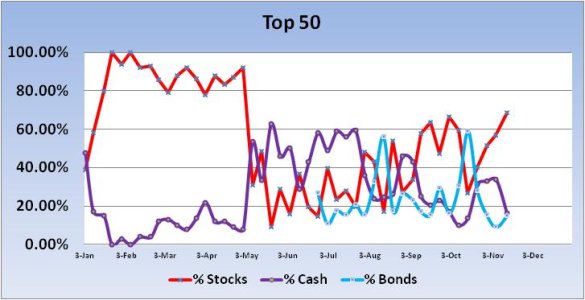

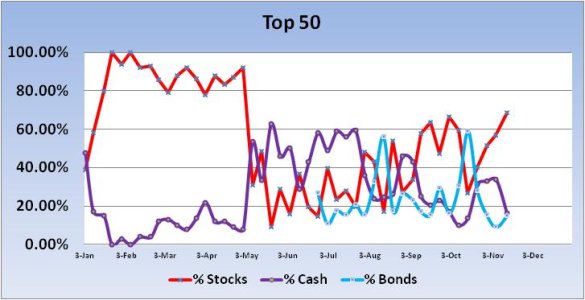

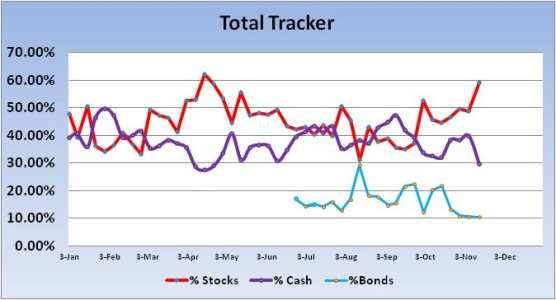

Normally, I'd expect to see stock allocations drop or remain near their previous level on bearish sentiment (our sentiment survey triggered a buy signal for next week), but instead those allocations increased. And by a good measure too. Some of that shift is probably attributable to Friday fund transfers once the survey results were posted. Here's the charts:

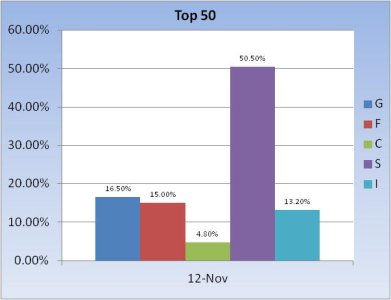

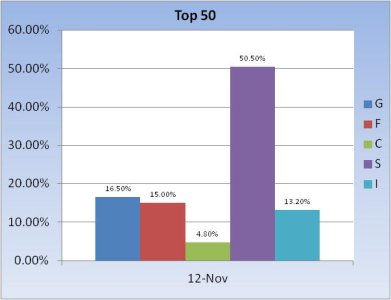

The Top 50 had increased their allocations each week for the past three weeks, and this week makes four as this group pushed their stock allocations from a total of 57.04% last week to 68.5% this week.

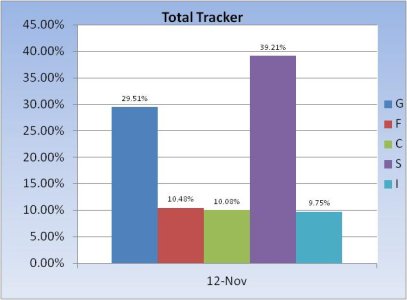

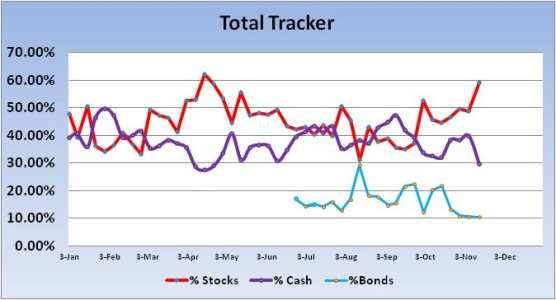

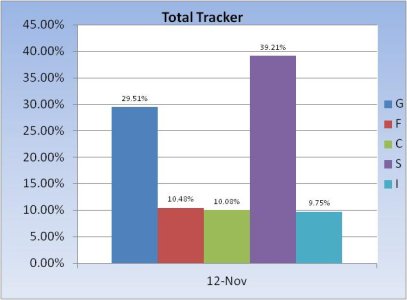

The Total Tracker also showed a healthy shift as total stock allocations rose from 48.6% to 59.04%; an increase of 10.48%.

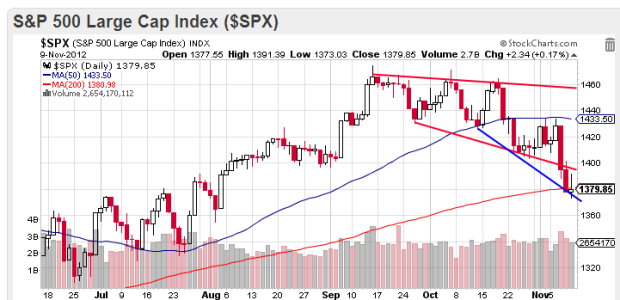

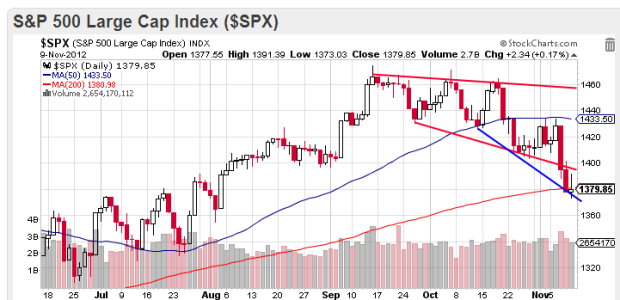

The S&P remained below its 200 dma Friday, but it did manage to close a bit higher. Start of a bottoming process? This is a good target area for a reversal, especially given our bearish sentiment (and subsequent sentiment survey buy signal). But it's also true that the intermediate term is currently negative. Many would argue that this is a "sell the rallies" environment (or short them). And that may indeed be the winning formula in the days/weeks ahead. But it won't be long before we get into a seasonally positive period either.

In any event, given how our stock allocations rose going into the new week, it would seem many of us are relatively confident of (or praying for) a rally. I think that's called bottom picking.

The Top 50 had increased their allocations each week for the past three weeks, and this week makes four as this group pushed their stock allocations from a total of 57.04% last week to 68.5% this week.

The Total Tracker also showed a healthy shift as total stock allocations rose from 48.6% to 59.04%; an increase of 10.48%.

The S&P remained below its 200 dma Friday, but it did manage to close a bit higher. Start of a bottoming process? This is a good target area for a reversal, especially given our bearish sentiment (and subsequent sentiment survey buy signal). But it's also true that the intermediate term is currently negative. Many would argue that this is a "sell the rallies" environment (or short them). And that may indeed be the winning formula in the days/weeks ahead. But it won't be long before we get into a seasonally positive period either.

In any event, given how our stock allocations rose going into the new week, it would seem many of us are relatively confident of (or praying for) a rally. I think that's called bottom picking.