It's just the third weekly sell signal issued from our sentiment survey all year as bulls outnumbered bears 63% to 26% respectively going into the new trading week. You might think we were increasing our stock exposure last week given those numbers, but we didn't. Fact is, both groups dropped their stock exposure. Here's the charts:

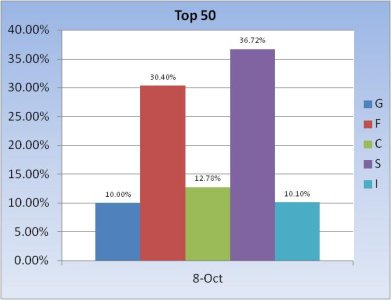

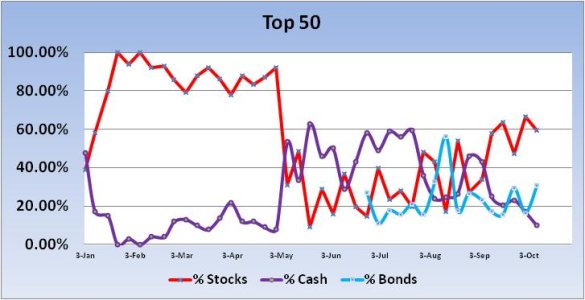

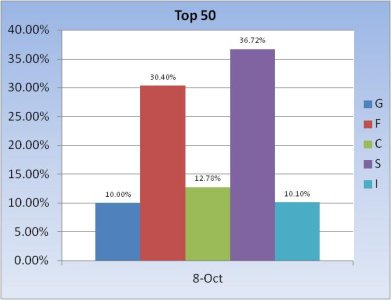

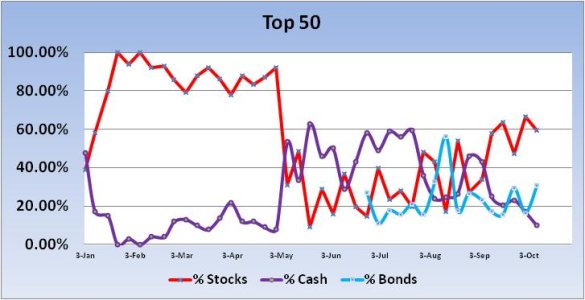

This week, the Top 50 dropped their collective stock exposure by 7%, from 66.6% to 59.6% week over week. That's still a somewhat healthy stock exposure though. I would note that last week the Top 50 correctly positioned themselves for a weekly stock gain as they increased their stock exposure by 19.2%. The C and S funds returned 1.00% and 1.47% respectively last week. That's 4 of the last 5 weeks they've re-positioned correctly. Prior to the last few weeks, their accuracy of getting properly re-positioned was no better than about 25%.

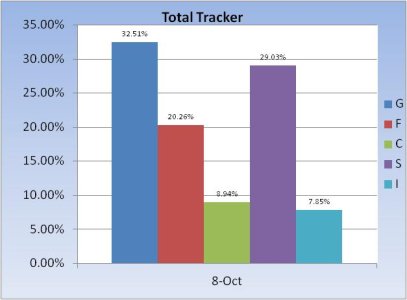

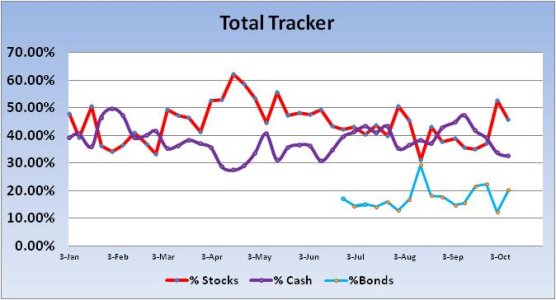

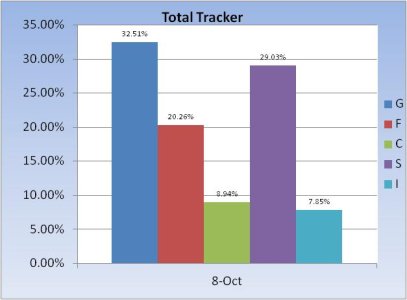

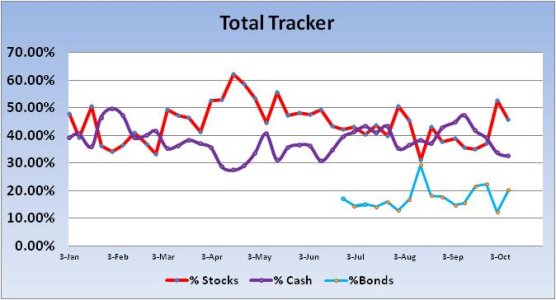

The Total Tracker showed a drop in stock exposure of 6.86%, from 52.67% to 45.82% week over week.

So we have a weekly bulls reading of 63%, but the Total Tracker is showing we sold off equity positions to a fairly conservative 45.82% stock exposure. That certainly shows how much actual confidence we have in this market.

This week, the Top 50 dropped their collective stock exposure by 7%, from 66.6% to 59.6% week over week. That's still a somewhat healthy stock exposure though. I would note that last week the Top 50 correctly positioned themselves for a weekly stock gain as they increased their stock exposure by 19.2%. The C and S funds returned 1.00% and 1.47% respectively last week. That's 4 of the last 5 weeks they've re-positioned correctly. Prior to the last few weeks, their accuracy of getting properly re-positioned was no better than about 25%.

The Total Tracker showed a drop in stock exposure of 6.86%, from 52.67% to 45.82% week over week.

So we have a weekly bulls reading of 63%, but the Total Tracker is showing we sold off equity positions to a fairly conservative 45.82% stock exposure. That certainly shows how much actual confidence we have in this market.