It's just one day and we were certainly due for some weakness after the recent run-up, but today's action does not necessarily mean the bulls are ready to let the bears have their way.

Today the media seemed to blame today's weakness on comments from German Finance Minister Wolfgang Schaeuble, who stated that it was wrong to expect a miracle cure from this weekend's summit. As you may know, there's been talk for some time about a plan to solve Europe's debt crisis, but very little substance behind those words. The German Finance Minister pointed out what should have been obvious to most.

And while the Volatility Index soared today volume was lacking, indicating the downside may very well be limited, although not necessarily over after today.

Here's today's charts:

NAMO and NYMO fell from multi-month highs today and suggest we could see a bit more selling pressure yet. Both also flipped to sells.

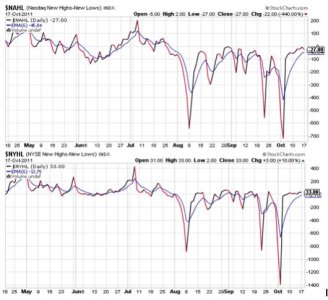

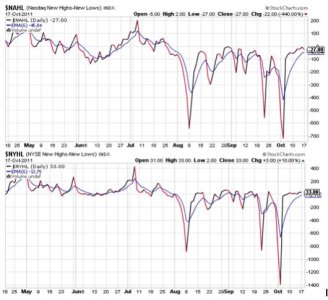

NAHL and NYHL only moved modestly today and remain in buy conditions.

TRIN spiked higher, but not enough to suggest more than a modestly oversold market. It also flipped to a sell. TRINQ also moved higher, but remained near its 13 day EMA. However it too flipped to a sell.

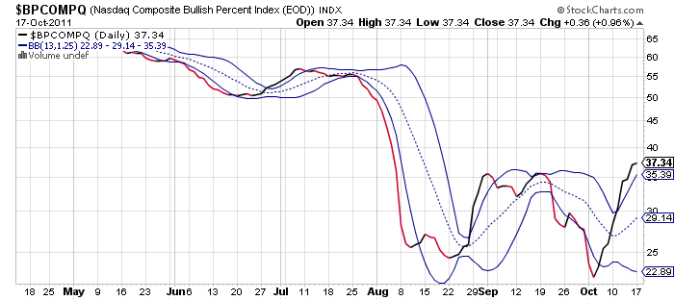

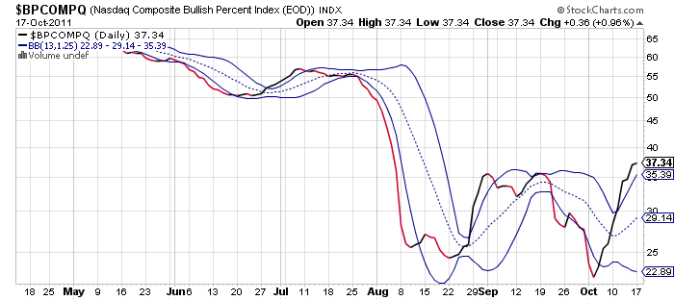

BPCOMPQ moved up marginally, but remains on a buy.

So the signals are mixed, but the system remains in a buy condition.

I'm not going to read too much into today's action. We were due for some selling pressure and we got it. We may get more. But there is still a great deal of shorting in the market and bearish conditions are still fairly prevalent. I would not be surprised if bearish sentiment rises after today either. That means the market may find support relatively quickly and bounce back up again. That's my read. I went 50% S on Friday anticipating an intraday reversal that never came. But I also felt and still do feel that higher prices are a very real possibility here. If we are down again tomorrow, I may be a buyer.

Today the media seemed to blame today's weakness on comments from German Finance Minister Wolfgang Schaeuble, who stated that it was wrong to expect a miracle cure from this weekend's summit. As you may know, there's been talk for some time about a plan to solve Europe's debt crisis, but very little substance behind those words. The German Finance Minister pointed out what should have been obvious to most.

And while the Volatility Index soared today volume was lacking, indicating the downside may very well be limited, although not necessarily over after today.

Here's today's charts:

NAMO and NYMO fell from multi-month highs today and suggest we could see a bit more selling pressure yet. Both also flipped to sells.

NAHL and NYHL only moved modestly today and remain in buy conditions.

TRIN spiked higher, but not enough to suggest more than a modestly oversold market. It also flipped to a sell. TRINQ also moved higher, but remained near its 13 day EMA. However it too flipped to a sell.

BPCOMPQ moved up marginally, but remains on a buy.

So the signals are mixed, but the system remains in a buy condition.

I'm not going to read too much into today's action. We were due for some selling pressure and we got it. We may get more. But there is still a great deal of shorting in the market and bearish conditions are still fairly prevalent. I would not be surprised if bearish sentiment rises after today either. That means the market may find support relatively quickly and bounce back up again. That's my read. I went 50% S on Friday anticipating an intraday reversal that never came. But I also felt and still do feel that higher prices are a very real possibility here. If we are down again tomorrow, I may be a buyer.