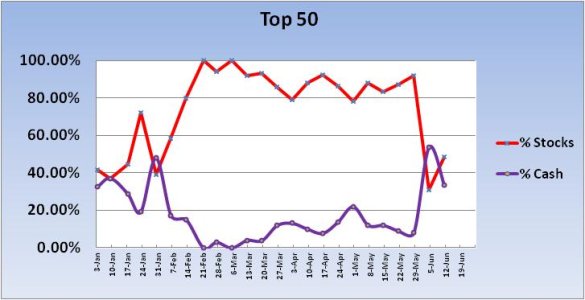

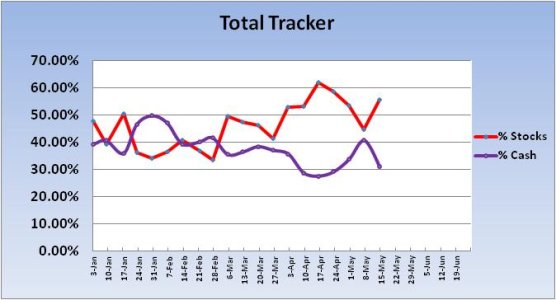

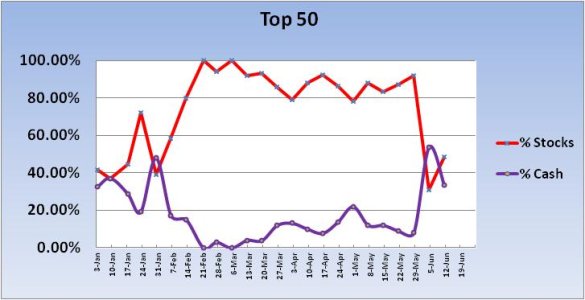

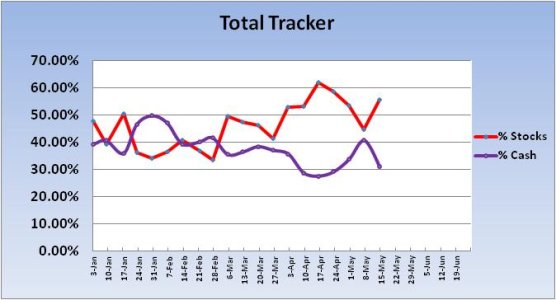

Last week we saw an incredible drop in total stock allocation for the Top 50. As a group, their total stock allocation fell by 61%. The herd (total tracker) also reduced stock exposure (by 8.82%). Reduced stock exposure proved to be the correct weekly call. Unfortunately, as ugly as the selling pressure seemed, damage was minimal for the domestic stock market. For the week, the C fund dropped about 1.06%, while the S fund only fell about .24%. However, the I fund fared the worst with a drop of 1.6%.

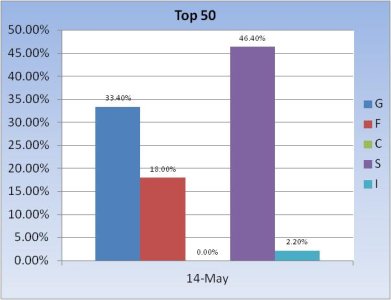

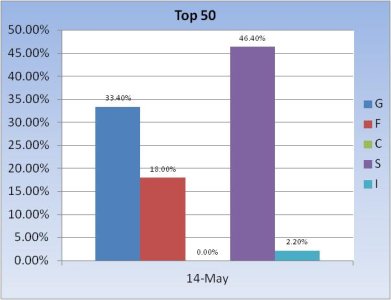

This week, the Top 50 increased their collective stock exposure a healthy 17.6%, but their total allocation is still only 48.6%, so bearishness persists in this group.

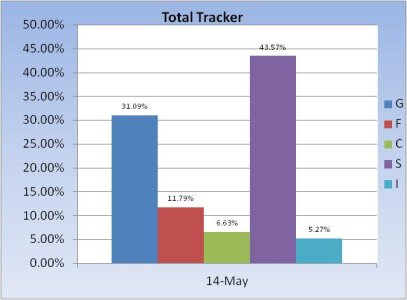

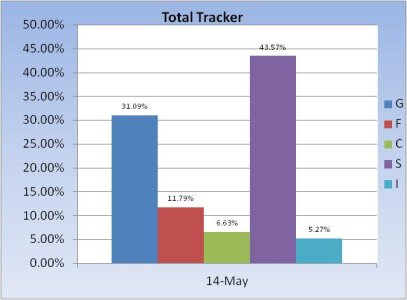

The Total Tracker also shows a pick up in stock allocations. This group raised their total stock exposure by 10.85%, which is a relatively large move. Total stock exposure here is 55.47%.

In spite of the huge bearish shifts last week, the market was down overall, so our sentiment survey took a a bit of a loss for the week. That survey remains on a buy going into the new week as well.

The Seven Sentinels remain in a buy condition, but have been under pressure since shortly after the buy condition was triggered. OPEX is next week, so I'm anticipating more volatility, but with limited downside action. I'm actually expecting higher prices overall next week, but we'll see how it plays out.

This week, the Top 50 increased their collective stock exposure a healthy 17.6%, but their total allocation is still only 48.6%, so bearishness persists in this group.

The Total Tracker also shows a pick up in stock allocations. This group raised their total stock exposure by 10.85%, which is a relatively large move. Total stock exposure here is 55.47%.

In spite of the huge bearish shifts last week, the market was down overall, so our sentiment survey took a a bit of a loss for the week. That survey remains on a buy going into the new week as well.

The Seven Sentinels remain in a buy condition, but have been under pressure since shortly after the buy condition was triggered. OPEX is next week, so I'm anticipating more volatility, but with limited downside action. I'm actually expecting higher prices overall next week, but we'll see how it plays out.