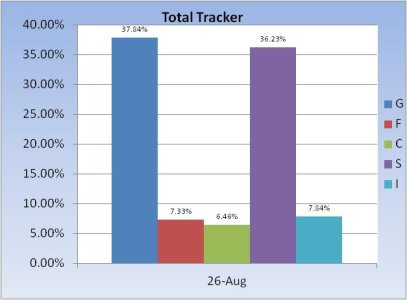

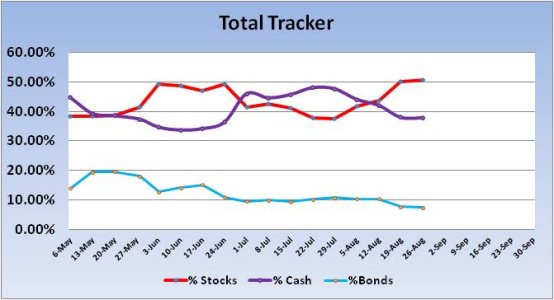

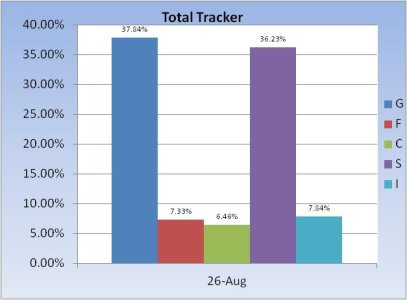

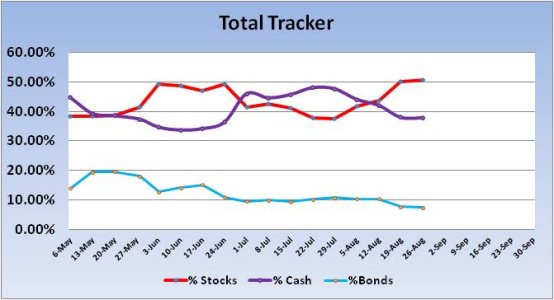

No signal was generated from the Total Tracker this week. Total stock allocations only rose by 0.33%. The previous wave of dip buying has paid off for those that increased stock exposure recently. Total stock allocations are 50.54%, which is still a conservative allocation in a bull market so I view this as bullish in the longer term. It makes sense to have some cash on hand to buy this market should lower prices present themselves in the weeks/months ahead. But if a major correction comes, will we buy it? Or will fear send folks deeper into the G fund? Emotion is a powerful thing. That’s why sentiment surveys are so valuable.

The Wilshire 4500 (equivalent to the S fund) found support at its 50 day moving average. I have also drawn a trend line that shows price closing above trend line support the past two trading days. MACD is hinting at a turn back up. RSI managed to have a positive centerline cross late last week. This chart suggests we have more upside coming in the short term (weekly).

On a weekly basis, I am looking for a bit more upside next week given current sentiment readings. Beyond that, I suspect we'll get another decline in the weeks ahead as my intermediate term indicator went negative this past week. It's not unusual for that indicator to go negative around the same time sentiment gets more bearish. This often leads to upside moves and potential whipsaws shortly after it goes negative. Not always though. It could also be an early warning. We are in the weak part of the seasonal cycle and so far we've not had more than moderate dips. And there is still more than two months left before we exit this part of the seasonal cycle.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/

This week, our sentiment survey came in at 40% bulls to 52% bears vs. 30% bulls to 61% bears the previous week. That’s a jump in the number of bulls and a drop in bears, which is still a modestly bullish reading. But while we got more bullish, AAII got more bearish and came in at 29.0% bulls to 42.9% bears vs. 34.5% bulls to 28.2% bears last week. That’s less bulls and a lot more bears. This is a bullish reading.

Our TSP allocations didn't change enough to generate any signals this week, but overall sentiment supports more upside in the short term. Here's this week's charts:

Last week this group had dropped their total stock allocations by 9.38%, which was very close to a buy signal. I thought it might be enough, especially given our sentiment survey was so bearish. As it turned out, it was enough as the C fund rose 0.5% and S fund jumped 1.35%. Total stock allocations this week rose by 3% to a total stock allocation of 90%.

No signal was generated from the Total Tracker this week. Total stock allocations only rose by 0.33%. The previous wave of dip buying has paid off for those that increased stock exposure recently. Total stock allocations are 50.54%, which is still a conservative allocation in a bull market so I view this as bullish in the longer term. It makes sense to have some cash on hand to buy this market should lower prices present themselves in the weeks/months ahead. But if a major correction comes, will we buy it? Or will fear send folks deeper into the G fund? Emotion is a powerful thing. That’s why sentiment surveys are so valuable.

The Wilshire 4500 (equivalent to the S fund) found support at its 50 day moving average. I have also drawn a trend line that shows price closing above trend line support the past two trading days. MACD is hinting at a turn back up. RSI managed to have a positive centerline cross late last week. This chart suggests we have more upside coming in the short term (weekly).

On a weekly basis, I am looking for a bit more upside next week given current sentiment readings. Beyond that, I suspect we'll get another decline in the weeks ahead as my intermediate term indicator went negative this past week. It's not unusual for that indicator to go negative around the same time sentiment gets more bearish. This often leads to upside moves and potential whipsaws shortly after it goes negative. Not always though. It could also be an early warning. We are in the weak part of the seasonal cycle and so far we've not had more than moderate dips. And there is still more than two months left before we exit this part of the seasonal cycle.

To see this week's full analysis, follow this link http://www.tsptalk.com/members/