Sensei

TSP Pro

- Reaction score

- 27

Aloha! I've been mostly ignoring the stock market as I'm on vacation with my family. We're coming to the end of a great week in Hawaii. My wife is currently in great physical shape despite having had surgery to remove breast cancer only a month ago. We're enjoying the here and now, as she faces about 4 months of chemotherapy immediately after we return home.

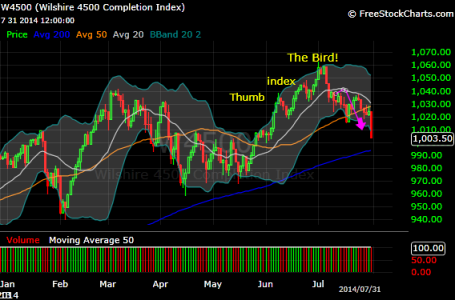

I'm still in the G fund. Sentiment is bullish, but the herd is only about half in. I'm hoping for a little downside pressure next week, which would give me a chance to buy in at a discounted price with a July IFT. Hoping for a shot on Wednesday or Thursday.

I'm still in the G fund. Sentiment is bullish, but the herd is only about half in. I'm hoping for a little downside pressure next week, which would give me a chance to buy in at a discounted price with a July IFT. Hoping for a shot on Wednesday or Thursday.