In my Sunday blog, I pointed out that it appeared we were selling rallies on strength in spite of more bullish sentiment readings in our weekly survey. Apparently, the broader market is currently subscribing to the same strategy as significant gains earlier in the day began to melt away before noon. By the close the DOW posted a gain of 0.36%, while the S&P 500 and Nasdaq posted 0.31% and 0.54% gains respectively.

The buying pressure began in response to a strong GDP reading from China, which reported second quarter GDP growth of 9.5% over the same period one year ago. That was much higher than expected and the market saw that in a very positive light early on.

Later in the trading day, Ben Bernanke provided semiannual testimony on monetary policy to the House Financial Services Committee. He essentially said that the Fed remained prepared to modify monetary policy as necessary in response to economic developments. He also stated that the Fed had reached a consensus on an exit strategy from current policy. It was during this testimony that buying pressure increased.

It should be noted that the dollar came under selling pressure in response to Bernanke's comments, which is why the I fund outperformed on the day.

Here's today's charts:

NAMO and NYMO bounced today, but remain on sells.

NAHL managed to just cross back up through its 6 day EMA, which flips it back to a buy condition, while NYHL remained on a sell.

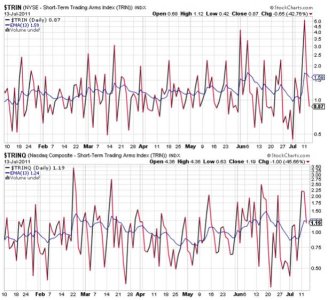

TRIN and TRINQ are both flashing buys and are showing relatively neutral readings at the moment.

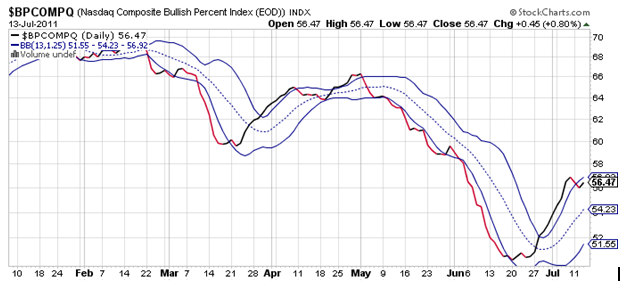

BPCOMPQ turned back up today, but remains on a sell.

So the signals are mixed, which keeps the Seven Sentinels in a buy condition.

I own an inflation protected bond fund in one of my IRAs and I've been watching it carefully of late. I've noticed that it has moved to the upside every trading day since QE2 expired, and it's been hitting new highs for the past week or so. It's only been about 2 weeks, but it certainly seems to suggest that the market may be getting concerned about inflation again.

And going back to my earlier comment about selling rallies; I also mentioned in my Sunday blog that the Top 50 had dropped their collective stock exposure by about 14% going into this week and had a total stock allocation a bit above 44%. Well guess what? In just two days the Top 50 has dropped their stock exposure another 14% to a total stock allocation of exactly 30%. Just some food for thought.

As for the rest of the week, keep in mind that Friday is Options Expiration so anything can happen between now and then. I am looking for lower prices myself. And the fact that Ben Bernanke's comments didn't keep this market at higher levels today can't be too encouraging either, but I'm only short term bearish here. I think we'll launch another rally at some point, but there's too much uncertainty out there for comfort, which is probably why rallies are being sold.