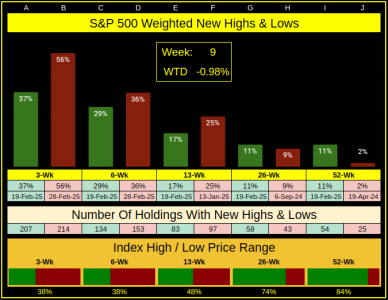

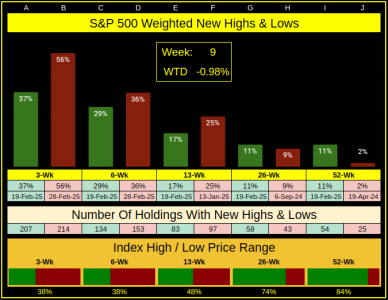

Week 9 lost -.98%, the index was somewhat chaotic with Thursday's -1.59% loss getting erased by Friday's 1.59% gain.

Friday's volume was the highest of 2025, and our 1-Day Average True Range over the past 5 sessions was twice that of the previous week.

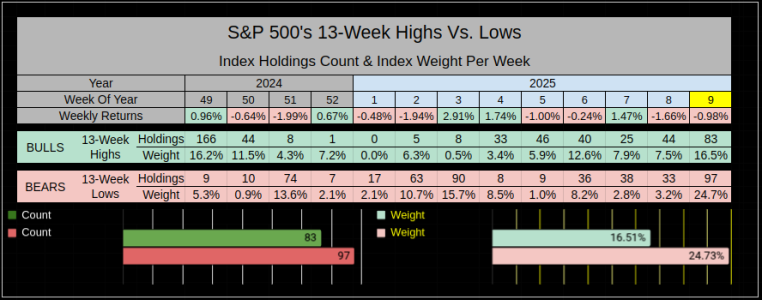

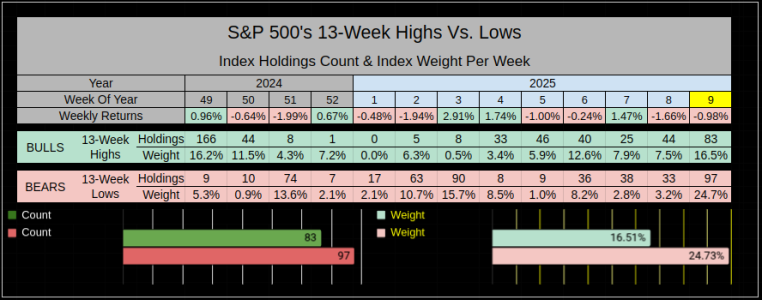

If I told you 8 of the last 13, weeks have closed down, that would be a 38% weekly win ratio. Over these last 756 weeks (back to Jun-2010), the 13-Week win ratio is 76%, so at present, we are well under the stats. For Week-9, the Bears outpaced the Bulls with 97 new 13-Week lows weighted at 24.73% of the Index.

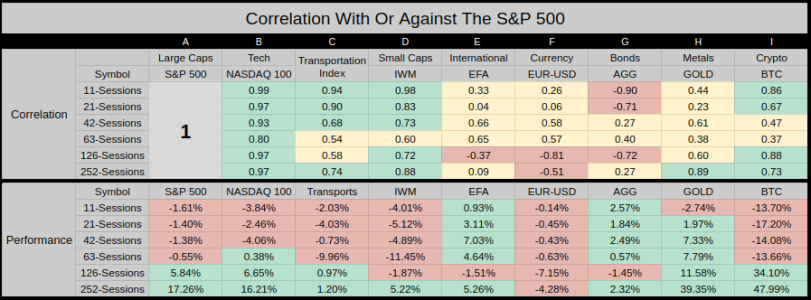

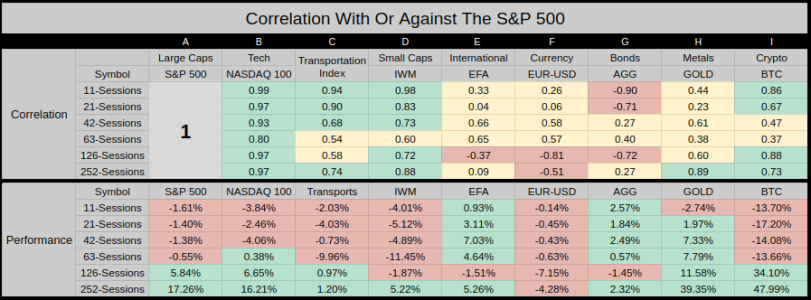

Google sheets has a Correlation feature =CORREL(A:A, B:B)

Everything here is compared against the S&P 500, the highest possible score is 1, the lowest -1.

___Column A-D___ When the US Markets are healthy, we should see a strong correlation between SPX/NDX/Tran/IWM

___Column E-F___ Represents the developed markets or the world econmy sans U.S. Stocks.

___Column G-I___ Bonds/Gold/Crypto represent divisification, fear & speculation

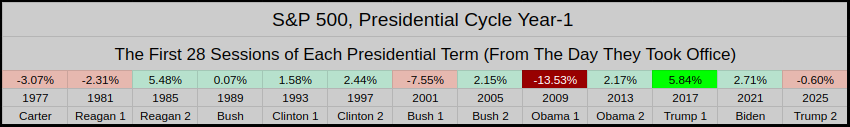

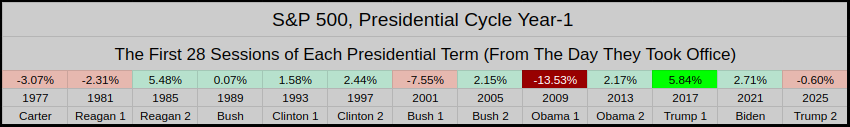

This chart compares the performance of each President's 1st Year of the Presidential Cycle, from the moment they took office.

This is a good method to even the playing field, and compare DJT's 2025 perfromance with the other presidents.

So this is the first 28 sessions of each president, the current 28-session average of all 13 presidents is -.36%

That's it, have a great stress-free week, and also there's a blog for March's stats.

Friday's volume was the highest of 2025, and our 1-Day Average True Range over the past 5 sessions was twice that of the previous week.

If I told you 8 of the last 13, weeks have closed down, that would be a 38% weekly win ratio. Over these last 756 weeks (back to Jun-2010), the 13-Week win ratio is 76%, so at present, we are well under the stats. For Week-9, the Bears outpaced the Bulls with 97 new 13-Week lows weighted at 24.73% of the Index.

Google sheets has a Correlation feature =CORREL(A:A, B:B)

Everything here is compared against the S&P 500, the highest possible score is 1, the lowest -1.

___Column A-D___ When the US Markets are healthy, we should see a strong correlation between SPX/NDX/Tran/IWM

___Column E-F___ Represents the developed markets or the world econmy sans U.S. Stocks.

___Column G-I___ Bonds/Gold/Crypto represent divisification, fear & speculation

This chart compares the performance of each President's 1st Year of the Presidential Cycle, from the moment they took office.

This is a good method to even the playing field, and compare DJT's 2025 perfromance with the other presidents.

So this is the first 28 sessions of each president, the current 28-session average of all 13 presidents is -.36%

That's it, have a great stress-free week, and also there's a blog for March's stats.

Last edited: